Puerto Rico Lease of Business Premises — Real Estate Rental is a legally binding agreement between a landlord and a tenant that allows the tenant to occupy a commercial property in Puerto Rico for a specified period of time. This type of lease is commonly used by businesses looking to establish themselves in Puerto Rico or expand their operations. It outlines the terms and conditions of renting the property and ensures a smooth and secure transaction for both parties involved. Key terms often included in a Puerto Rico Lease of Business Premises — Real Estate Rental may include: 1. Lease Term: This specifies the duration of the lease, whether it is for a fixed period (e.g., one year) or on a month-to-month basis. 2. Rent: The agreed-upon amount to be paid by the tenant to the landlord in exchange for the use of the premises. This may also cover additional expenses such as utilities or maintenance. 3. Security Deposit: A refundable deposit paid by the tenant to the landlord to cover any potential damages or unpaid rent at the end of the lease term. 4. Maintenance Responsibilities: Outlines who are responsible for maintaining and repairing the property, including common areas. 5. Use of Premises: Specifies the permitted use of the premises, ensuring it aligns with the tenant's business activities and any relevant zoning regulations. 6. Insurance: May require the tenant to obtain liability insurance to protect against any accidents or damages that may occur on the premises. 7. Renewal and Termination: Outlines the process for extending the lease beyond the initial term and the conditions for terminating the lease by either party. Different types of Puerto Rico Lease of Business Premises — Real Estate Rental may include: 1. Triple Net Lease (NNN): In this type of lease, the tenant is responsible for paying not only the rent but also all additional expenses such as property taxes, insurance, and maintenance costs. 2. Gross Lease: The landlord covers all additional expenses, and the tenant pays a fixed rent amount, making it simpler for the tenant to budget. 3. Percentage Lease: Often used in retail settings, this type of lease involves the tenant paying a base rent plus a percentage of their sales. This allows the landlord to benefit from the tenant's business success. 4. Short-Term Lease: A lease agreement typically lasting less than one year, which offers flexibility for businesses with temporary needs such as pop-up stores or seasonal operations. In conclusion, a Puerto Rico Lease of Business Premises — Real Estate Rental is a crucial legal document that facilitates the rental of commercial properties in Puerto Rico. It provides clear agreements and protections for both parties involved, ensuring a mutually beneficial arrangement. Whether it is a triple net lease, gross lease, percentage lease, or short-term lease, choosing the most suitable type of lease depends on the specific needs and circumstances of the tenant and the property involved.

Puerto Rico Lease of Business Premises - Real Estate Rental

Description

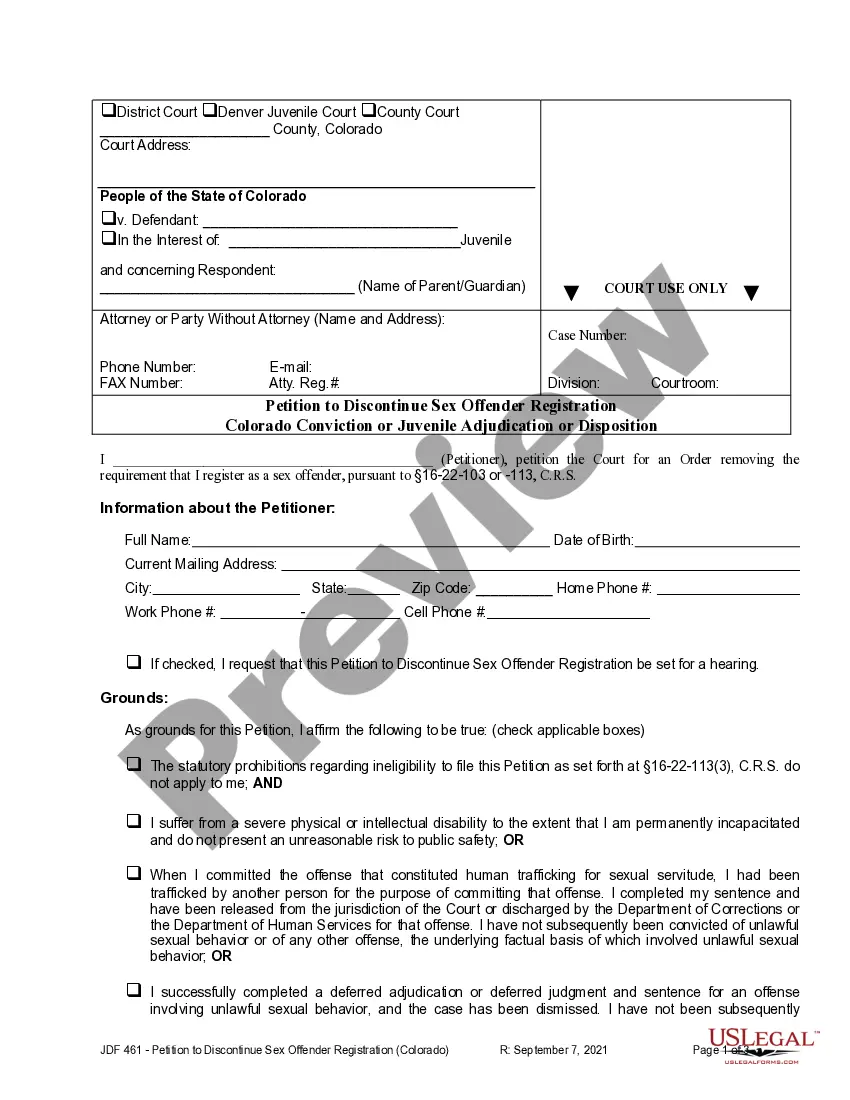

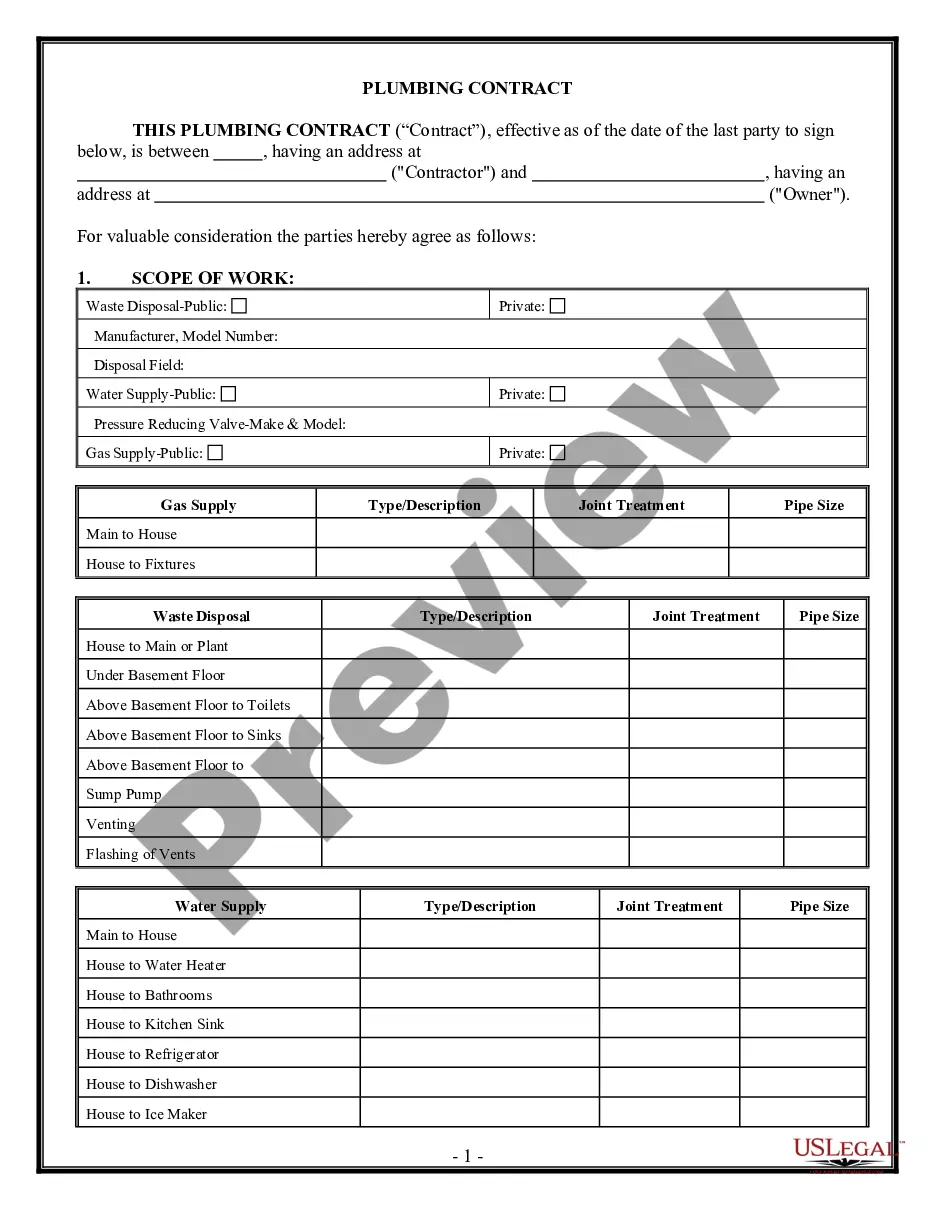

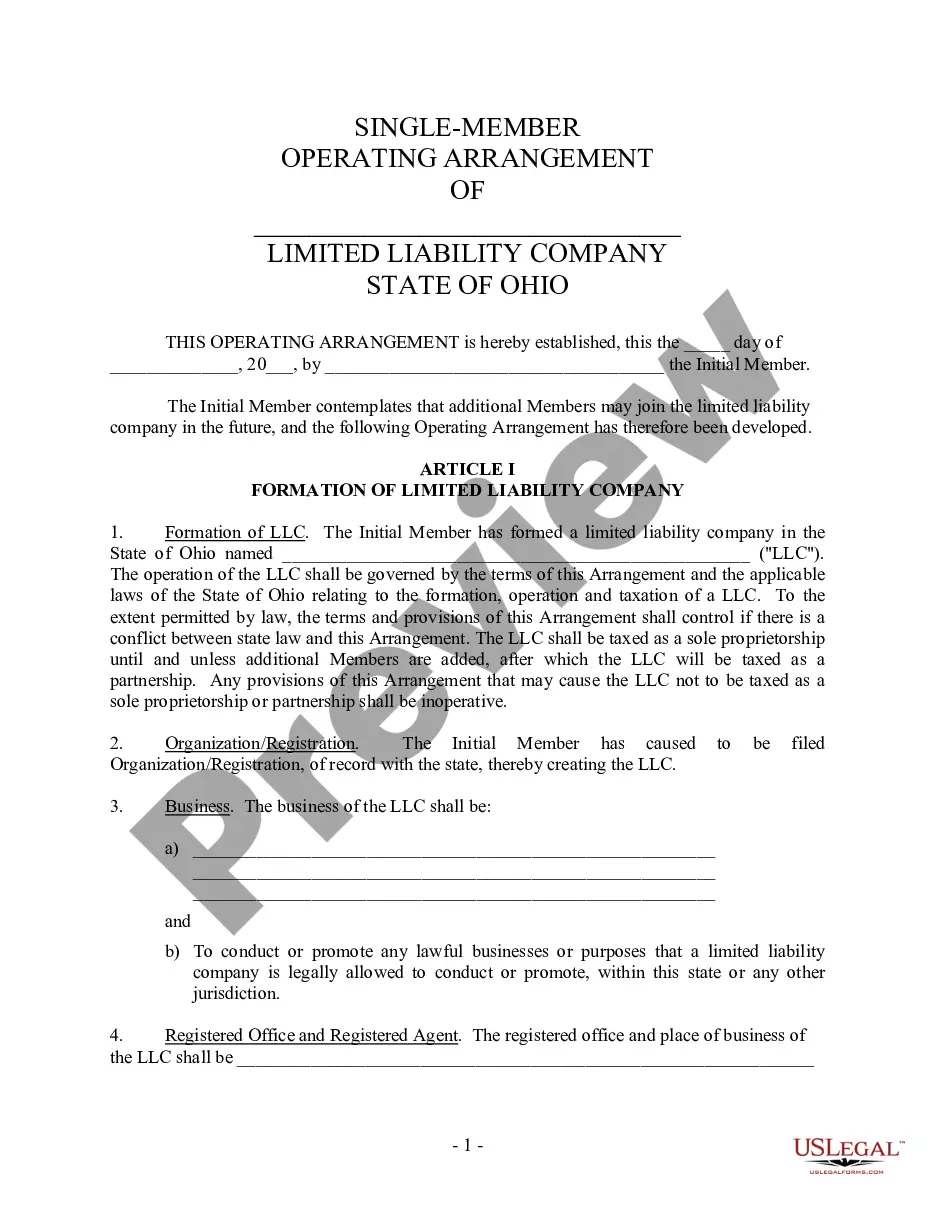

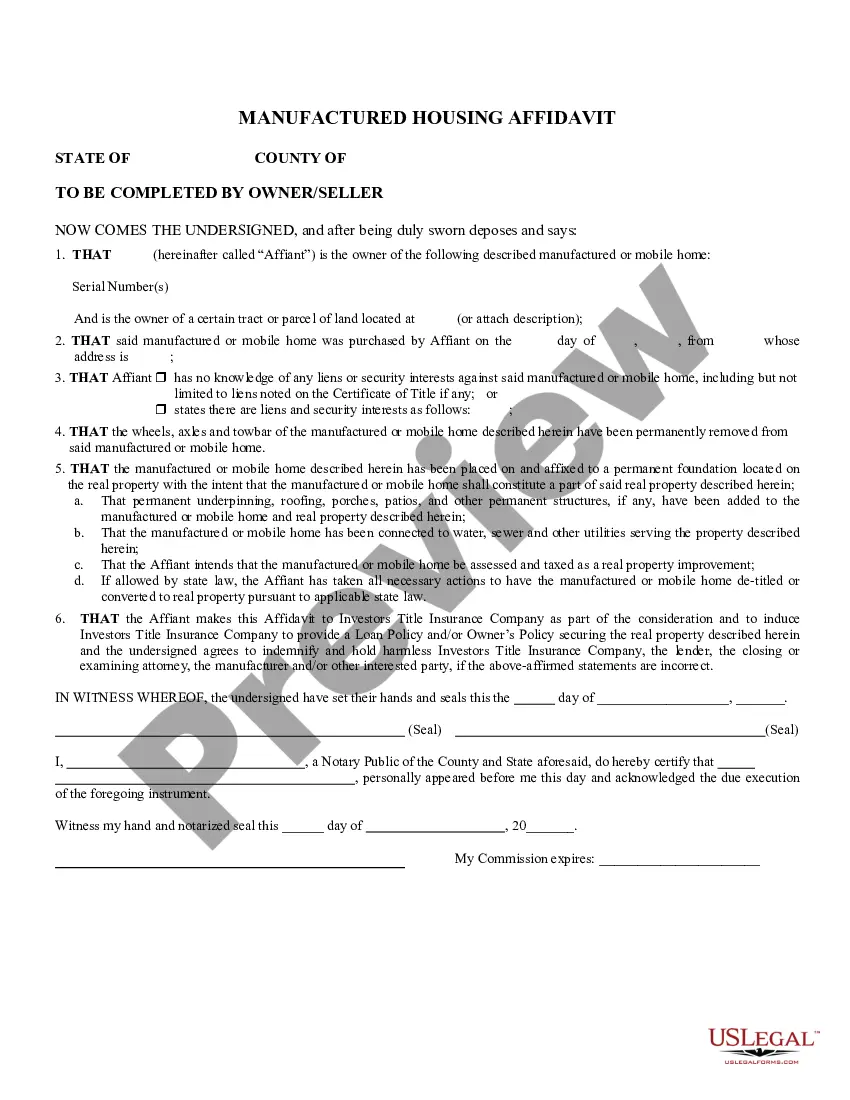

How to fill out Puerto Rico Lease Of Business Premises - Real Estate Rental?

It is feasible to invest numerous hours online attempting to discover the valid document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of valid forms that can be reviewed by professionals.

It is easy to download or print the Puerto Rico Lease of Business Premises - Real Estate Rental from the services.

If available, utilize the Review option to browse through the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download option.

- After that, you may complete, edit, print, or sign the Puerto Rico Lease of Business Premises - Real Estate Rental.

- Every valid document template you obtain is yours permanently.

- To obtain another version of any purchased form, visit the My documents tab and click on the corresponding option.

- If you use the US Legal Forms site for the first time, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for your county/city of choice.

- Check the form details to make sure you have chosen the right form.

Form popularity

FAQ

Having good credit can improve your chances of being approved to rent an apartment in Puerto Rico, but it is not always a strict requirement. Landlords may consider other factors, such as rental history and income, when evaluating a tenant's application. Understanding the expectations of landlords is essential for navigating the Puerto Rico Lease of Business Premises - Real Estate Rental process.

Short-term rentals are allowed in Puerto Rico, but they must comply with specific regulations set by local governments. Landlords should obtain the necessary permits and consider any zoning restrictions to operate legally. Being aware of these requirements is essential for success in a Puerto Rico Lease of Business Premises - Real Estate Rental.

Rental laws in Puerto Rico dictate the legal rights and responsibilities of both landlords and tenants. These laws cover aspects such as lease agreements, security deposits, and eviction processes. Understanding these regulations is crucial for anyone involved in a Puerto Rico Lease of Business Premises - Real Estate Rental to avoid legal disputes.

To evict a tenant in Puerto Rico, landlords must follow a legal process that includes providing proper notice and, if necessary, seeking assistance from the court. The process is governed by specific laws that protect both the landlord and tenant. Knowledge of these guidelines is vital when managing a Puerto Rico Lease of Business Premises - Real Estate Rental.

Yes, rental income is considered taxable in Puerto Rico. Landlords should report all income earned from leasing property, including from a Puerto Rico Lease of Business Premises - Real Estate Rental. Understanding tax obligations ensures landlords remain compliant and avoid potential legal issues down the line.

Yes, mortgages are recorded in Puerto Rico to protect the interests of lenders and borrowers. When obtaining financing for a Puerto Rico Lease of Business Premises - Real Estate Rental, recording the mortgage ensures that all parties are aware of the property’s financial obligations. This process adds transparency and security to real estate transactions.

Evicting a tenant in Puerto Rico involves several steps to ensure compliance with local laws. First, landlords must provide a written notice to the tenant, specifying the reason for the eviction and giving them time to respond. A landlord should familiarize themselves with the Puerto Rico Lease of Business Premises - Real Estate Rental laws to handle the situation properly and consult a legal expert if needed.

Owning a home in Puerto Rico offers various tax benefits that make it an attractive option for investors. Residents may benefit from exemptions on property taxes and lower income tax rates, significantly increasing the potential return on investment. Take time to learn about these incentives as they can enhance your experience in the Puerto Rico Lease of Business Premises - Real Estate Rental market.

Wealthy homebuyers are drawn to Puerto Rico for several reasons, including generous tax incentives and a favorable climate. Additionally, the real estate landscape provides diverse options for investment, such as Puerto Rico Lease of Business Premises - Real Estate Rental. Buyers see not only a luxurious lifestyle but also a smart financial decision in investing in this unique market.

Investing in property in Puerto Rico can be highly beneficial. The region offers unique incentives that attract both local and foreign investors. With opportunities in the Puerto Rico Lease of Business Premises - Real Estate Rental, you can capitalize on various markets. Doing thorough research and seeking expert advice will enhance your investment strategy.

More info

If you choose to sign, it may help to remember to check your lease contract for the time your property is leased. For instance, if a property is leased for 6 months, or 12 months, you must either sign a 12 months lease or pay the difference. You may also wish to consult with your attorney if a new property owner wants to lease one of your properties for several years, or if the change in ownership involves large assets. For this latter situation, you may want to seek advice from an attorney about what happens next. What If You Want To Refuse To Sign? Signing a lease is a huge part of your life as a residential property owner. If it turns out you don't want to sign a lease, be aware that most states have what's known as a lease conversion statute. Most states will allow you to cancel your lease before its time, and some states have also enacted “no-fault” insurance laws that protect leaseholders from paying damages when the lease is terminated prematurely.