Puerto Rico General Form of Revocable Trust Agreement

Description

How to fill out General Form Of Revocable Trust Agreement?

US Legal Forms - one of the top libraries of legal documents in the United States - provides a variety of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can locate the latest forms such as the Puerto Rico Revocable Trust for Married Couple in just a few minutes.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the payment plan you prefer and enter your details to create an account.

- If you possess a subscription, Log In to obtain the Puerto Rico Revocable Trust for Married Couple from the US Legal Forms library.

- You'll see the Download option on every form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have selected the correct form for your city/state.

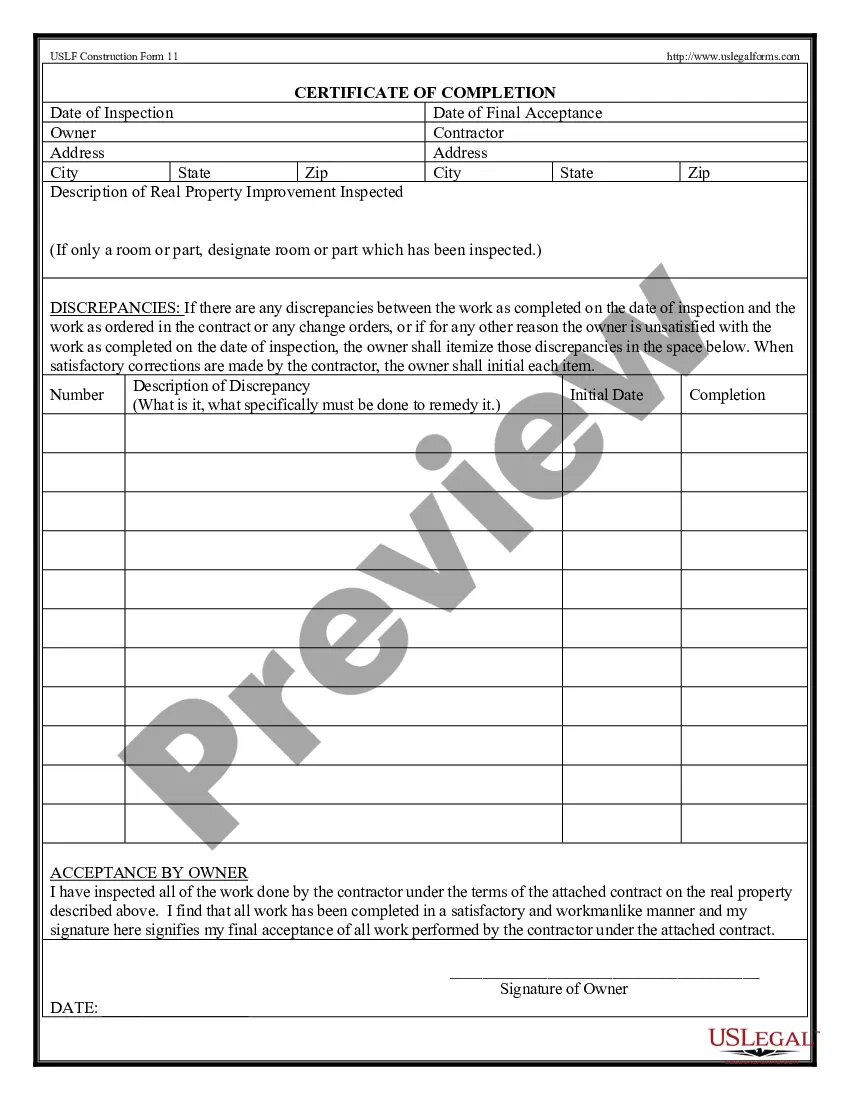

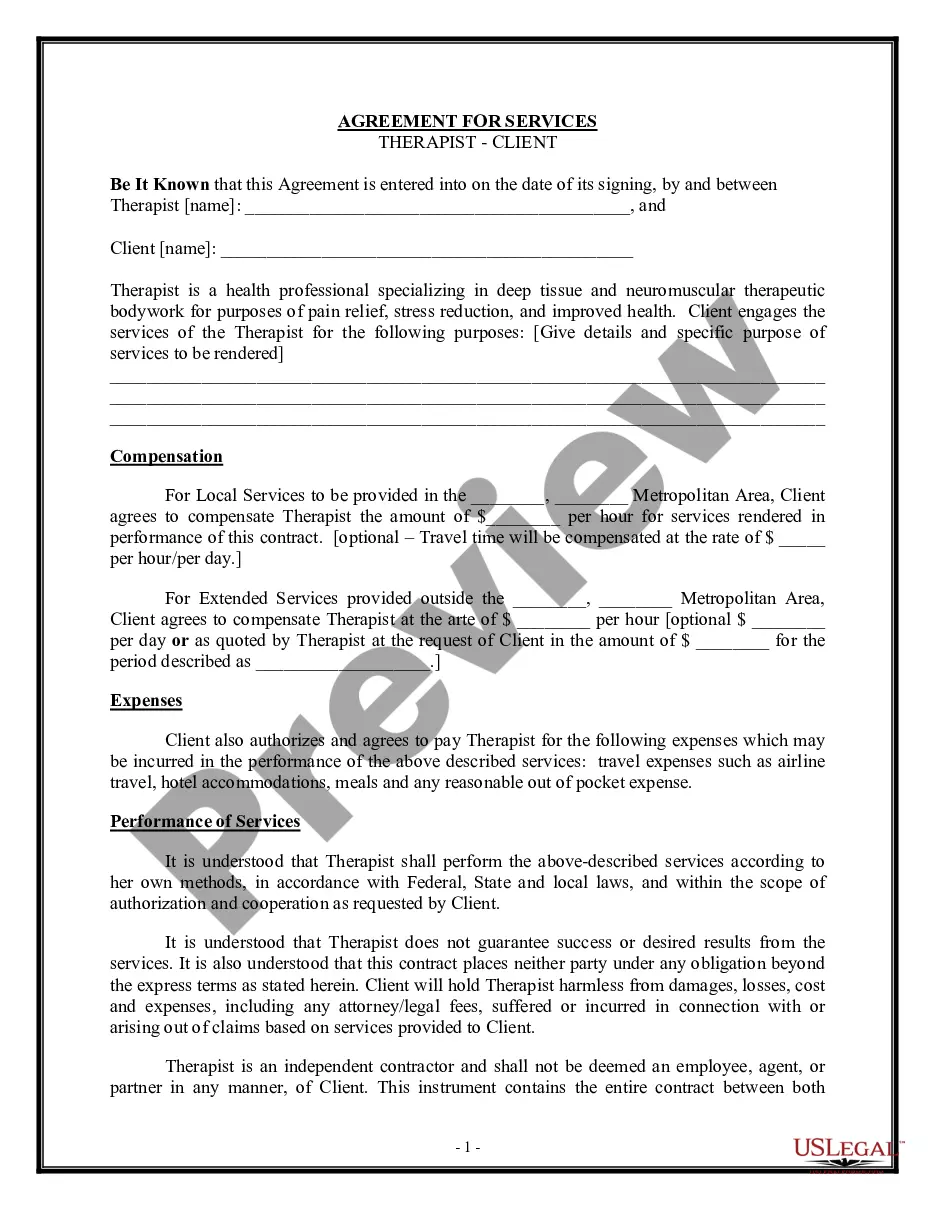

- Click on the Review option to examine the contents of the form.

Form popularity

FAQ

Considering a move to Puerto Rico for tax benefits can be a strategic decision. Puerto Rico offers unique tax incentives that may significantly lower your tax liability. However, it is essential to weigh these benefits against other lifestyle factors and consult with a tax professional to determine if establishing a Puerto Rico revocable trust for married couples complements your overall financial strategy.

When someone dies in Puerto Rico, their property typically goes through a legal process called probate. If you have established a Puerto Rico revocable trust for a married couple, this process may be simplified, as the trust can facilitate the direct transfer of assets outside of probate. This helps your loved ones avoid potential delays and complications during a difficult time.

A survivor's trust becomes effective after the first spouse dies, ensuring assets pass directly to the surviving spouse. In contrast, a marital trust, often used in a Puerto Rico revocable trust for married couples, pools assets for shared benefit during both spouses' lifetimes. Understanding these differences can help you decide which type of trust best fits your estate planning needs.

The new inheritance law in Puerto Rico modernizes how estates are handled, particularly concerning the rights of spouses and children. Under this law, a Puerto Rico revocable trust for married couples can help ensure that your wishes regarding asset distribution are fulfilled. This law aims to make the estate distribution process clearer and more equitable for families.

Yes, you can put a house in a Puerto Rico revocable trust for married couples. This trust allows you to manage your property, protect your estate from probate, and ensure a smooth transfer of assets upon your passing. It also provides flexibility, as you can modify or revoke the trust during your lifetime, making it a convenient choice for estate planning.

A joint trust is a legal arrangement where two spouses manage their assets together within a single trust. Both individuals can input assets and make decisions collectively, providing transparency and ease in managing finances. Upon the death of one spouse, the trust continues to operate, usually under the remaining spouse’s control. For many couples, a Puerto Rico Revocable Trust for Married Couples serves as a practical solution to achieve shared financial goals.

Remarried couples often benefit from using a Qualified Terminable Interest Property (QTIP) trust or a revocable living trust. These trusts can protect the interests of both partners and their children from previous marriages. They provide flexibility for asset management while ensuring that all beneficiaries are considered. A Puerto Rico Revocable Trust for Married Couples can also serve this purpose effectively.

When one spouse dies, a joint revocable trust typically becomes irrevocable regarding that spouse's share. The surviving spouse usually retains full rights to manage and utilize the trust's assets. This structure offers continuity and clarity in managing the couple’s shared estate. Establishing a Puerto Rico Revocable Trust for Married Couples can effectively address these needs.

The purpose of a spousal trust is to ensure that a surviving spouse can access family assets while protecting them for the next generation. It can provide financial support to the surviving spouse after one partner passes away. Additionally, it helps in mitigating estate taxes and ensuring a smoother transition of wealth. A Puerto Rico Revocable Trust for Married Couples can effectively incorporate these objectives.

One disadvantage of a spousal trust is that it can limit the flexibility in managing assets. Once you place assets in a spousal trust, they may be tied up and less accessible for other financial needs or emergencies. Moreover, depending on the circumstances, it may not offer the same tax advantages as other trust types. It's crucial to weigh these factors when considering a Puerto Rico Revocable Trust for Married Couples.