This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Receipt and Acceptance of Residential Mortgage Loan Commitment

Description

How to fill out Receipt And Acceptance Of Residential Mortgage Loan Commitment?

Are you presently within a place where you will need files for sometimes organization or individual reasons nearly every day time? There are a lot of legal file layouts available on the net, but discovering kinds you can rely on is not simple. US Legal Forms provides thousands of type layouts, just like the Puerto Rico Receipt and Acceptance of Residential Mortgage Loan Commitment, that happen to be written in order to meet federal and state needs.

Should you be previously acquainted with US Legal Forms website and get a free account, just log in. Afterward, you are able to obtain the Puerto Rico Receipt and Acceptance of Residential Mortgage Loan Commitment design.

If you do not have an account and need to begin using US Legal Forms, adopt these measures:

- Find the type you will need and make sure it is for your right metropolis/region.

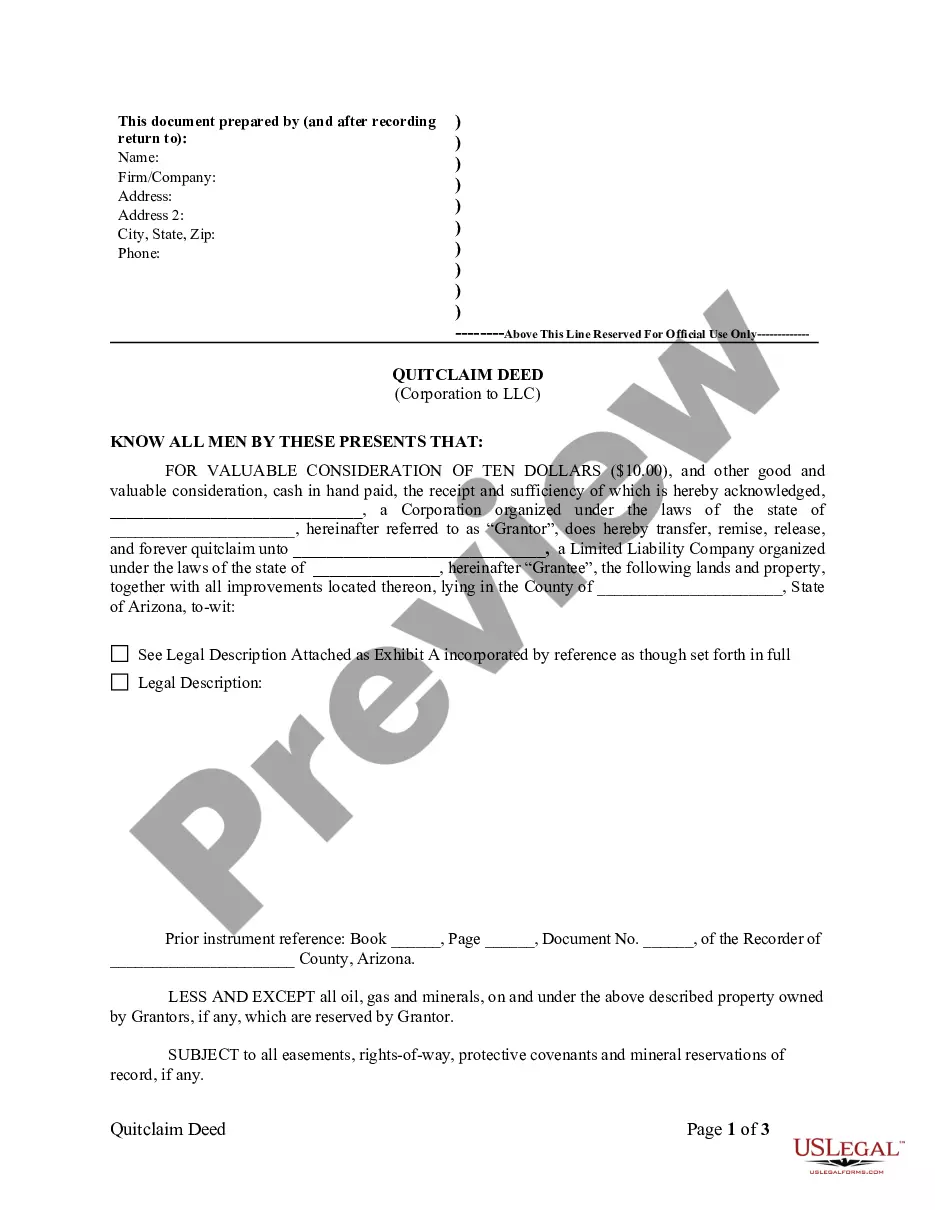

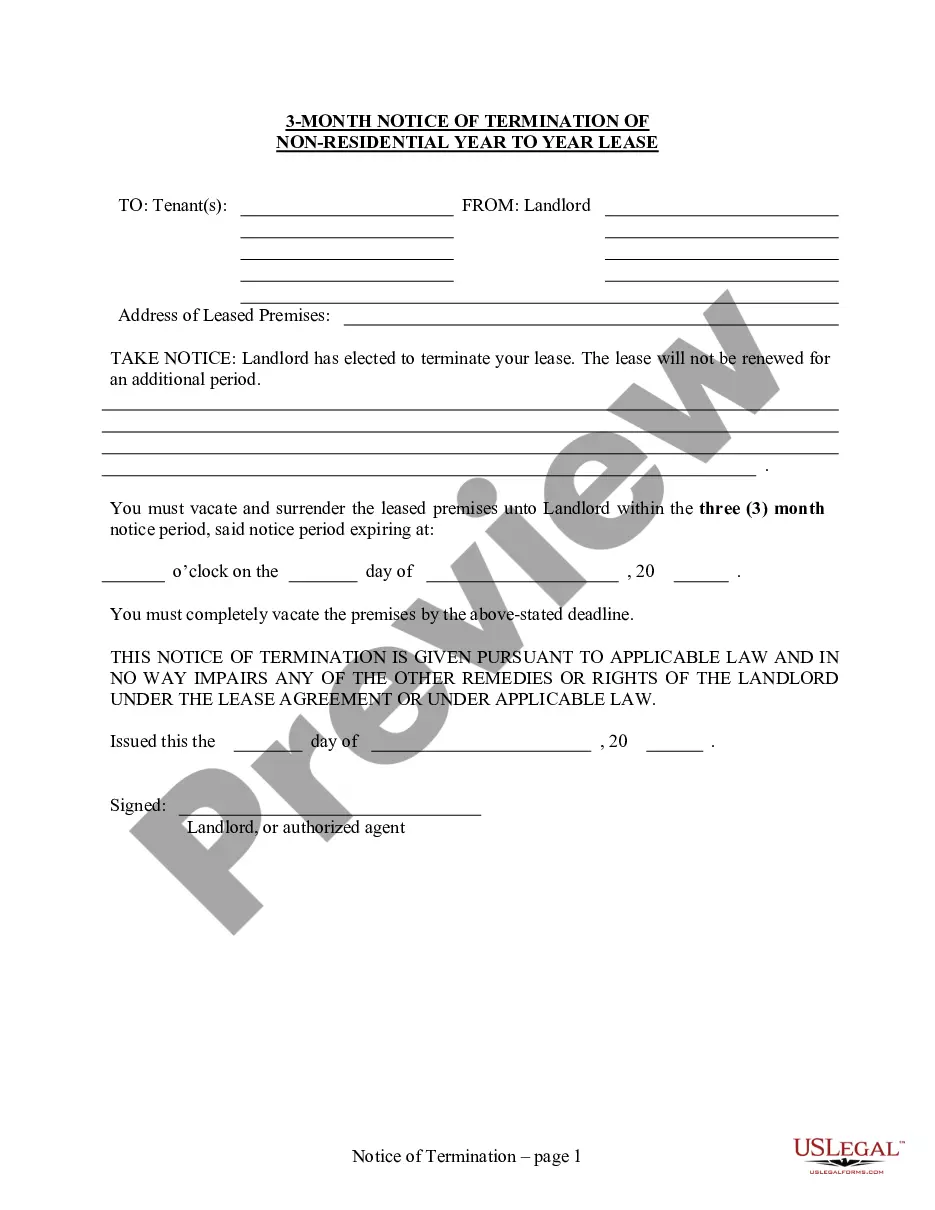

- Utilize the Preview switch to review the form.

- See the information to ensure that you have selected the correct type.

- When the type is not what you`re searching for, make use of the Look for industry to find the type that suits you and needs.

- Whenever you obtain the right type, just click Get now.

- Opt for the rates plan you need, complete the required info to create your account, and buy your order utilizing your PayPal or credit card.

- Select a convenient paper formatting and obtain your duplicate.

Get each of the file layouts you might have purchased in the My Forms food selection. You can get a more duplicate of Puerto Rico Receipt and Acceptance of Residential Mortgage Loan Commitment at any time, if possible. Just click on the needed type to obtain or print out the file design.

Use US Legal Forms, the most comprehensive assortment of legal varieties, to conserve some time and steer clear of faults. The support provides expertly made legal file layouts that can be used for a selection of reasons. Make a free account on US Legal Forms and commence generating your daily life easier.

Form popularity

FAQ

Specifically, a conditional commitment letter is issued by a lender after they have reviewed the borrower's financial information, reliability, and other relevant factors. It signifies the lender's intention to provide the loan, subject to certain conditions being met.

The loan commitment date is a day specified in a purchase and sales agreement that a buyer's lender must provide a written commitment to a borrower that would provide financing for a particular home. Usually, the date is 21-35 days after the parties sign an offer to purchase.

Know that you're free to switch lenders at any time during the process; you're not committed to a lender until you've actually signed the closing papers. But if you do decide to switch, re-starting paperwork and underwriting could cause delays in your home purchase or refinance process.

A mortgage commitment letter is not the same as final approval, but it shows that you're in a good position to buy a home. Once you make an offer on a home and the seller accepts it, you can move on to the full application process, which involves a more in-depth review of your finances and the property you want to buy.

Know that you're free to switch lenders at any time during the process; you're not committed to a lender until you've actually signed the closing papers. But if you do decide to switch, re-starting paperwork and underwriting could cause delays in your home purchase or refinance process.

Does A Loan Commitment Letter Mean I'm Approved? After you're preapproved, you'll receive a conditional mortgage commitment letter. That does not mean you're approved for the loan. With this conditional approval, you'll still have steps to take in the mortgage application process.

To obtain a conditional or final commitment letter, you'll need to go through your chosen lender's mortgage preapproval process. Doing so may require you to provide documentation such as pay stubs, bank statements, and other materials that provide proof of employment and earnings.

Mortgage rate lock FAQ A rate lock doesn't lock you into the deal ? if you find better terms and lower closing costs from another lender, you can opt to go with that lender after your rate lock with the first lender begins.