Puerto Rico Officers Bonus — Percenprofitfi— - Resolution Form is a document used by businesses operating in Puerto Rico to formalize the allocation of bonuses for company officers based on a certain percentage of profits. This form is essential for ensuring transparent and accurate distribution of bonuses and aligning the interests of officers with the financial success of the company. The Puerto Rico Officers Bonus — Percenprofitfi— - Resolution Form includes various crucial details, starting with the name and contact information of the company, followed by the specific financial period for which the bonus is being calculated. The form also states the percentage of profit that will be allocated as bonuses to officers. This percentage is typically determined by the company's board of directors or management, considering factors such as the company's financial performance, industry standards, and other relevant considerations. Furthermore, the form outlines the criteria for determining eligibility for the bonus. These criteria may include job titles, length of service, performance evaluations, or other predetermined factors. It is essential to clearly specify these criteria to avoid any ambiguity or misunderstanding in the bonus allocation process. The Puerto Rico Officers Bonus — Percenprofitfi— - Resolution Form may include a section for documenting the individual bonus amount allocated to each officer based on their eligibility. This information should be filled out accurately, ensuring that all officers are compensated fairly and in line with the resolution. It's important to note that there might be different types of Puerto Rico Officers Bonus — Percenprofitfi— - Resolution Forms based on the specific structure and requirements of different companies. Some companies may have different profit-sharing models, where bonuses are allocated based on a combination of individual and company performance metrics. Other variations may exist based on the specific legal and tax regulations in Puerto Rico. In conclusion, the Puerto Rico Officers Bonus — Percenprofitfi— - Resolution Form is a crucial document for companies operating in Puerto Rico to formalize the allocation of bonuses to officers based on a certain percentage of profits. By utilizing this form, companies can ensure transparency, fairness, and alignment of officer incentives with the company's financial success.

Puerto Rico Officers Bonus - Percent of Profit - Resolution Form

Description

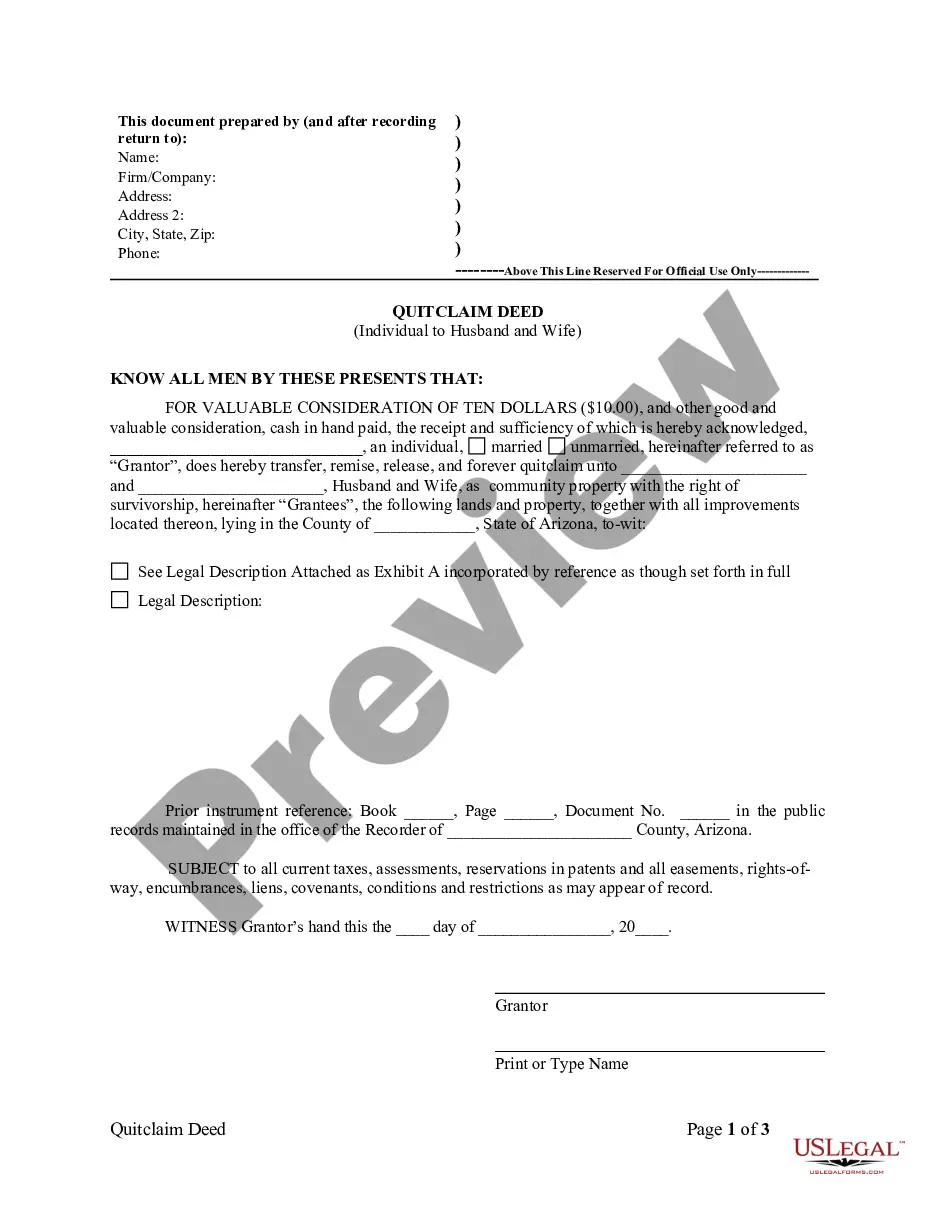

How to fill out Officers Bonus - Percent Of Profit - Resolution Form?

US Legal Forms - one of the largest collections of legal documents in the country - offers a variety of legal form templates that you can download or print.

While using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can retrieve the latest versions of forms such as the Puerto Rico Officers Bonus - Percent of Profit - Resolution Form within moments.

If you already have a monthly subscription, Log In to obtain the Puerto Rico Officers Bonus - Percent of Profit - Resolution Form from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Puerto Rico Officers Bonus - Percent of Profit - Resolution Form. Each template you added to your account does not have an expiration date and is yours permanently. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Puerto Rico Officers Bonus - Percent of Profit - Resolution Form with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward instructions to get you started.

- Make sure to select the correct form for your city/county.

- Click the Review button to examine the content of the form.

- Check the form details to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Get now button.

- Next, select the payment plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

Form 482 is utilized in Puerto Rico for reporting certain tax information relevant to bonuses and other compensations. It plays a vital role in ensuring compliance with local tax laws. For assistance with completing this form and understanding its significance, consider consulting with resources available through uslegalforms.

Form 480.6 C is a document used in Puerto Rico for reporting various types of income, including bonuses. This form provides necessary details to both the employee and the tax authorities regarding the income earned. Understanding this form's requirements is crucial, and uslegalforms offers valuable information to assist you properly.

The calculation of bonuses in Puerto Rico considers the company's total profit and the agreed-upon bonus percentage. Each company may have different calculations based on its performance and profit-sharing policies. To ensure accurate calculation methods, refer to resources like the Puerto Rico Officers Bonus - Percent of Profit - Resolution Form.

Bonuses in Puerto Rico are subject to specific tax regulations, which may differ from standard income tax rates. Generally, these bonuses are taxed at a different rate and may involve local and federal tax implications. It is advisable to consult a tax professional or use uslegalforms to navigate the complexities of tax reporting related to bonuses.

The bonus law in Puerto Rico mandates companies to distribute a portion of their profits as bonuses to their employees, typically calculated at a percentage. This law aims to promote employee welfare and a fair distribution of earnings. Familiarizing yourself with the guidelines in the Puerto Rico Officers Bonus - Percent of Profit - Resolution Form is essential for compliance.

To report income from Puerto Rico, you typically need to file a Puerto Rican tax return and include all your income. Ensure you account for all relevant deductions and credits correctly. A comprehensive understanding of your reporting obligations will help, and resources like uslegalforms can provide guidance on the necessary forms and procedures.

Rule 22 in Puerto Rico outlines specific regulations concerning profit-sharing and bonuses for employees. This rule plays a crucial role in ensuring fair compensation and adherence to local laws. For detailed insights and documentation regarding your rights and obligations, refer to the Puerto Rico Officers Bonus - Percent of Profit - Resolution Form.

Your bonus is calculated based on the company's overall profits, with a specific percentage designated for bonuses. This percentage is often determined by company policies and performance metrics. To learn more about precise calculations and the Puerto Rico Officers Bonus - Percent of Profit - Resolution Form, consider consulting a financial advisor or a reliable service like uslegalforms.

Puerto Rico form 482 is related to the reporting of taxes withheld on specific income types. This form plays a vital role in accurately documenting payments while leveraging Puerto Rico Officers Bonus - Percent of Profit - Resolution Form. Proper use of form 482 helps business owners ensure compliance and avoid penalties related to tax regulations.

Yes, employers in Puerto Rico must provide a Christmas bonus, known as the 'aguinaldo', to eligible employees. This bonus is typically calculated based on the income earned during the year and is a crucial aspect of the Puerto Rico Officers Bonus - Percent of Profit - Resolution Form. It is essential for businesses to follow these rules to foster goodwill and maintain compliance.