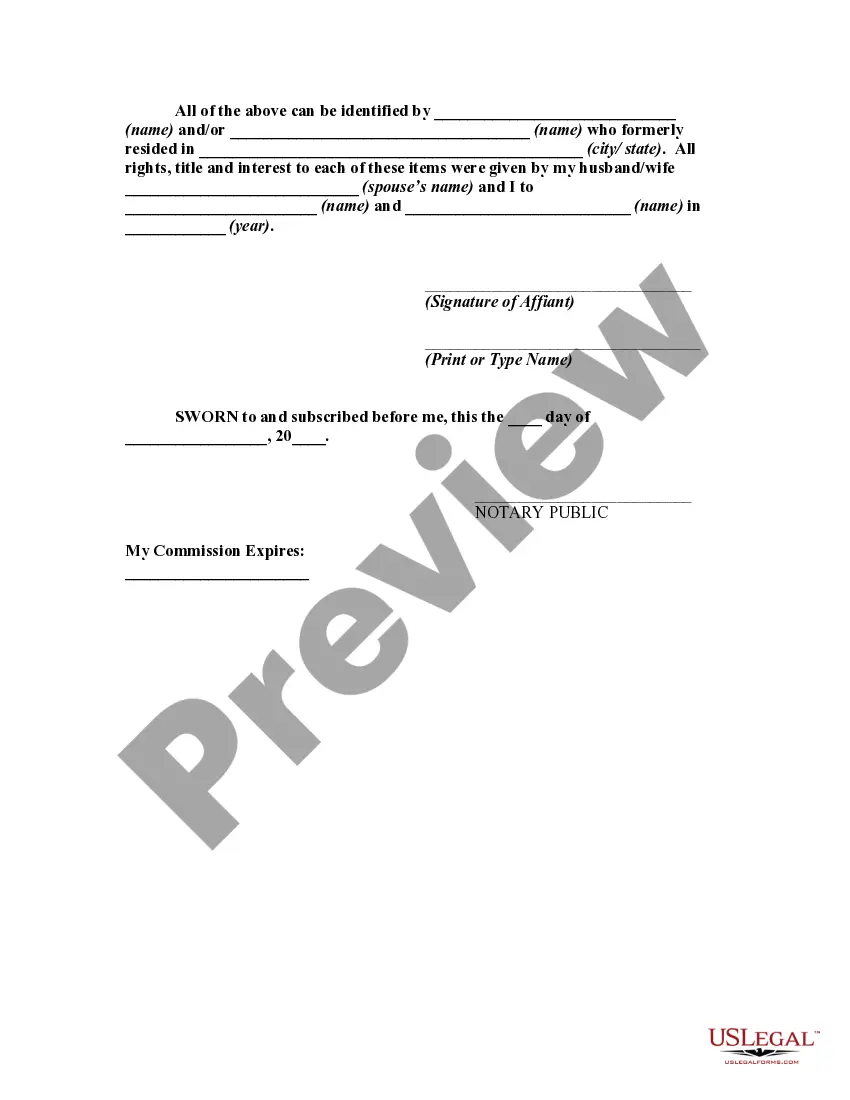

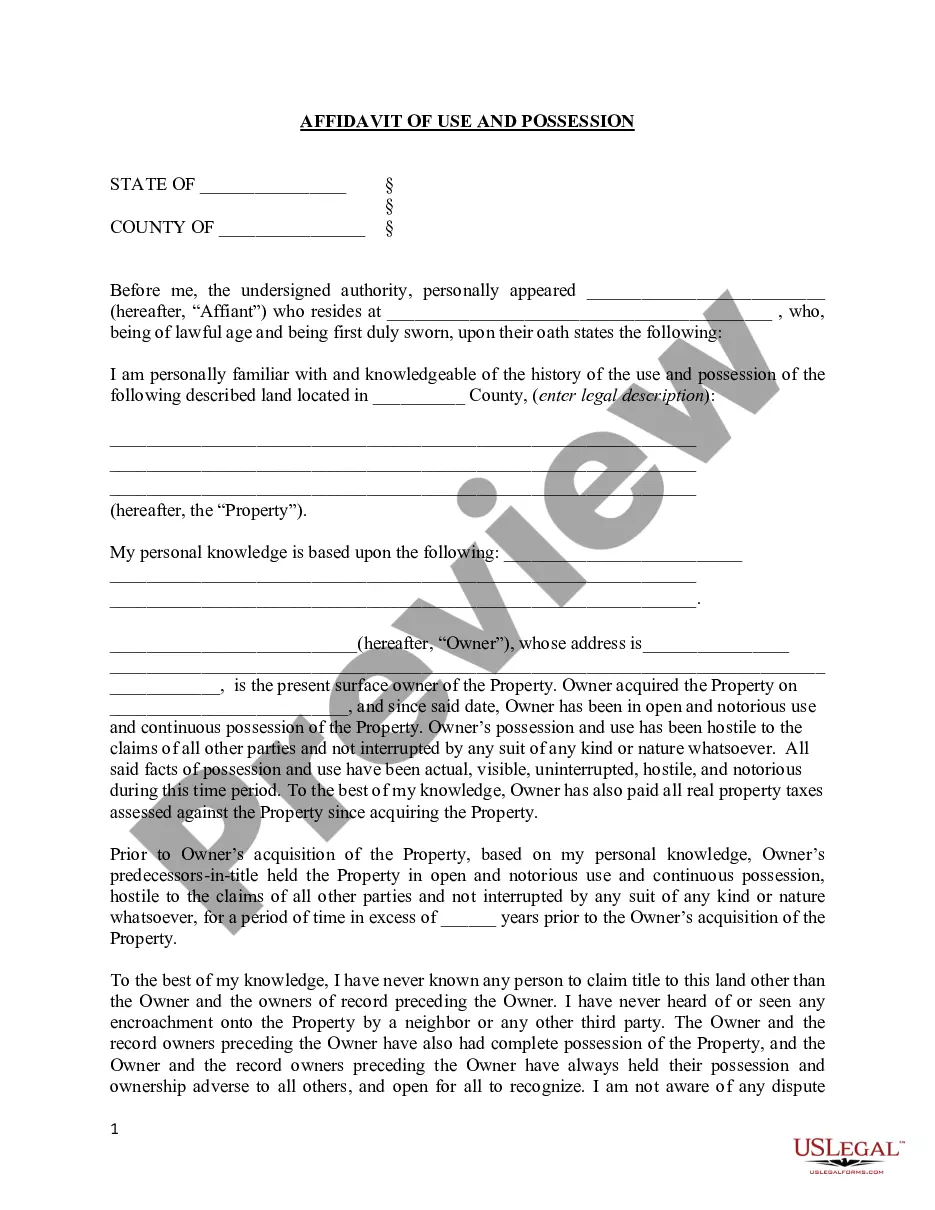

A notary public has the power and is authorized to administer oaths and affirmations, receive proof and acknowledgment of writings, and present and protest any type of negotiable paper, in addition to any other acts to be done by notaries public as provided by law.

Source: YSL 2-21 ?§12, modified.

Nothing in this section shall preclude acknowledgment by a notary public duly authorized to acknowledge instruments in any state or territory of the United States or other foreign jurisdiction; provided, however, that said notary public complies with the laws of that jurisdiction.

Source: TSL 4-91, ?§ 10, modified.