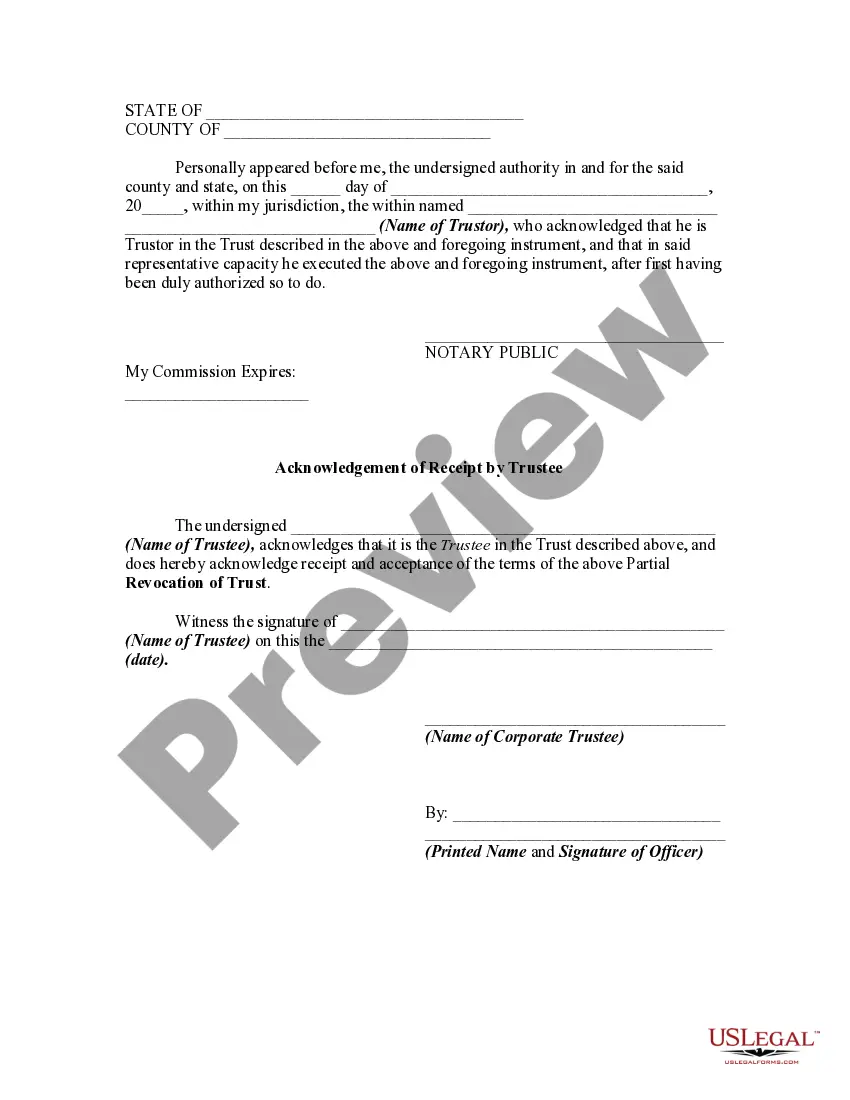

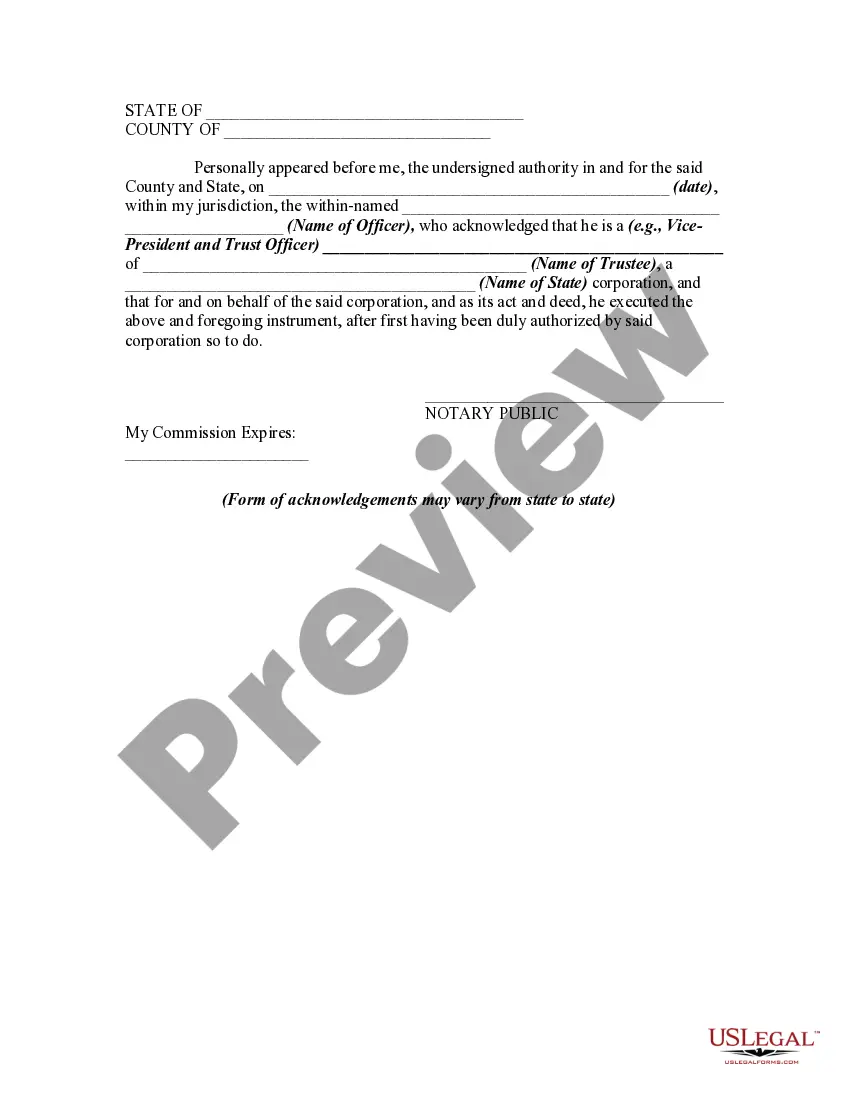

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

Selecting the optimal officially sanctioned document template can be a challenge.

Certainly, there exists a multitude of templates accessible online, but how can you find the official document you require.

Utilize the US Legal Forms website. This platform provides an extensive collection of templates, including the Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, suitable for both business and personal needs.

First, ensure you have selected the correct template for your region. You can preview the form using the Preview button and review the form details to confirm it is suitable for you.

- All documents are reviewed by specialists and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

- Use your account to view the legal documents you have previously purchased.

- Navigate to the My documents section of your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

Form popularity

FAQ

An example of a revocation of a trust would be a written document signed by the grantor clearly stating their intent to dissolve the trust. This document must outline the reasons for revocation and provide instructions on asset distribution. If you're facing a situation involving a Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, ensure your revocation complies with legal standards.

Iowa Code 633A 2202 defines the terms surrounding the creation and authority of a trust, along with the roles of trustees. This code helps clarify responsibilities, which is vital when considering any revocation or changes to a trust. For guidance on navigating the Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, checking these codes is important.

Yes, Iowa has adopted the Uniform Trust Code, which offers a comprehensive legal framework for managing trusts. This adoption ensures consistency and clarity across trusts in Iowa. When looking into Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, it is beneficial to be aware of Iowa’s regulations as they may influence your decisions.

Generally, a nursing home cannot directly take assets held in a revocable trust if the grantor is still alive and capable. However, Medicaid can put a lien on the trust assets if you apply for assistance, so planning is crucial. Understanding the implications of Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can help safeguard your assets.

The revocation of trust signifies that the trust has been terminated at the grantor's discretion. This means that the assets are no longer held in trust and revert back to the grantor or are distributed as specified prior to revocation. If you’re considering a Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, ensure all legal documents are properly executed.

Revocation of trust refers to the legal process of canceling a trust, rendering it null and void. This action typically requires the trust creator to express their intent clearly, often through a written document. When dealing with Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, understanding this process is essential.

Individuals might revoke a trust for various reasons, such as changing circumstances, dissatisfaction with the trust's terms, or the desire to consolidate assets. This decision can significantly impact estate planning strategies, especially in light of Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. It’s prudent to consult with a legal expert to navigate this process.

To dissolve a trust in South Carolina, the trust’s terms must allow for its termination. This process typically involves notifying the trustee and providing necessary documentation. If you find yourself in a situation involving the Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, seeking legal assistance can ensure you meet all requirements.

The Iowa Trust Code governs the creation, operation, and termination of trusts in Iowa. It provides important legal frameworks to ensure trusts function according to the grantor's wishes. Understanding this is essential, especially when addressing issues related to Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

In Iowa, the code concerning the certificate of trust is found in Section 633A. The provisions outline how a certificate of trust should be drafted, its purpose, and its legal effect. This can be relevant if you're considering a Puerto Rico Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.