Puerto Rico Agreement for Sale of Goods, Equipment and Related Software

Description

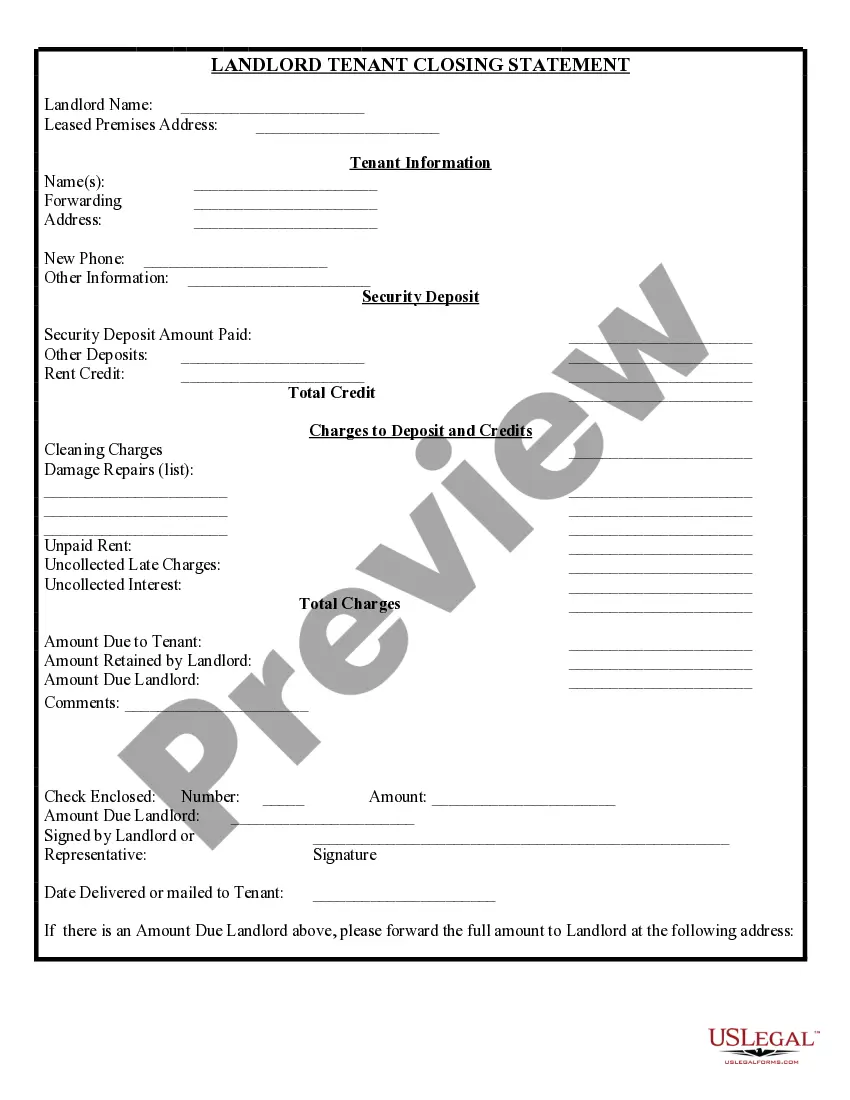

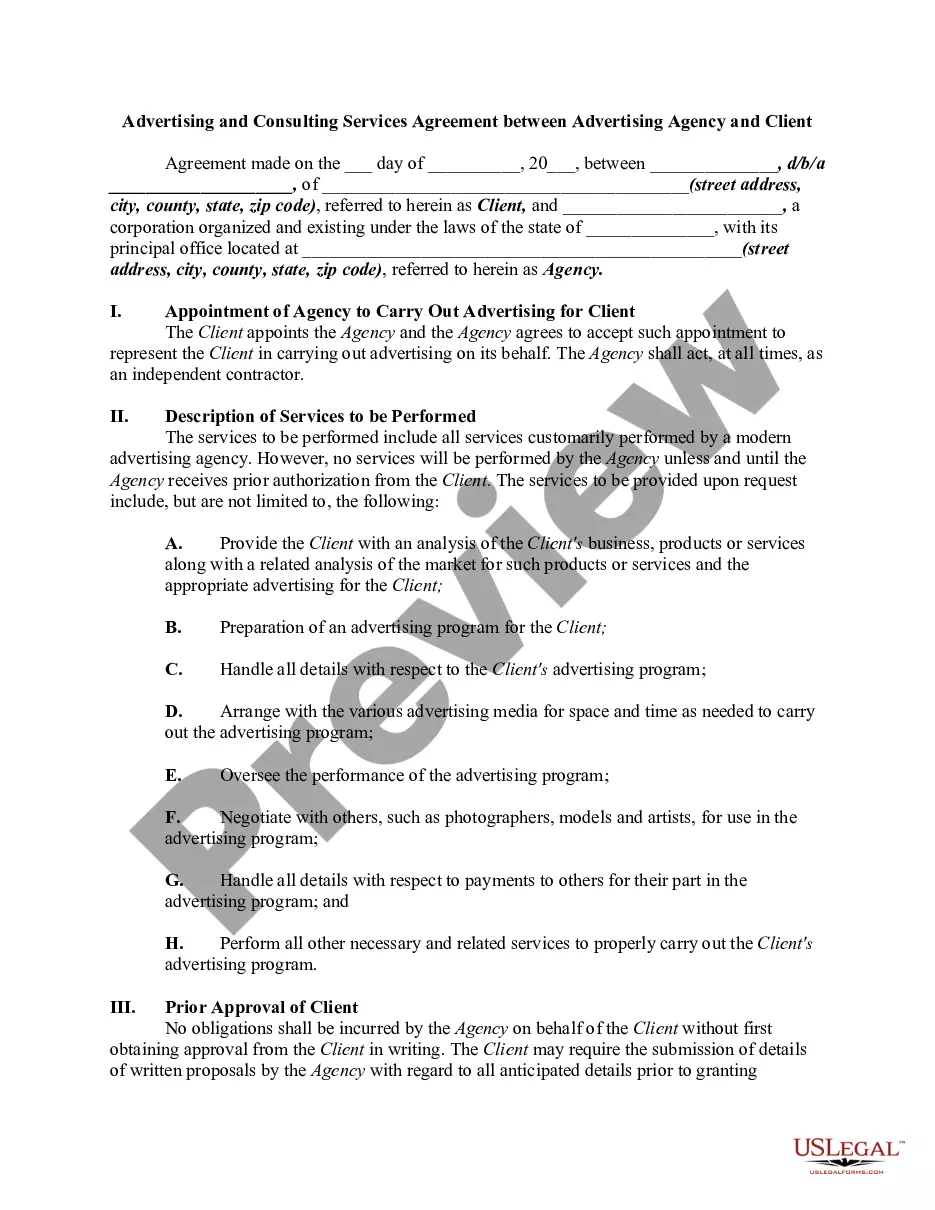

How to fill out Agreement For Sale Of Goods, Equipment And Related Software?

Selecting the appropriate authorized document template can be a challenge.

Of course, there are numerous templates available online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software, which can be utilized for both business and personal purposes.

You can preview the document using the Preview option and review the document details to confirm it is the right one for you.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already a member, Log In to your account and click the Download button to obtain the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software.

- Use your account to browse the legal forms you have previously acquired.

- Navigate to the My documents section of your account to retrieve another copy of your needed documents.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the correct form for your city/state.

Form popularity

FAQ

The current IVU rate in Puerto Rico is typically 11.5%, which consists of a 1% municipal tax and a 10.5% central tax. This rate applies to most goods, services, and rentals across the island. It is essential to factor in this tax when engaging in transactions, including those associated with a Puerto Rico Agreement for Sale of Goods, Equipment and Related Software. Always verify the latest rates to ensure compliance.

On March 22, 1873, Puerto Rico abolished slavery, marking a significant step toward civil rights and freedom. This historical event set the stage for economic reforms, including those affecting the trade of goods and services. Understanding this context enriches businesses today, particularly those involved in the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software, as it emphasizes the importance of ethical practices in trade relations.

Rule 22 in Puerto Rico refers to specific guidelines related to advertising and marketing of products. This rule impacts companies that utilize the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software by stipulating transparency and ethical marketing methods. Following these guidelines helps businesses cultivate a positive brand image and secure customer loyalty.

Law 33 in Puerto Rico encompasses a variety of protective measures for consumers, including regulations on sales and marketing practices. Businesses involved in the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software must understand these regulations to avoid deceptive practices. Compliance will enhance consumer trust and support lasting business relationships.

Law 21 in Puerto Rico regulates the importation and sale of certain goods, ensuring compliance with local standards. This law is particularly relevant for businesses involved in the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software, as it outlines import duties and certifications required for specific products. Adhering to these regulations is crucial to maintain a smooth operational process.

To obtain a seller's permit in Puerto Rico, businesses must register with the Department of Treasury. This process includes filling out the necessary forms and paying applicable fees. Once you secure this permit, it enhances your ability to enter sales transactions under the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software without complications.

Law 22 in Puerto Rico is designed to encourage individuals and businesses to relocate to the island by providing tax incentives. This legislation significantly benefits those engaged in the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software by offering reduced tax rates on various types of income. Understanding this law can help businesses optimize their financial strategies in Puerto Rico.

Yes, Puerto Rico does issue resale certificates. These certificates help businesses avoid paying sales tax on items purchased for resale. By utilizing the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software, sellers can ensure they are compliant with local regulations while managing their inventory effectively.

To register for sales tax in Puerto Rico, businesses must complete the registration process with the Puerto Rico Department of Treasury. Obtain the necessary forms and provide details about your business, including the type of services or products you offer under the Puerto Rico Agreement for Sale of Goods, Equipment and Related Software. Once registered, you will receive a sales tax number, which allows you to collect and remit taxes legally.

Puerto Rico imposes several taxes, including income tax, sales tax, and property tax. The sales tax applies to goods and services covered under a Puerto Rico Agreement for Sale of Goods, Equipment and Related Software. Additionally, businesses may face different tax obligations based on their operations. Keeping abreast of these tax requirements is crucial to avoid penalties.