The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

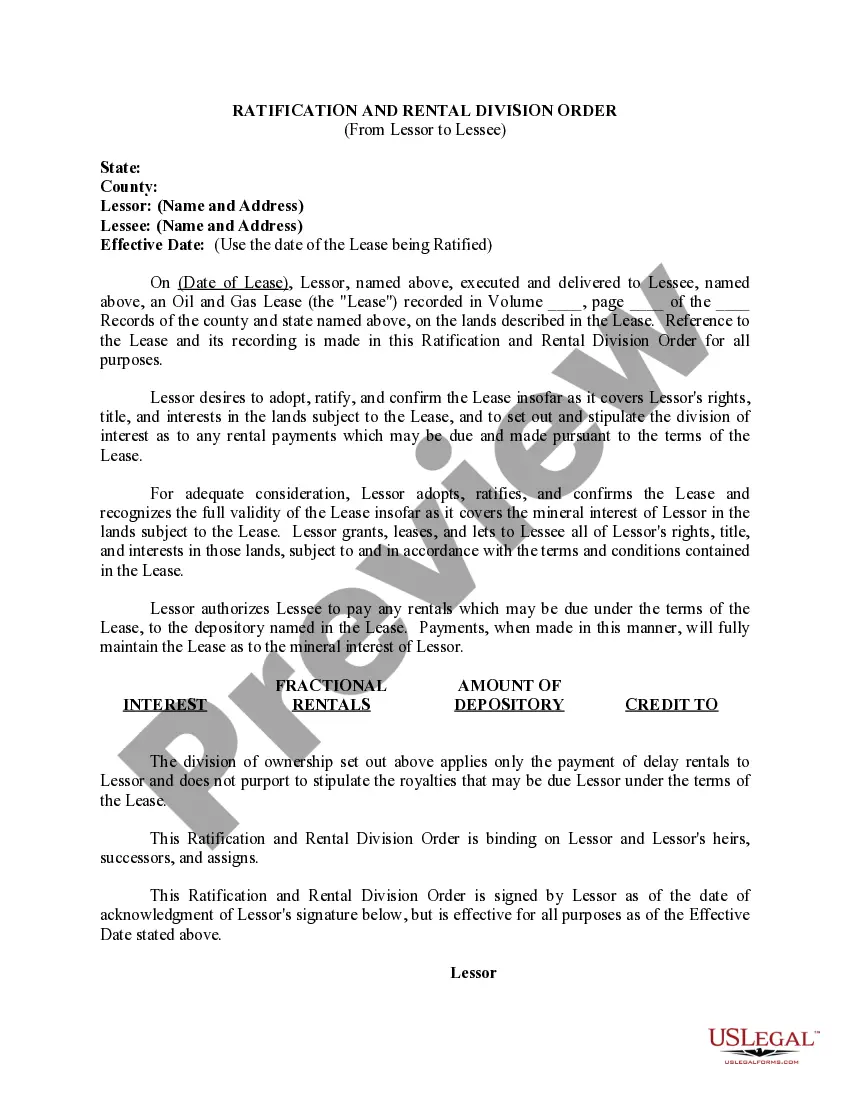

Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

Finding the appropriate legitimate document template can be quite challenging.

Naturally, there are numerous templates accessible online, but how can you locate the official form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, which you can utilize for business and personal purposes.

First, ensure you have selected the correct form for your area/county. You can review the form using the Review button and examine the form description to confirm it's suitable for you. If the form does not meet your needs, utilize the Search field to find the right form. Once you are certain the form works, click on the Buy now button to acquire the form. Choose the pricing plan you want and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, modify, print, and sign the obtained Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. US Legal Forms is the largest catalog of legal forms where you can find various document templates. Use the service to obtain professionally crafted papers that meet state regulations.

- All of the forms are verified by experts and comply with federal and state regulations.

- If you are already a member, Log In to your account and click the Download button to obtain the Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

Form popularity

FAQ

While naming a trust as an IRA beneficiary can offer benefits, it may also lead to complex tax implications or reduced benefits. A trust might accelerate required minimum distributions, impacting the overall tax burden. Therefore, examining the benefits of a Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account could provide a clearer picture of how to minimize drawbacks while achieving your goals.

Certainly, a trust can be a designated beneficiary of an IRA. Doing so can offer flexibility in distributing benefits according to your wishes. Establishing a Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account might be a strategic choice, providing control over how funds are disbursed to your heirs.

Yes, a trust can serve as a beneficiary of your IRA. This setup often provides an advantage by allowing for continued management of assets according to your preferences. If you choose to go this route, consider establishing a Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account to optimize tax and distribution benefits.

A trust can override a beneficiary designation in certain situations. When you name a trust, the terms of the trust govern who receives the assets. Therefore, it is important to structure your Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account correctly to ensure that it aligns with your intent.

A trust can indeed be the beneficiary of a retirement account, allowing for greater control over asset distribution. Choosing the Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account provides a strategic way to preserve wealth for your beneficiaries. However, it is crucial to consult with a legal expert to align the structure of the trust with IRS guidelines and ensure seamless asset transitions.

Yes, you can name a trust as the beneficiary of your 401k, but it is essential to understand the implications. By designating the Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account or 401k, you can manage how assets are distributed. However, ensure that the trust is structured correctly to avoid potential tax issues and ensure your wishes are respected.

One issue with naming a trust as a beneficiary of an IRA is the potential for complicated tax implications. The IRS may impose different rules on distributions, which can affect how quickly your beneficiaries receive funds. Additionally, if the trust does not meet specific requirements, it may lose the benefits associated with the Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account.

Naming a trust as the beneficiary of your retirement account can provide several advantages, particularly with estate planning. The Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can help ensure that your retirement assets are managed according to your wishes. Moreover, it can assist in protecting your assets from creditors, and it may provide a streamlined process for transferring funds after your passing.

Deciding whether to name a Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account is a significant choice. This option can provide asset protection and control over the distribution process, making it appealing to many. However, it's crucial to weigh the potential tax ramifications and administrative burdens. Seeking guidance from a knowledgeable source can help you make the best decision for your situation.

One downside of naming a Puerto Rico Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account is the potential for increased tax consequences. The trust may trigger different tax rates, affecting the overall value of your retirement benefits. Moreover, the administrative aspects of managing a trust can be more complex than direct beneficiary designations. Understanding these factors is essential before making a decision.