Puerto Rico Lease to Own for Commercial Property

Description

How to fill out Lease To Own For Commercial Property?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. Discover the most recent versions of forms like the Puerto Rico Lease to Own for Commercial Property in just minutes.

If you already have an account, Log In and download the Puerto Rico Lease to Own for Commercial Property from the US Legal Forms library. The Download button will appear on every form you view. You have access to all your previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Make changes. Fill in, modify, and print and sign the downloaded Puerto Rico Lease to Own for Commercial Property.

Each template you add to your account does not expire and is yours permanently. So, if you wish to download or print an additional copy, just go to the My documents section and click on the form you want.

Access the Puerto Rico Lease to Own for Commercial Property with US Legal Forms, the most extensive library of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or individual needs and requirements.

- Ensure you have selected the correct form for your city/county.

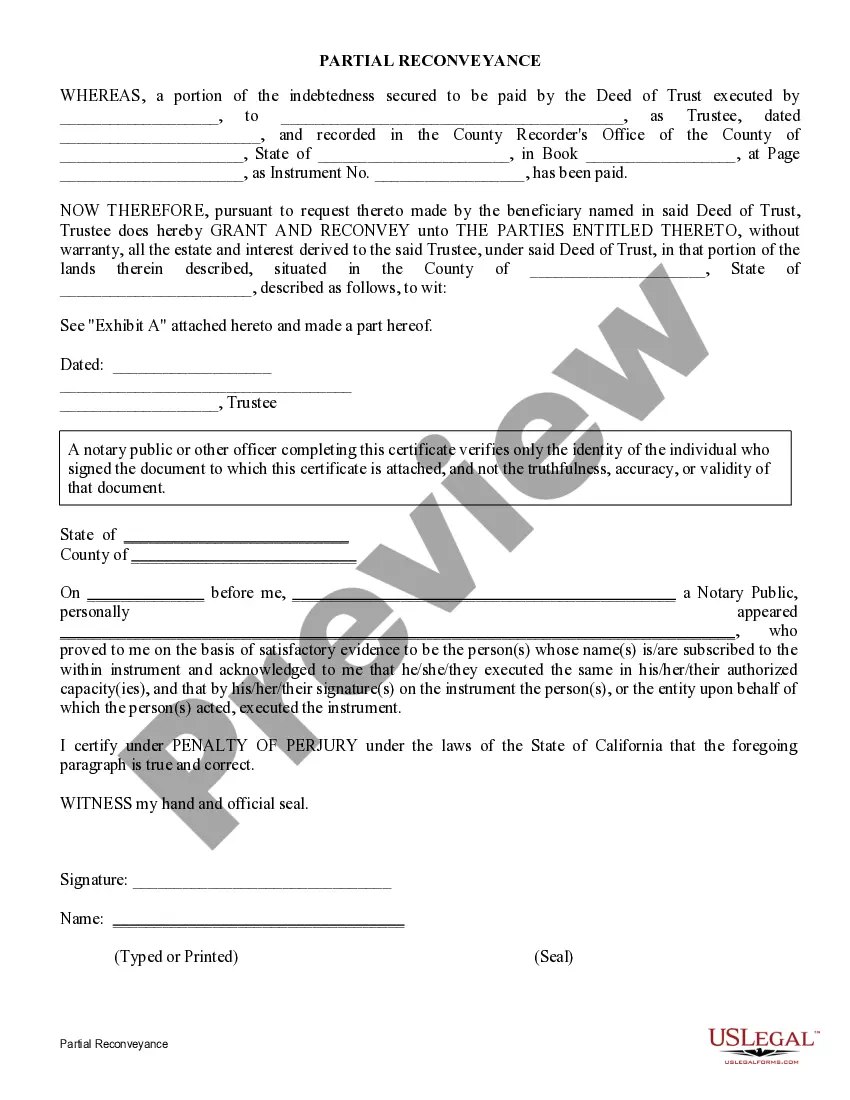

- Click the Review button to examine the contents of the form.

- Check the form details to ensure you have chosen the right one.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and enter your information to register for the account.

Form popularity

FAQ

Foreigners can freely buy property in Puerto Rico. To enter into a real estate transaction, it is important to hire a real estate agent as knowledge in Spanish is very much needed. When an agreement has been reached, a deposit of 5% of the purchase price is usually paid by the buyer.

Whether you're looking to retire or want to purchase a home or condominium in Puerto Rico for investment purposes, right now seems to be a very good time to do it. The island is recovering and, as we mentioned, most of Puerto Rico has been designated as an opportunity zone.

Real estate prices In Puerto Rico, you'll find stunning beachfront properties for 50-75% less than Miami, and stately colonial homes for 50% less than Cartagena's Old City in Colombia. Experts predict ROI for rental real estate to exceed 10 percent with lower acquisition costs and a sound vacation rental market.

Buying real estate in Puerto Rico offers a number of logical investment perks for Americans, including flexible finance possibilities, zero immigration concerns, and amazing tax breaks (should you qualify).

Real property is subject on an annual real property tax levied on the property's market value. The tax rates range from 8.03% to 11.83%for personal property.

Yes, foreigners can buy property in Puerto Rico and the Government of Puerto Rico welcomes investment from overseas buyers. There are no restrictions on foreign buyers acquiring real estate in Puerto Rico.

Being preapproved for a loan is a requirement to buy a house in Puerto Rico, unless you plan to pay cash, in which case you're required to demonstrate evidence of sufficient funds. To procure a mortgage, you'll need a good credit score and enough liquid funds to make a 20% down payment.

San Juan, PR Housing MarketThe median listing home price in San Juan, PR was $229K in March 2022, trending up 57.9% year-over-year. The median listing home price per square foot was $152.

The reason why is simple and fantastic: Puerto Rico is a commonwealth of the United States! That means any American citizen can purchase property or a home on the island no problem. Also, when traveling back-and-forth there's no need to go through customs which can save you a lot of time and energy.

Because Puerto Rico is a commonwealth of the United States, there are no restrictions on Americans acquiring property on the island. Another advantage is that U.S. citizens don't have to go through customs when traveling between Puerto Rico and the U.S. mainlandthis can be a big time saver.