An alteration of a written instrument is a change in language of the instrument that is made by one of the parties to the instrument who is entitled to make the change. Any material alteration of a written instrument, after its execution, made by the owner or holder of the instrument, without the consent of the party to be charged, renders the instrument void as to the nonconsenting party. The party to be charged refers to that party or parties against whom enforcement of a contract or instrument is sought.

If a party consents to the alteration, the instrument will not be rendered invalid as to that party.

Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations

Description

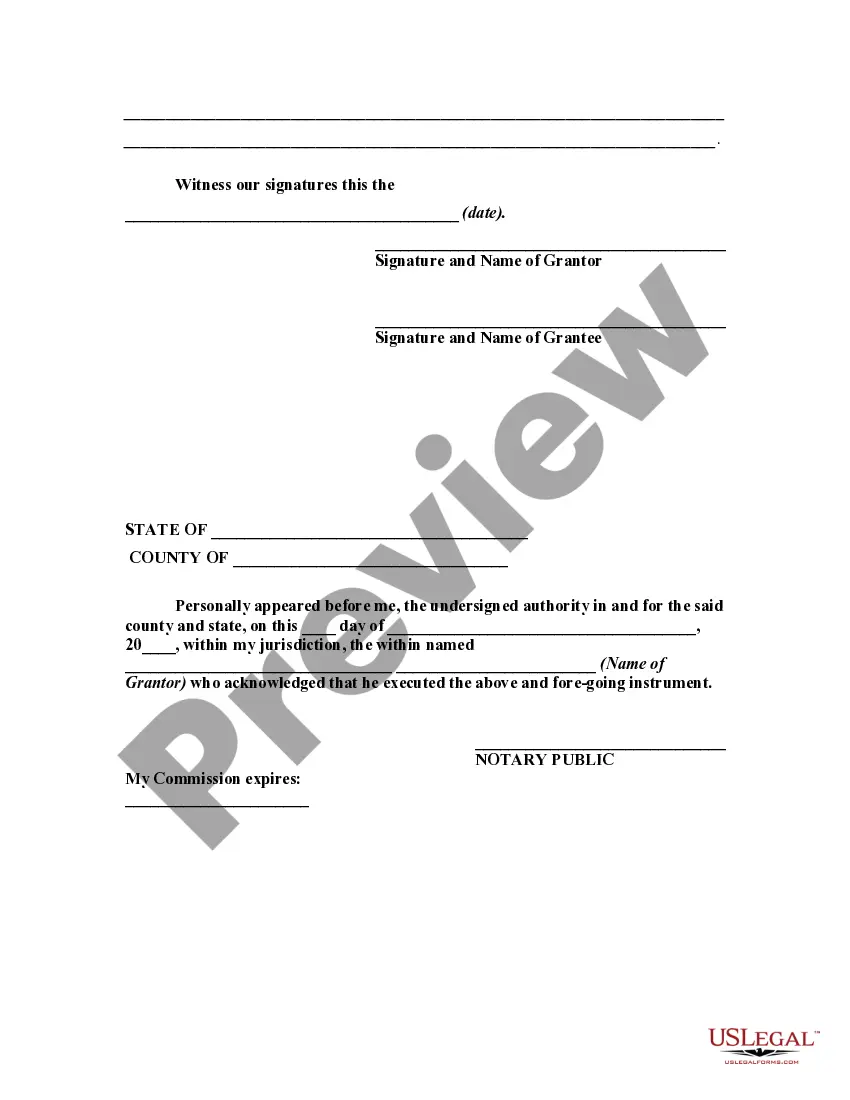

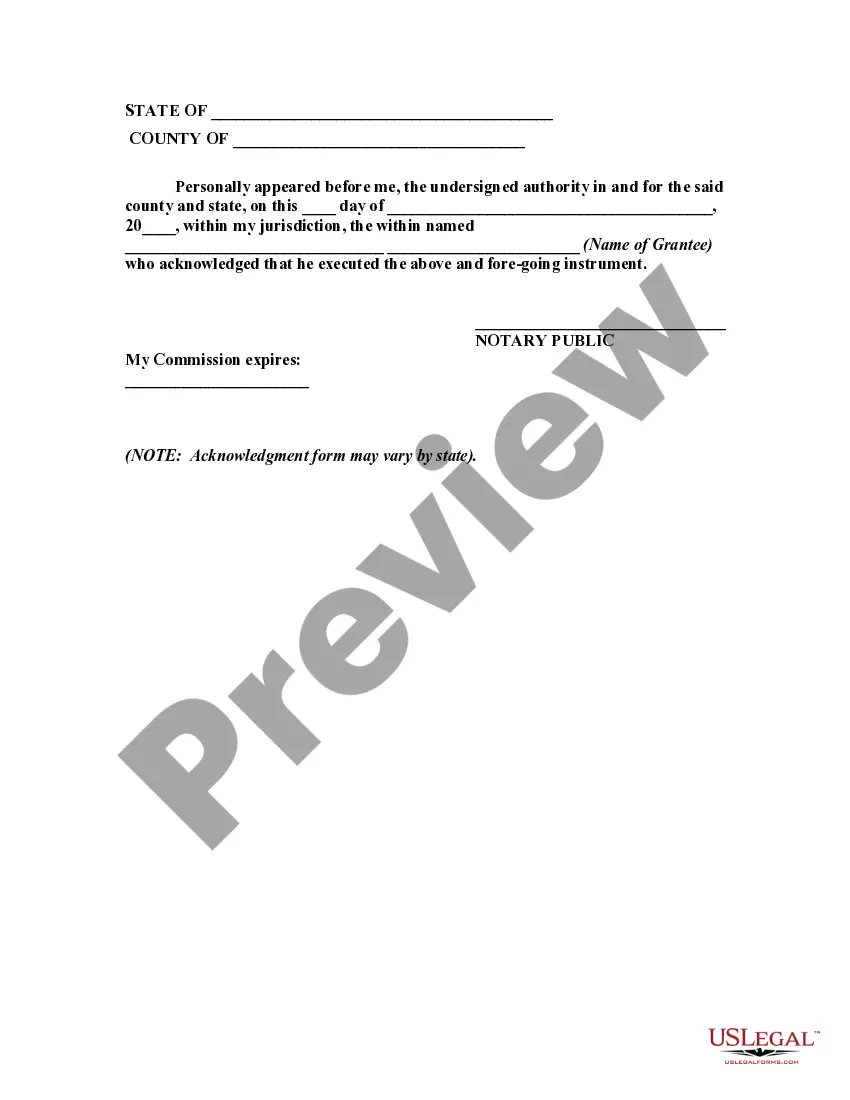

How to fill out Ratification Of Re-Execution Of Recorded Instrument With Alterations?

US Legal Forms - one of the largest collections of legal templates in the USA - offers a wide range of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest versions of forms like the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations.

If you already have a monthly subscription, Log In and download Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

- Ensure you have selected the correct form for your city/region.

- Click the Review button to examine the form`s content.

- Check the form description to confirm you have chosen the correct one.

- If the form does not meet your needs, use the Research field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your credentials to sign up for the account.

Form popularity

FAQ

The Foraker Act, enacted in 1900, established a civil government for Puerto Rico and marked the island's transition to an unincorporated territory of the U.S. This act laid the groundwork for America's governance over Puerto Rico, including representation and law-making authority. In this context, it's crucial to consider how the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations has evolved since the Foraker Act, shaping current legal and economic frameworks.

The Puerto Rico status act aimed to provide a clear path for political status resolutions; however, it has seen various proposals and discussions without a conclusive outcome. The ongoing debate reflects the complexities of Puerto Rico's relationship with the United States. Engaging with the implications of the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations can provide insight into these political developments and their impact on residents.

To qualify for Puerto Rico tax exemption, individuals typically need to become bona fide residents of the island. This means establishing a physical presence, demonstrating intent to remain, and meeting the residency requirements set forth in Tax Incentive Acts like Act 22. Understanding these criteria is essential when considering how the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations can enhance your financial strategy.

Act 22 is a law designed to attract wealthy individuals to Puerto Rico by offering tax exemptions on certain types of income. The act specifically targets residents who relocate to the island, ensuring they can significantly reduce their tax burden. With the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations supporting this measure, the law plays a vital role in revitalizing the local economy.

Yes, Puerto Rico continues to maintain its status as a tax haven, largely due to the incentives offered by various acts, including Act 22. These measures provide significant tax breaks that attract investors and retirees alike. The ongoing benefits highlight the importance of understanding the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations as they relate to taxation and investment opportunities.

Yes, moving to Puerto Rico may allow you to benefit from lower capital gains taxes under Act 22. This act provides tax incentives for new residents, making it an attractive option for individuals looking to optimize their tax situation. However, you must meet specific criteria and officially relocate, so consider consulting with a tax professional to understand the process involved in the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations.

Act 22, also known as the Individual Investors Act, was established to attract high-net-worth individuals to Puerto Rico. This decree offers significant tax incentives, including exemptions on capital gains for individuals who relocate to the island. As part of the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations, this act reflects Puerto Rico's strategy to boost its economy and draw investment into the territory.

In 1952, Puerto Rico transitioned from being a territory to a commonwealth of the United States. This change provided Puerto Rico with greater autonomy over its local affairs while remaining under U.S. sovereignty. The Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations allowed for more self-governance and established a locally drafted constitution, marking a significant shift in its political landscape.

Yes, individuals born in Puerto Rico are U.S. citizens and are eligible to run for president. However, the unique status of Puerto Rico means that its residents sometimes feel disconnected from the full benefits of citizenship. Recognizing this can be important when discussing legal matters, including the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations.

The 17 non-self-governing territories include locations such as American Samoa, Guam, and the U.S. Virgin Islands. Each territory shares a unique relationship with the U.S., impacting its governance and legal frameworks. Understanding the context of these territories can enhance insights into legal matters like the Puerto Rico Ratification of Re-Execution of Recorded Instrument With Alterations.