One principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Another advantage is that such trusts, like other gifts of insurance policies, may afford substantial estate tax savings.

Puerto Rico Irrevocable Trust Funded by Life Insurance

Description

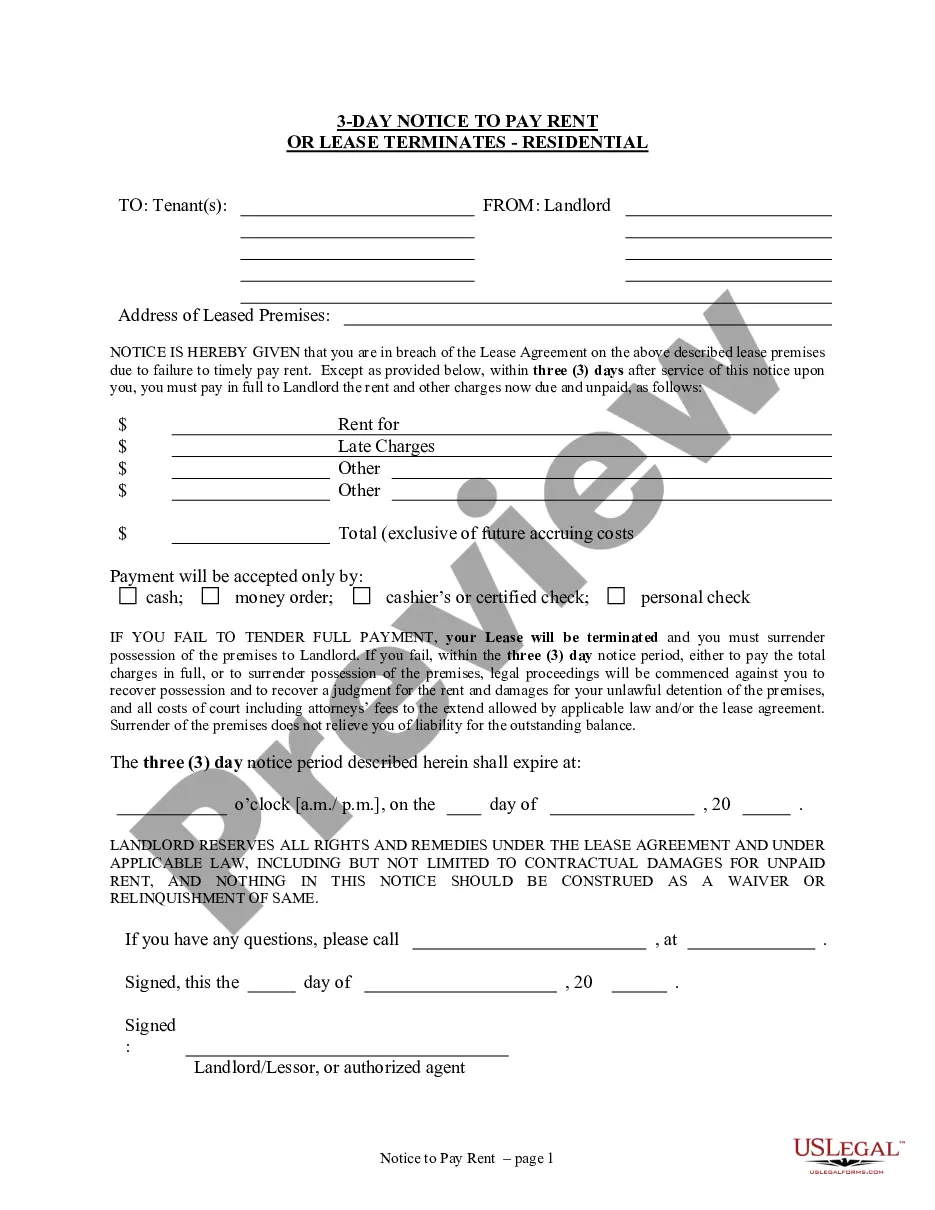

How to fill out Irrevocable Trust Funded By Life Insurance?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal form templates that you can download or create.

By using the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You'll be able to find the latest versions of forms like the Puerto Rico Irrevocable Trust Funded by Life Insurance in moments.

If you have a subscription, Log In and download the Puerto Rico Irrevocable Trust Funded by Life Insurance from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the payment.

Choose the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Puerto Rico Irrevocable Trust Funded by Life Insurance. Each template you add to your account has no expiration date and belongs to you indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Puerto Rico Irrevocable Trust Funded by Life Insurance with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

- Review the Preview button to see the contents of the form.

- Check the form summary to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, select the pricing plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

The IRS lays out specific rules for irrevocable trusts, including the Puerto Rico Irrevocable Trust Funded by Life Insurance. Generally, these trusts are treated as separate tax entities. This means they must report income, deductions, and potentially file their own tax returns. It’s important to review IRS guidelines and consult with an expert to ensure compliance and optimize benefits for your heirs.

Indeed, an irrevocable life insurance trust, such as a Puerto Rico Irrevocable Trust Funded by Life Insurance, often must file a tax return. This requirement exists particularly when the trust generates income from assets. Understanding these tax obligations is essential for proper trust management. Consulting with a qualified tax professional can ensure you meet all necessary reporting requirements.

Yes, an irrevocable life insurance trust, including a Puerto Rico Irrevocable Trust Funded by Life Insurance, typically has its own tax obligations. If the trust generates income, there is a requirement to file a tax return. It's crucial to track any earnings from the policy or assets held within the trust. Seeking guidance from a tax advisor can help clarify these responsibilities.

When dealing with a Puerto Rico Irrevocable Trust Funded by Life Insurance, it's essential to understand your tax obligations. Generally, irrevocable trusts must file their own tax returns if they generate income. This means you need to be aware of the income produced by the trust assets. Consulting with a tax professional is wise to ensure compliance and to handle any complexities.

The 3 year rule for an irrevocable life insurance trust focuses on the timing of asset transfers. If you transfer a life insurance policy to an ILIT and die within three years, the IRS may still consider the policy as part of your estate for tax purposes. To ensure that your planning aligns with your goals, consulting with an expert familiar with the Puerto Rico Irrevocable Trust Funded by Life Insurance is advisable.

The 3 year rule for irrevocable trusts primarily deals with how asset transfers affect estate taxes. If assets were transferred into an irrevocable trust like the Puerto Rico Irrevocable Trust Funded by Life Insurance and the grantor dies within three years, those assets might still be counted in their estate. Understanding this rule helps you plan more effectively to minimize tax liabilities.

When the owner of an irrevocable trust passes away, the assets within the trust are distributed according to the trust's terms. In the case of the Puerto Rico Irrevocable Trust Funded by Life Insurance, this means the life insurance proceeds will provide support to the named beneficiaries. Importantly, these assets typically avoid probate and any associated delays.

The 3 year look back on life insurance refers to the period the IRS examines when assessing tax implications on transferred policies. If you transfer the ownership of a policy or place it in a trust like the Puerto Rico Irrevocable Trust Funded by Life Insurance, and pass away within three years, the policy's value may still be included in your estate. It is vital to understand the timing to optimize your estate planning strategies.

The 3 year look back rule for an irrevocable life insurance trust (ILIT) concerns the transfer of assets and their taxation. If you transfer a life insurance policy into an ILIT, any proceeds from that policy may be included in your taxable estate if you die within three years of the transfer. Hence, to maximize benefits, it's crucial to plan ahead.

Yes, you can definitely place life insurance in an irrevocable trust, like the Puerto Rico Irrevocable Trust Funded by Life Insurance. Doing this helps remove the life insurance policy from your taxable estate, which can benefit your beneficiaries. However, you need to carefully follow the legal procedures to ensure the trust meets all requirements.