Puerto Rico Gift Affidavit Form is a legal document used in Puerto Rico to declare the gifting of property or assets by one party to another. It serves as a sworn statement affirming the voluntary transfer of ownership without any consideration or payment involved. This form must be completed accurately and submitted to the appropriate authorities for record keeping and taxation purposes. The Puerto Rico Gift Affidavit Form typically includes important details such as the names and contact information of both the donor (person giving the gift) and the recipient, a description of the gifted property, its value, and the date of the gift. Additionally, the form may also require details about any liens or encumbrances on the property, if applicable. It is essential to provide clear and precise information to ensure legal compliance. Different types of Puerto Rico Gift Affidavit Forms may exist depending on the nature of the gift. For example, there might be separate forms for the gifting of real estate, vehicles, securities, or other valuable assets. Each form may have specific sections tailored to capture the necessary details relevant to the specific type of gift being declared. It is crucial to utilize the correct form that corresponds to the type of property being gifted to ensure accuracy and adherence to legal procedures. Completing the Puerto Rico Gift Affidavit Form accurately is essential to avoid potential legal complications and taxation issues. Failure to file a gift affidavit or providing false information can lead to penalties or disputes in the future. It is advisable to consult with a legal professional or seek guidance from the appropriate authorities to ensure compliance with all necessary regulations and requirements.

Puerto Rico Gift Affidavit Form

Description

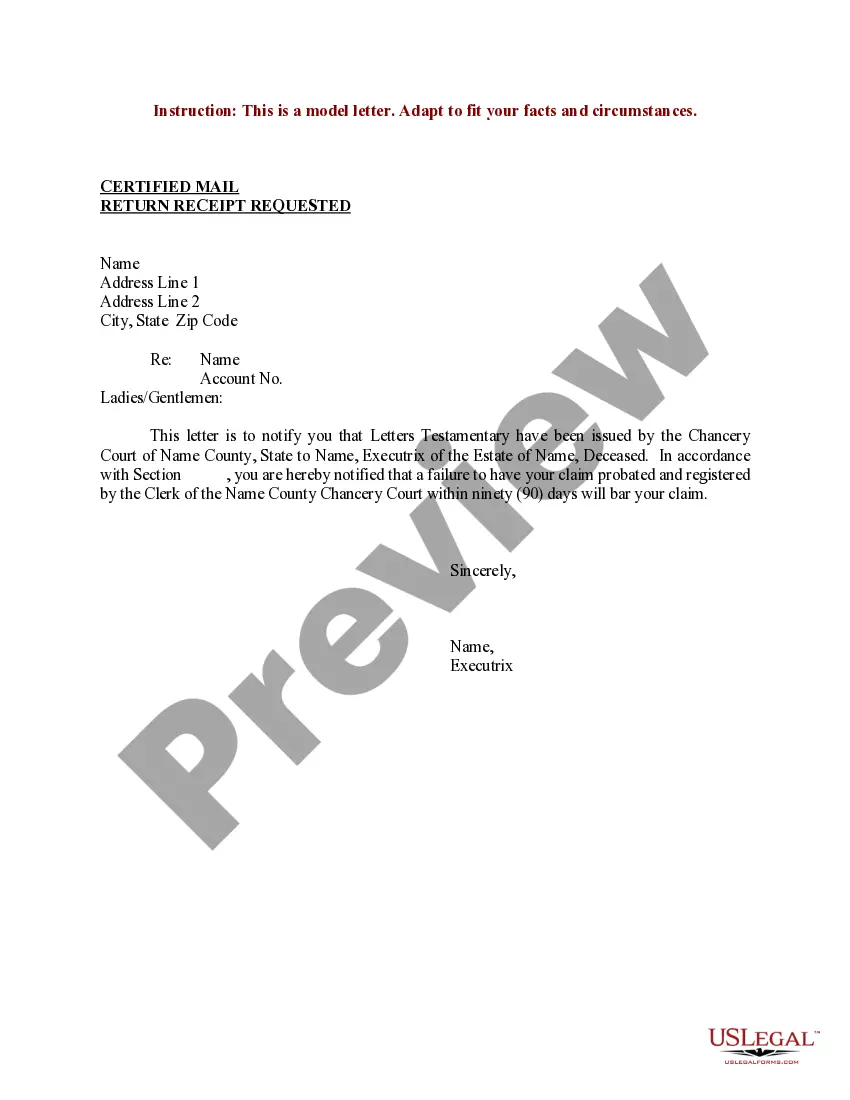

How to fill out Puerto Rico Gift Affidavit Form?

US Legal Forms - one of the premier collections of legal documents in the United States - offers a broad spectrum of legal form templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent forms like the Puerto Rico Gift Affidavit Form in just a few moments.

If you possess an account, Log In and retrieve the Puerto Rico Gift Affidavit Form from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and obtain the form on your device. Modify the document. Fill out, edit, print, and sign the saved Puerto Rico Gift Affidavit Form. Each template you add to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the Puerto Rico Gift Affidavit Form with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a vast number of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct form for your city/state.

- Select the Review button to check the form’s details.

- Examine the form description to confirm you have chosen the right one.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Yes, if you receive a foreign gift that exceeds $100,000, you must report it to the IRS. The rules surrounding foreign gifts can be complex, so it’s crucial to be aware of your obligations. Completing the Puerto Rico Gift Affidavit Form can provide clarity in the process and help ensure that your foreign gifts are reported accurately and promptly.

Yes, your parents can gift you $100,000; however, they may need to file a gift tax return if the amount exceeds the annual gift tax exclusion limit. For 2023, the limit is $17,000 per recipient. Using the Puerto Rico Gift Affidavit Form can assist in documenting this generous transfer and ensuring that all necessary tax regulations are followed.

Generally, the recipient of a gift does not have to report it to the IRS unless the amount exceeds certain thresholds. However, if you receive a gift from a foreign person or entity, you may have additional reporting requirements. To ensure compliance, it’s beneficial to use the Puerto Rico Gift Affidavit Form, which can ease the process of documenting gifts and understanding any reporting obligations.

The gift tax in Puerto Rico is imposed on transfers of property without receiving something of equal value in return. While the federal gift tax does apply, Puerto Rico has its own tax system, including a separate gift tax structure. It's essential to understand the specific rates and exemptions that may apply when filling out the Puerto Rico Gift Affidavit Form, as it helps document these transfers correctly.

Puerto Rico is often viewed as a tax haven due to its favorable tax laws and incentives designed to attract investors and entrepreneurs. Many U.S. citizens may find significant tax relief by establishing residency in Puerto Rico. However, using a Puerto Rico Gift Affidavit Form can streamline processes and ensure compliance with local regulations while enjoying these benefits.

Yes, a U.S. citizen can gift to a non-U.S. citizen, subject to IRS guidelines on gift amounts and reporting. This can be advantageous, especially when planning estates or transfers of wealth. Ensuring accurate completion of the Puerto Rico Gift Affidavit Form can help document this gifting process effectively.

Indeed, a U.S. citizen can gift an unlimited amount to a non-U.S. citizen spouse without incurring gift tax under certain conditions. This often applies if the gift is for educational or medical purposes, which can be tax-exempt. To simplify the documentation, using a Puerto Rico Gift Affidavit Form ensures proper handling of these exemptions.

Yes, US citizens investing in property or capital assets in Puerto Rico face capital gains tax, similar to federal regulations. However, Puerto Rico offers certain deductions and tax breaks that may benefit residents and specified investors. Consulting a professional and understanding how a Puerto Rico Gift Affidavit Form works can help in minimizing tax liabilities associated with capital gains.

Non-residents in Puerto Rico may face different tax obligations compared to residents. They generally encounter a flat income tax rate based on their income types and amounts. It is vital for non-residents to understand their tax responsibilities, and a Puerto Rico Gift Affidavit Form can assist in navigating the complexities of tax law regarding gifts.

A US citizen can gift up to $15,000 per year to a non-US citizen without incurring any gift tax, as of 2021. However, amounts exceeding this limit may require the use of IRS Form 709 and proper reporting. Using a Puerto Rico Gift Affidavit Form helps facilitate this process and ensures compliance with local laws, which may have specific requirements.