Puerto Rico Revocable Trust for Grandchildren

Description

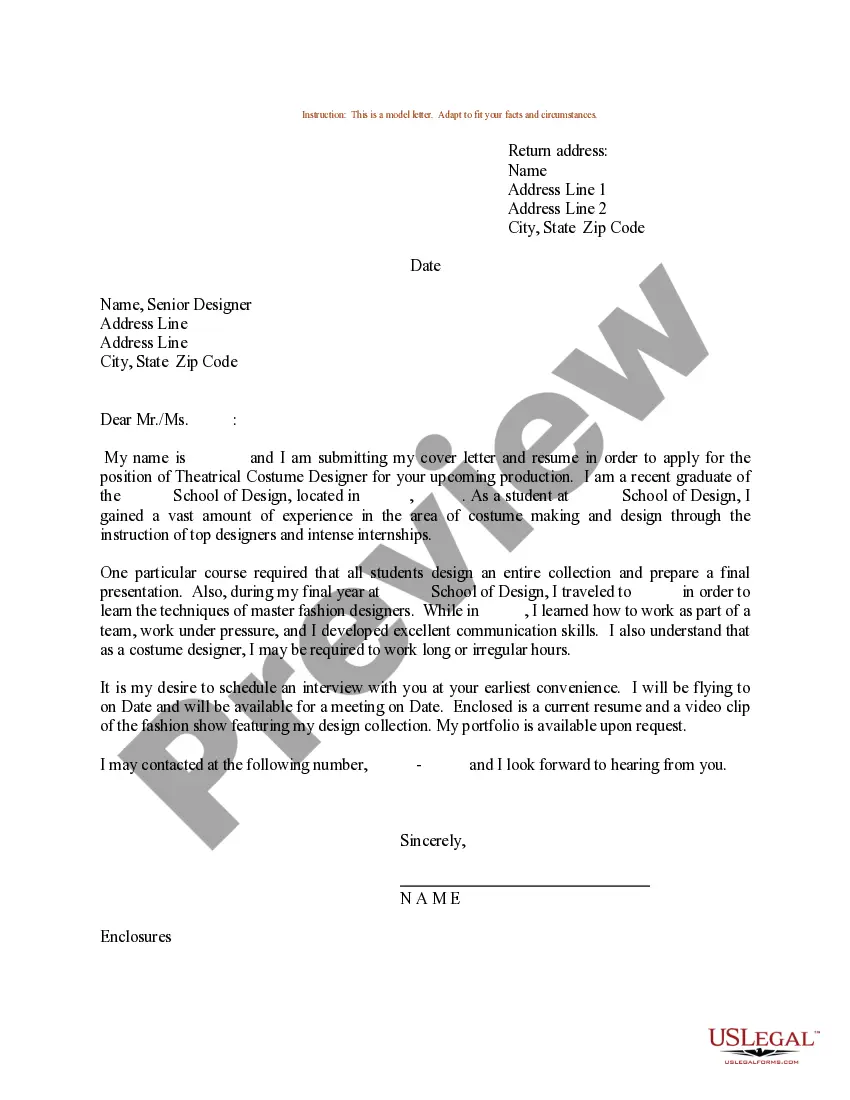

How to fill out Revocable Trust For Grandchildren?

Have you ever found yourself in a situation where you need documents for either business or personal purposes almost every day.

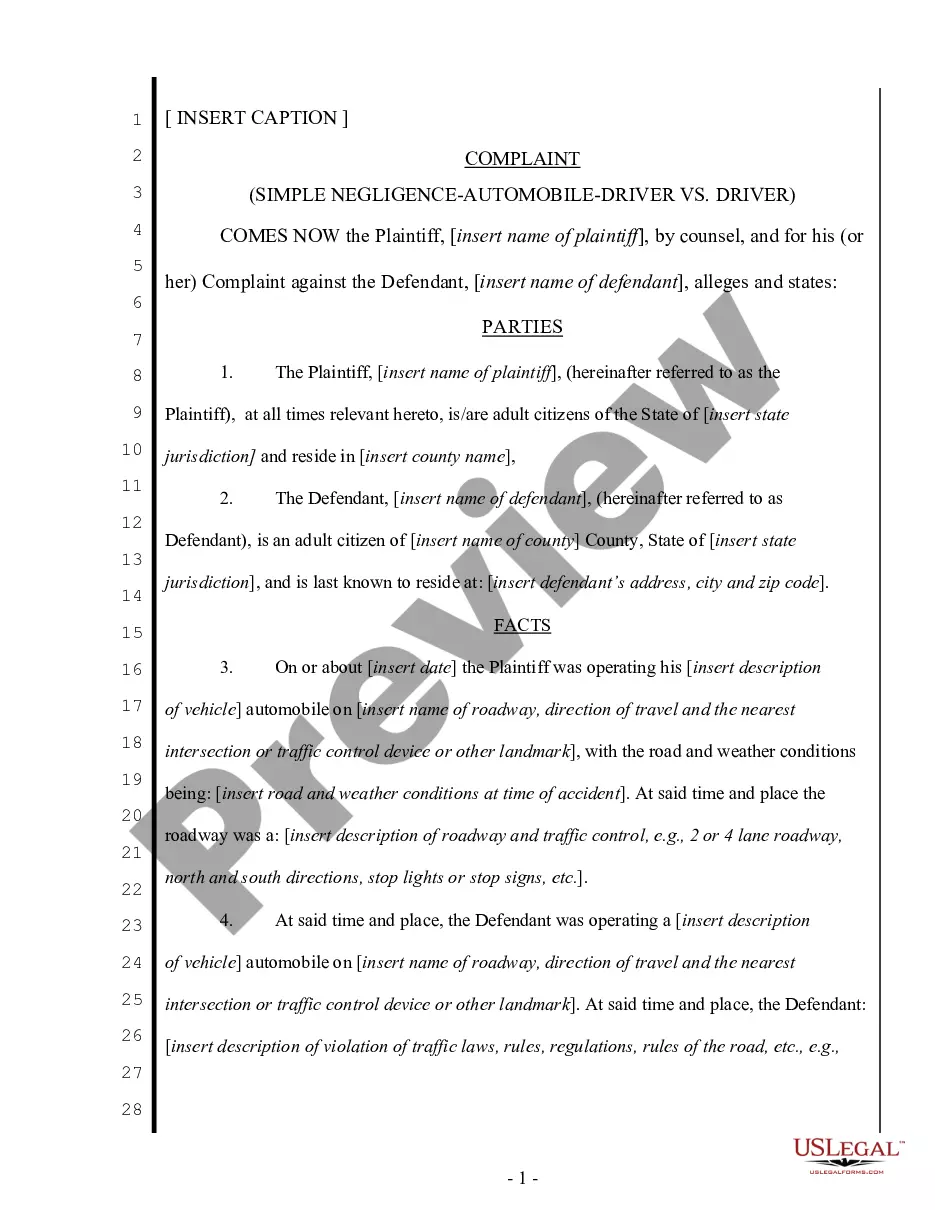

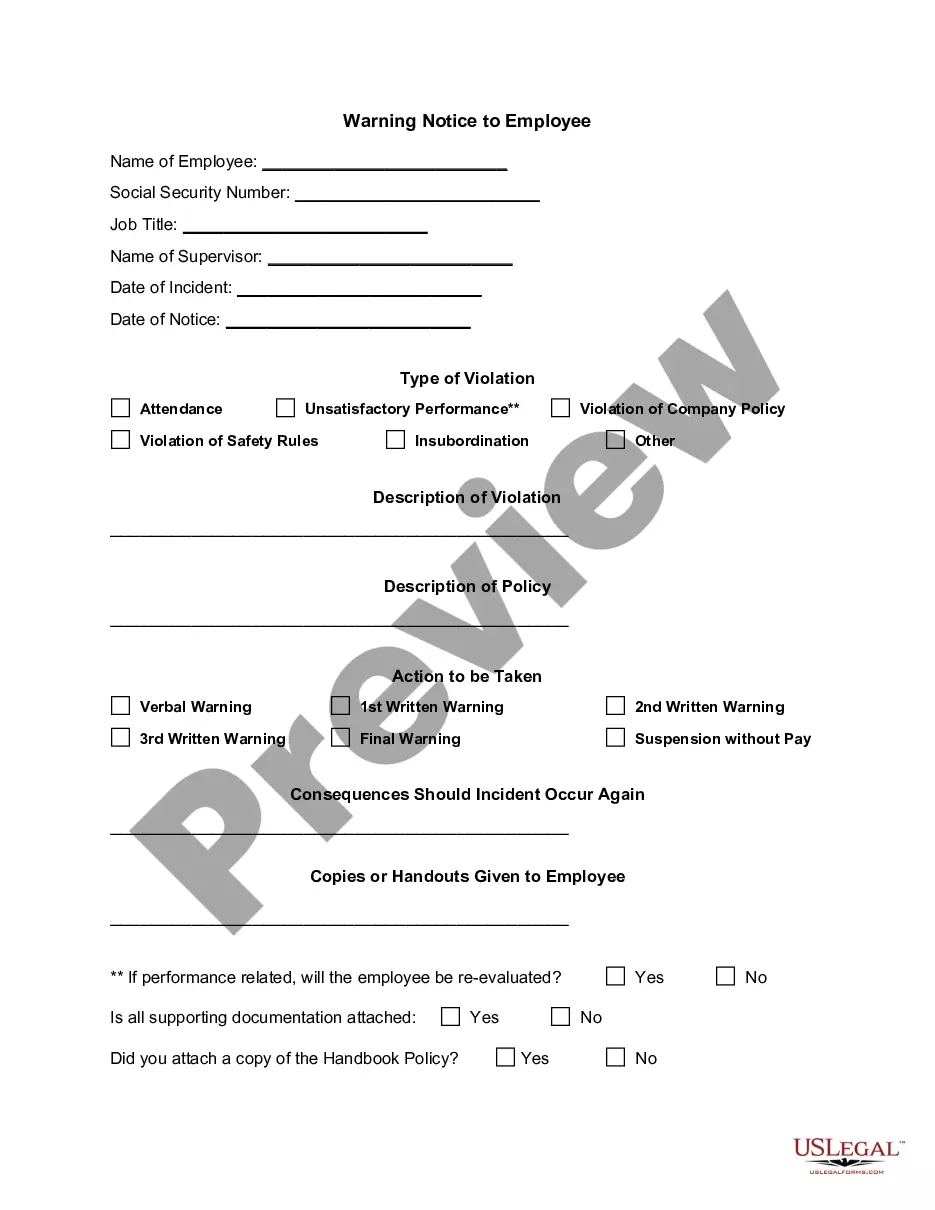

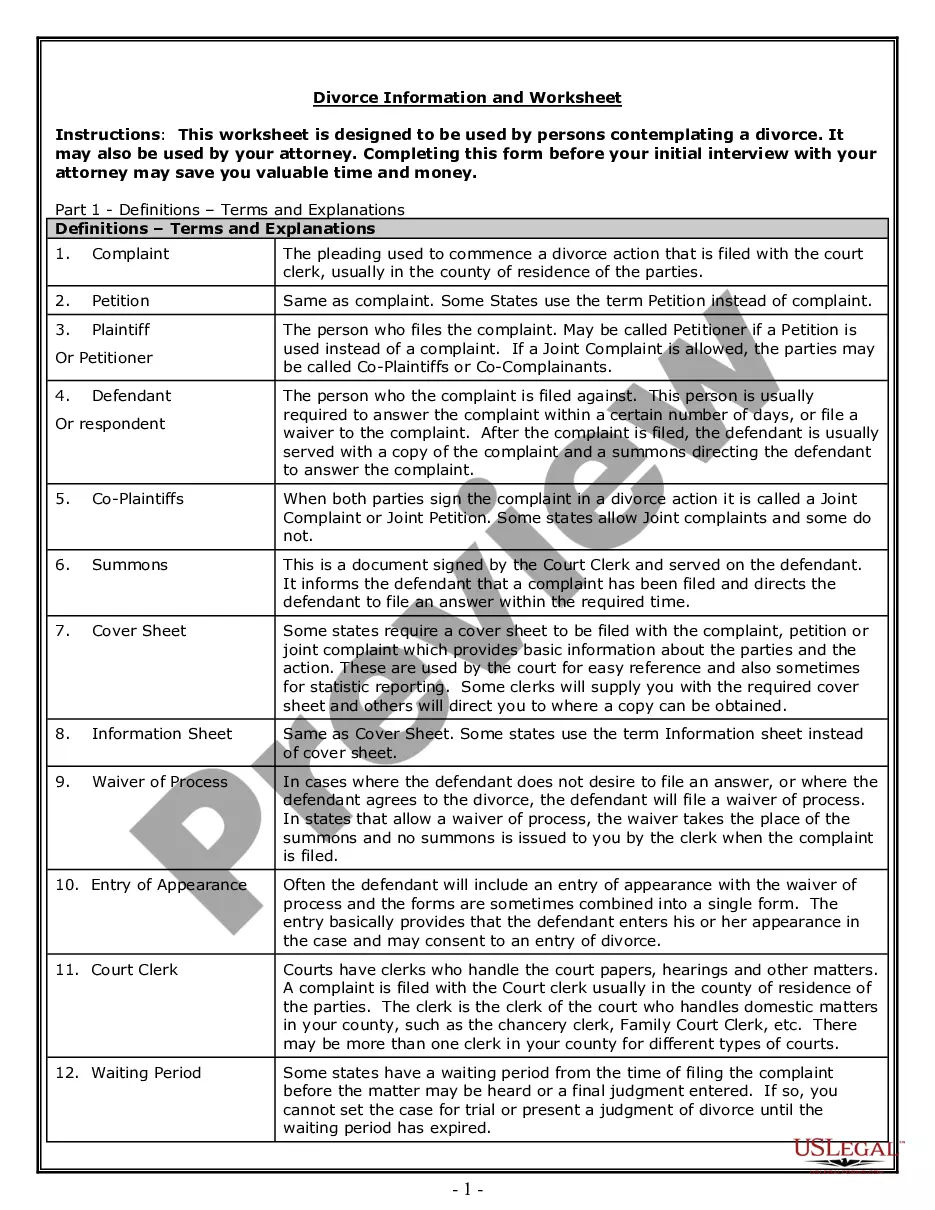

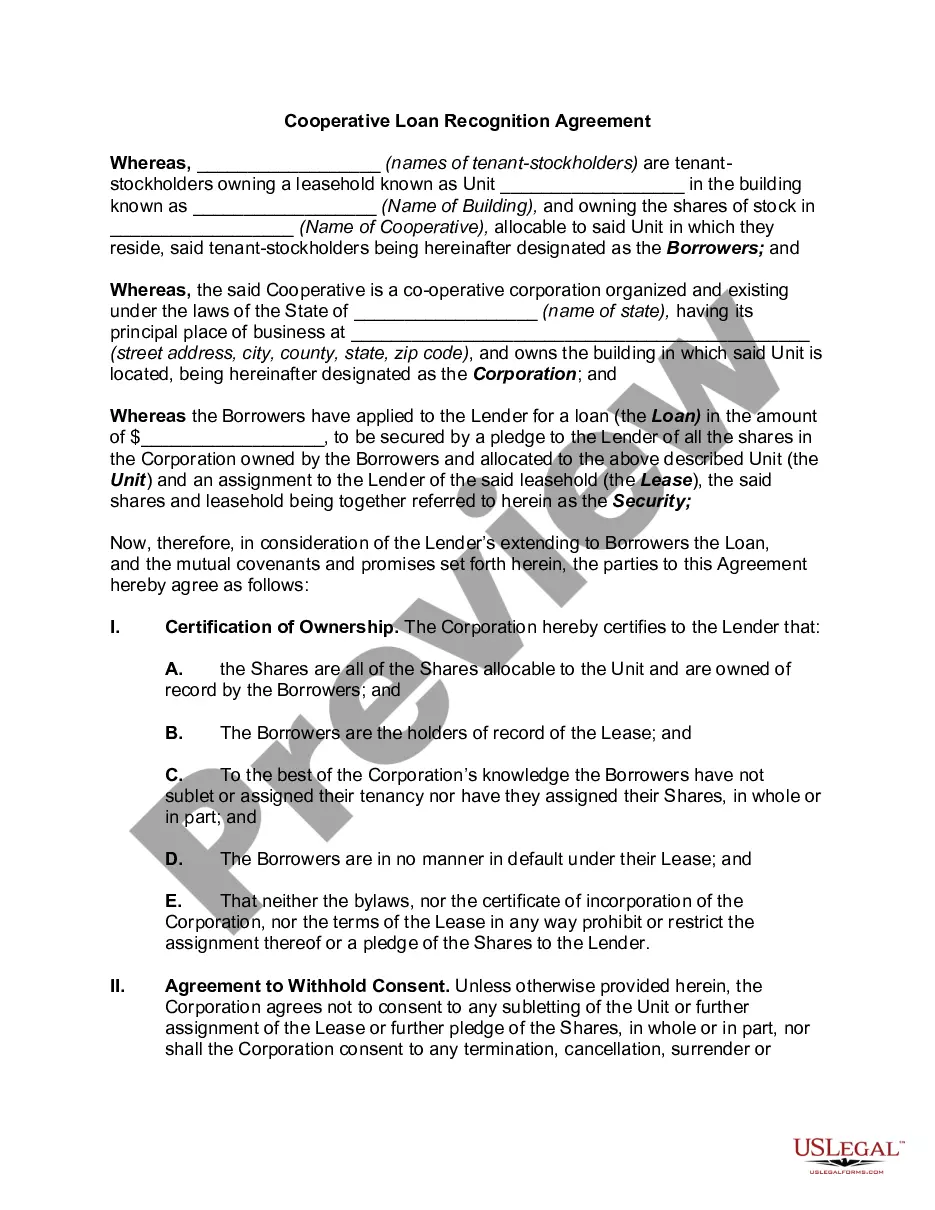

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Puerto Rico Revocable Trust for Grandchildren, designed to meet both state and federal requirements.

Once you find the correct form, click Acquire now.

Select the pricing plan you prefer, provide the necessary details to create your account, and process the payment via PayPal or credit card.

- If you already have an account on the US Legal Forms site, simply Log In.

- Then, you can download the Puerto Rico Revocable Trust for Grandchildren template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Choose the form you need and ensure it is for the correct city/county.

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that suits your requirements.

Form popularity

FAQ

The minimum amount to set up a trust can vary widely based on the trust's type and purpose. For a Puerto Rico Revocable Trust for Grandchildren, it's essential to consult with a legal expert to determine your specific needs and financial goals. Generally, many advisors recommend starting with at least $10,000 to ensure that the trust can effectively serve its purpose. Ultimately, the right amount will depend on your circumstances and intentions.

A Puerto Rico Revocable Trust for Grandchildren is an excellent option for providing financial support while maintaining flexibility. This type of trust allows you to adjust beneficiaries, investment strategies, and distributions as needed. It also enables you to set specific terms for your grandchildren’s education or milestones, ensuring they receive the intended support. Collaborating with a legal expert can enhance your trust’s effectiveness.

One significant mistake parents often make is neglecting to clearly define the trust's purpose and guidelines. For a Puerto Rico Revocable Trust for Grandchildren, outlining how the funds can be used is crucial. Ambiguity can lead to misunderstandings or conflicts among family members. Additionally, failing to update the trust as circumstances change can create issues down the line.

Adding a beneficiary to an irrevocable trust can be complex, as the terms usually cannot be changed after creation. However, certain types of trusts, including a Puerto Rico Revocable Trust for Grandchildren, allow for adjustments during your lifetime. To do so, you may need to work with an estate planning attorney who can guide you through the necessary steps and documentation. It’s essential to ensure that any changes comply with trust laws to avoid complications.

structured estate plan incorporating a Puerto Rico Revocable Trust for Grandchildren can help minimize inheritance tax liabilities. By placing your assets in this type of trust, you may achieve certain tax efficiencies while ensuring your grandchildren benefit fully from their inheritance. Consulting with an expert can further optimize your strategy to protect your family's wealth.

When it comes to leaving assets for your children, the Puerto Rico Revocable Trust for Grandchildren can also be beneficial. It offers you the ability to dictate how funds are allocated and when they are accessible. This trust promotes effective financial planning, as you can tailor it to your children’s specific needs while avoiding the lengthy process of probate.

A Puerto Rico Revocable Trust for Grandchildren is often considered the best choice for grandkids. This trust provides a straightforward way to manage assets and distribute them according to your preferences. It allows you to adjust the terms as needed, giving you peace of mind that your grandchild's interests are safeguarded.

The best way to leave an inheritance to grandchildren is through a Puerto Rico Revocable Trust for Grandchildren. This type of trust allows you to control how and when your grandchildren receive their inheritance, ensuring that it meets your wishes. By establishing a revocable trust, you provide flexibility and a clear structure for managing assets, which can protect your grandchildren's financial future.

The Puerto Rico Territory Act defines the political and legal status of Puerto Rico within the United States. It impacts various aspects of law and governance, including property and estate planning. For those considering a Puerto Rico Revocable Trust for Grandchildren, awareness of the Act can help navigate estate laws and ensure a smooth transfer of assets to future generations.

The Puerto Rico bond scandal revolves around the mismanagement and alleged fraud surrounding the island's municipal bonds, which led to significant financial distress. This issue highlights the importance of sound financial planning, such as utilizing a Puerto Rico Revocable Trust for Grandchildren, to protect assets from potential economic turmoil. Understanding financial landscapes can empower families to make informed decisions regarding their legacies.