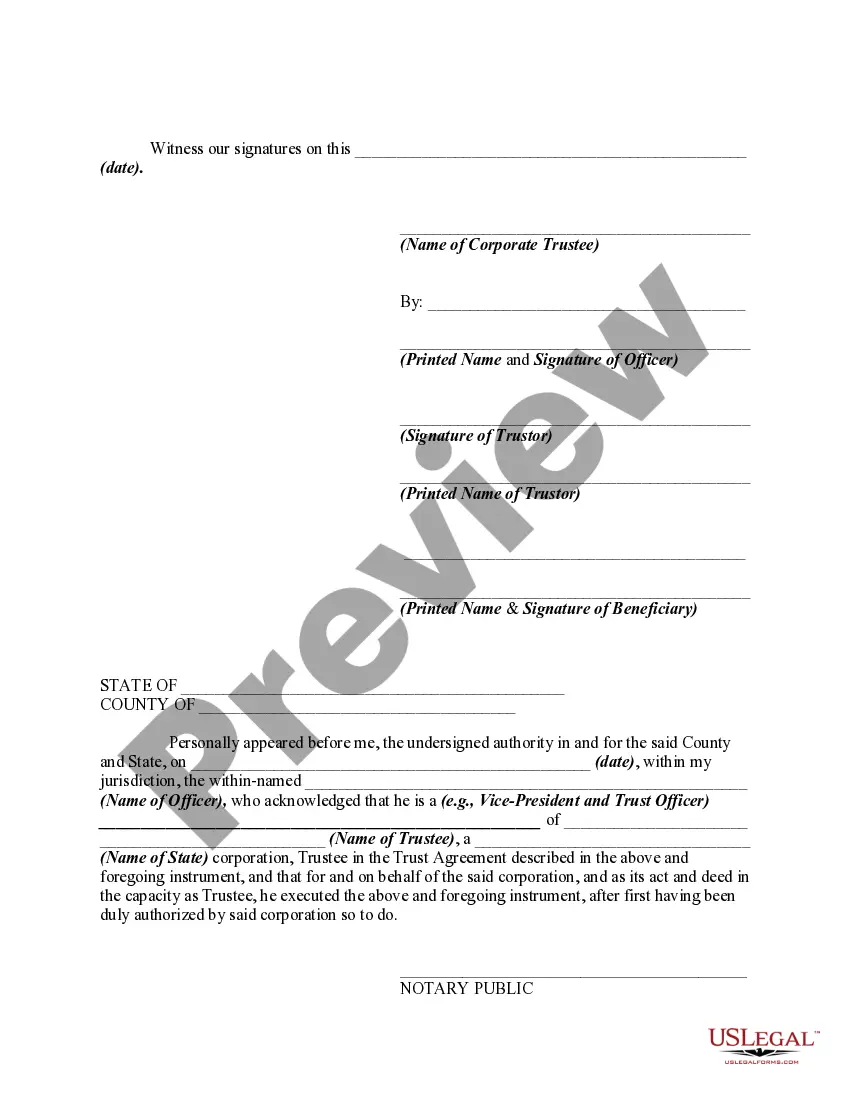

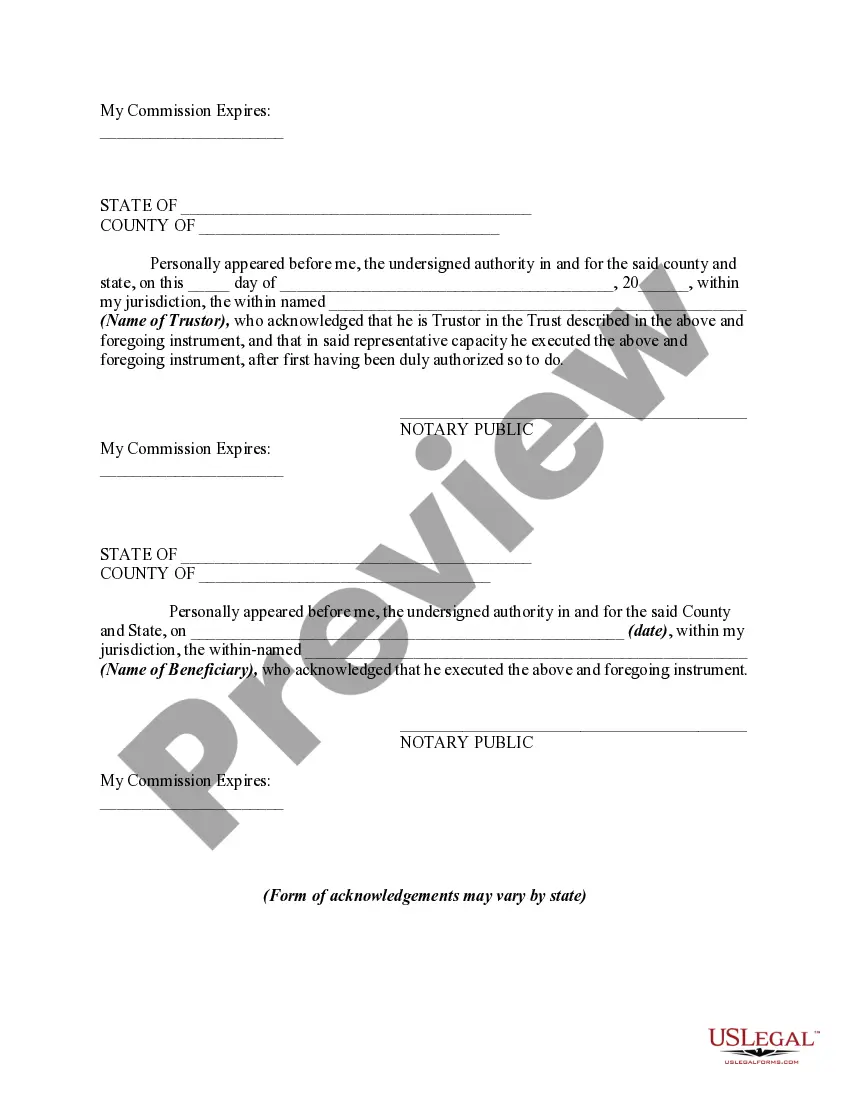

This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Agreement to Renew Trust Agreement: The Puerto Rico Agreement to Renew Trust Agreement refers to a legal arrangement that pertains to the renewal of the trust agreement in Puerto Rico. This agreement provides a legal framework for the extension and continuation of a trust between the parties involved. The agreement outlines the terms and conditions under which the trust agreement will be renewed, ensuring transparency, clarity, and mutual consent. Keywords: Puerto Rico, agreement to renew, trust agreement, legal arrangement, extension, continuation, parties involved, terms and conditions, mutual consent, transparency, clarity. Different types of Puerto Rico Agreement to Renew Trust Agreement may include: 1. Revocable Trust Agreement: This type of trust agreement allows the granter to make changes or revoke the agreement during their lifetime, providing flexibility and control over the assets held in trust. 2. Irrevocable Trust Agreement: Unlike a revocable trust agreement, an irrevocable trust cannot be easily modified or revoked once established. This type of trust agreement provides enhanced asset protection and can offer various tax benefits. 3. Testamentary Trust Agreement: A testamentary trust agreement is established through a will and comes into effect upon the death of the testator. It allows the distribution of assets to beneficiaries according to the terms specified in the will. 4. Living Trust Agreement: A living trust agreement, also known as an inter vivos trust agreement, is created during the granter's lifetime and remains in effect until their death. It allows for the management and distribution of assets while providing flexibility and privacy. 5. Special Needs Trust Agreement: A special needs trust agreement is designed to protect the assets of an individual with special needs without affecting their eligibility for government benefits. It ensures the provision of supplemental care and enhances the individual's quality of life. 6. Charitable Trust Agreement: This type of trust agreement is established for charitable purposes. It allows individuals or organizations to donate assets to a trust, ensuring the fulfillment of specific philanthropic goals and contributions to the community. In conclusion, the Puerto Rico Agreement to Renew Trust Agreement plays a significant role in renewing trust arrangements for various purposes. By understanding the different types of trust agreements available, individuals can choose the most suitable option based on their specific needs and objectives.