Puerto Rico Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

Are you currently in a position where you frequently need documents for business or personal purposes.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers a vast array of template designs, such as the Puerto Rico Bill of Transfer to a Trust, which are created to comply with both federal and state standards.

Once you find the correct form, click Acquire now.

Choose a payment plan that suits you, provide the required information to create your account, and complete the payment using your PayPal or credit card. Select a convenient document format and download your copy. You can track all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Puerto Rico Bill of Transfer to a Trust at any time if necessary. Simply select the required form to download or print the template. Utilize US Legal Forms, which offers one of the largest selections of legal forms, to save time and avoid errors. The service provides well-crafted legal document templates that can be used for various purposes. Create a free account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can obtain the Puerto Rico Bill of Transfer to a Trust template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it is for the correct city/county.

- Use the Review button to evaluate the form.

- Check the summary to confirm that you have selected the right template.

- If the form is not what you seek, utilize the Search field to find the template that meets your needs.

Form popularity

FAQ

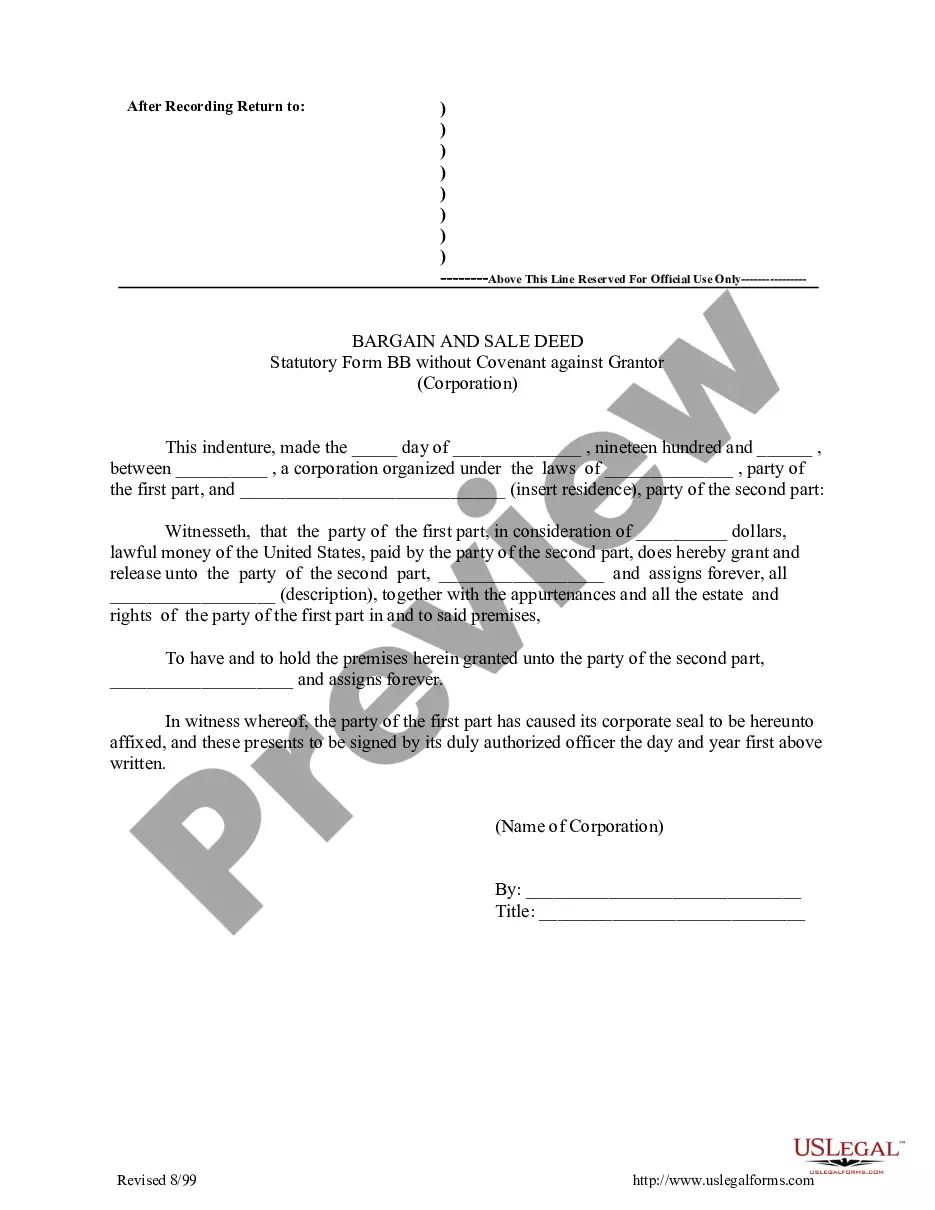

A bill of transfer is a legal document used to transfer ownership of assets into a trust. In the context of a Puerto Rico Bill of Transfer to a Trust, this document facilitates the proper transfer of property rights, aligning with your estate planning goals. This process ensures that the assets are held and managed by the trust as intended. For assistance in creating a bill of transfer, consider using the uslegalforms platform for reliable templates and guidance.

The Puerto Rico Trust Act establishes the legal framework for the creation and management of trusts in Puerto Rico. This legislation outlines various types of trusts, including those created through the Puerto Rico Bill of Transfer to a Trust. Under this law, individuals can enjoy enhanced estate planning flexibility and asset protection. Understanding this act can guide you in making informed decisions about your trust.

Gifts to a trust can be subject to taxation, depending on the amount and the type of trust. When you utilize a Puerto Rico Bill of Transfer to a Trust, it is essential to be aware of the tax implications involved. Generally, amounts beyond the annual gift tax exclusion require proper reporting and possible tax payments. Consulting a tax professional can help you navigate this area effectively.

Yes, you can place a house in a trust in Puerto Rico. This process involves creating a Puerto Rico Bill of Transfer to a Trust, which officially transfers ownership of the property to the trust. By doing so, you ensure that the house is managed according to your wishes, offering an effective estate planning solution. This structure not only protects the asset, but also simplifies the transfer to heirs.

Moving assets into a trust can provide you with numerous benefits, including asset protection and efficient estate management. The Puerto Rico Bill of Transfer to a Trust facilitates this process, allowing you to allocate your assets according to your preferences. However, evaluating your financial goals and personal circumstances is essential before making a decision. Consulting with legal experts like uslegalforms can guide you through the necessary steps.

Placing bank accounts in a trust can offer several advantages. With the Puerto Rico Bill of Transfer to a Trust, you can secure easy access and management of your financial assets for your heirs. This approach also helps minimize probate costs and potential disputes among beneficiaries. Considering these benefits, placing bank accounts in a trust can be a smart financial strategy.

Yes, Puerto Rico recognizes trusts and provides a framework for their formation and administration. The Puerto Rico Bill of Transfer to a Trust plays a vital role in establishing trust structures that comply with local laws. This recognition allows residents to utilize trusts for various purposes, including estate planning and tax benefits. It can be a strategic way to manage your estate effectively.

The Puerto Rico Bill of Transfer to a Trust is a legal document that facilitates the transfer of assets into a trust. This bill outlines the terms under which assets can be managed for future benefits, such as estate planning and asset protection. Utilizing this document correctly can simplify the management of your estate after your passing. It helps ensure that your wishes are followed and your beneficiaries are protected.

A transfer to a trust may not be taxable, depending on various factors. Generally, the Puerto Rico Bill of Transfer to a Trust allows you to move assets without triggering immediate tax consequences. However, it is crucial to consider your specific situation and consult with a tax professional for personalized advice. Understanding the implications can help ensure your assets are structured effectively.

Transferring assets to a trust after death can be complex, but it's manageable. If you have established a trust and want to include your assets, the estate may need to go through probate to transfer those assets legally. Relying on the Puerto Rico Bill of Transfer to a Trust ensures that your beneficiaries follow appropriate procedures. Utilizing resources like uslegalforms can provide assistance during this critical time.