An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

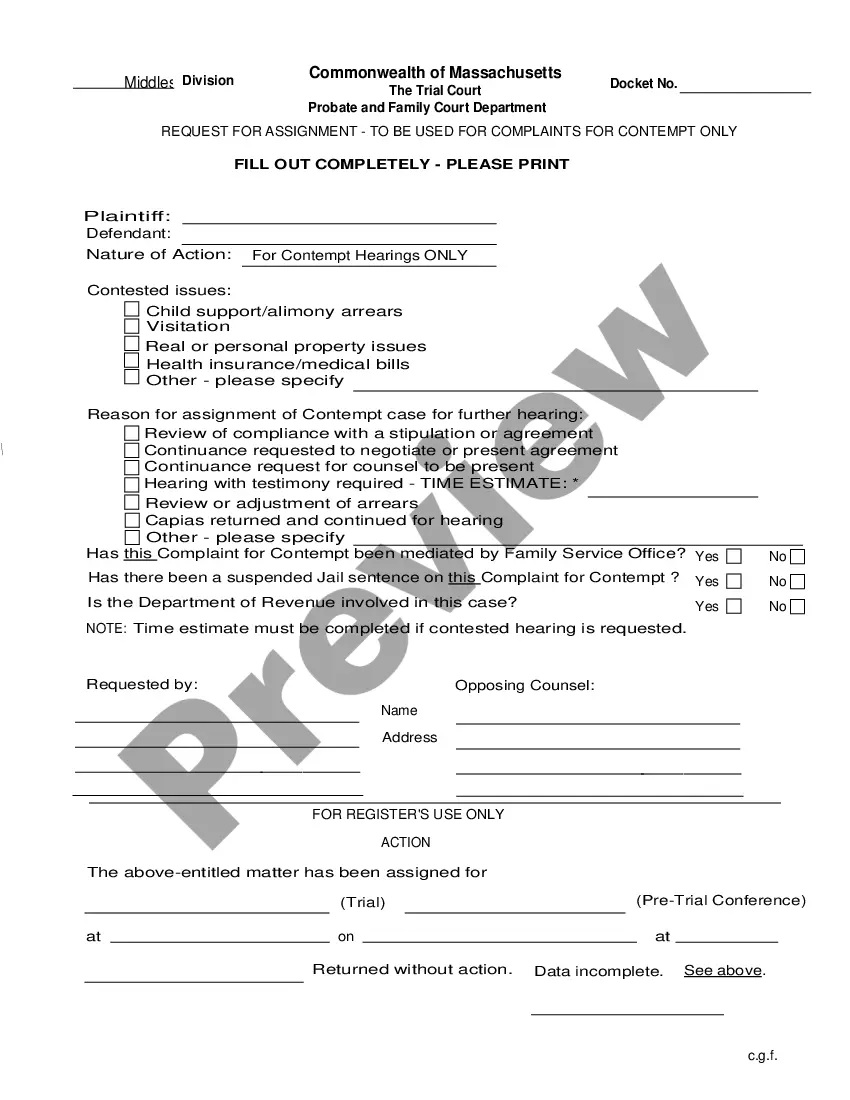

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

Selecting the appropriate legal document format can be a struggle. Naturally, there are numerous templates available online, but how do you find the legal form you need? Use the US Legal Forms website. The service offers a variety of templates, such as the Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, which can be utilized for business and personal purposes. All the forms are reviewed by experts and meet state and federal requirements.

If you are already registered, Log In to your account and click the Acquire button to obtain the Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. Use your account to search for the legal forms you have previously purchased. Go to the My documents tab in your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple guidelines for you to follow: First, make sure you have chosen the correct form for your specific area/county. You can review the form using the Review button and check the form details to ensure it is the right one for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident the form is suitable, click the Buy now button to purchase the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the document format and download the legal document to your device. Complete, modify, print, and sign the acquired Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

US Legal Forms is indeed the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted paperwork that adhere to state requirements.

- Selecting the appropriate legal document format can be a struggle.

- Naturally, there are numerous templates available online, but how do you find the legal form you need.

- All the forms are reviewed by experts and meet state and federal requirements.

- Go to the My documents tab in your account to download another copy of the document you need.

- If the form does not meet your requirements, use the Search field to find the correct form.

- Once you are confident the form is suitable, click the Buy now button to purchase the form.

Form popularity

FAQ

To declare residency in Puerto Rico, you need to file the appropriate forms with the local tax authorities. This process often requires you to prove your physical presence and intent to make Puerto Rico your permanent home. Completing a Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can serve as an official step in establishing your residency.

In some cases, a trust can be its own beneficiary, but this requires careful planning and legal consideration. This arrangement can be complex, depending on the terms set forth in the trust document. Leveraging the concept of Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can help clarify the implications of this structure.

Moving to Puerto Rico can be beneficial for tax purposes, especially under the Act 60 tax incentives. However, you should carefully consider all aspects, including lifestyle and local regulations. Consulting with professionals familiar with the Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can provide you with tailored advice to maximize your benefits.

Establishing a bona fide residence in Puerto Rico involves moving there with the intention of making it your primary home. This includes obtaining local identification, registering to vote, and integrating into the community. Using a Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can also be part of your strategy to demonstrate genuine ties to Puerto Rico.

The bona fide residence test requires you to demonstrate that your primary residence is in Puerto Rico. You must also pass a residency period test, which verifies your presence in Puerto Rico for at least 183 days. Familiarizing yourself with the Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can provide additional insights into how trust assets affect your residency status.

Yes, a trust can be a beneficiary of another trust. This can help in estate planning and asset management for beneficiaries. By understanding the Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, you can strategically structure your trusts to achieve your financial goals.

To become bona fide, you need to establish a genuine presence in Puerto Rico. This involves proving your intent to reside there permanently, such as by leasing or purchasing property. Additionally, completing a Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary may enhance your commitment to your residency in Puerto Rico.

Yes, a trust can distribute to another trust. This process is often outlined in the trust document itself. Understanding how a Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary works can clarify the distribution rules between trusts while ensuring compliance with regulations.

Yes, you can set up a trust in Puerto Rico. Many choose to establish trusts to manage assets effectively and provide for beneficiaries as part of a Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. The process involves drafting the trust document and meeting local legal requirements. Using platforms like uslegalforms can simplify this process, providing you with the necessary forms and guidance to create a trust that suits your needs.

Yes, a beneficiary can assign their interest in a trust. This is often done through a Puerto Rico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. However, it is crucial to understand the specific rules and regulations governing such assignments, as they may affect the rights of the beneficiary and the distribution of assets. Consulting with a legal expert can provide clarity and ensure that the assignment process adheres to the legal requirements.