Puerto Rico Revocable Trust for Property

Description

How to fill out Revocable Trust For Property?

Are you currently in a predicament where you require paperwork for various business or personal needs most of the time.

There is an abundance of legal document templates available online, but locating forms you can trust is not straightforward.

US Legal Forms provides a vast array of form templates, including the Puerto Rico Revocable Trust for Property, which can be tailored to meet federal and state regulations.

Once you identify the correct form, click on Buy now.

Choose the payment plan you prefer, fill in the required information to set up your account, and complete your purchase using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Puerto Rico Revocable Trust for Property template.

- If you do not possess an account and wish to begin using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to your specific city/state.

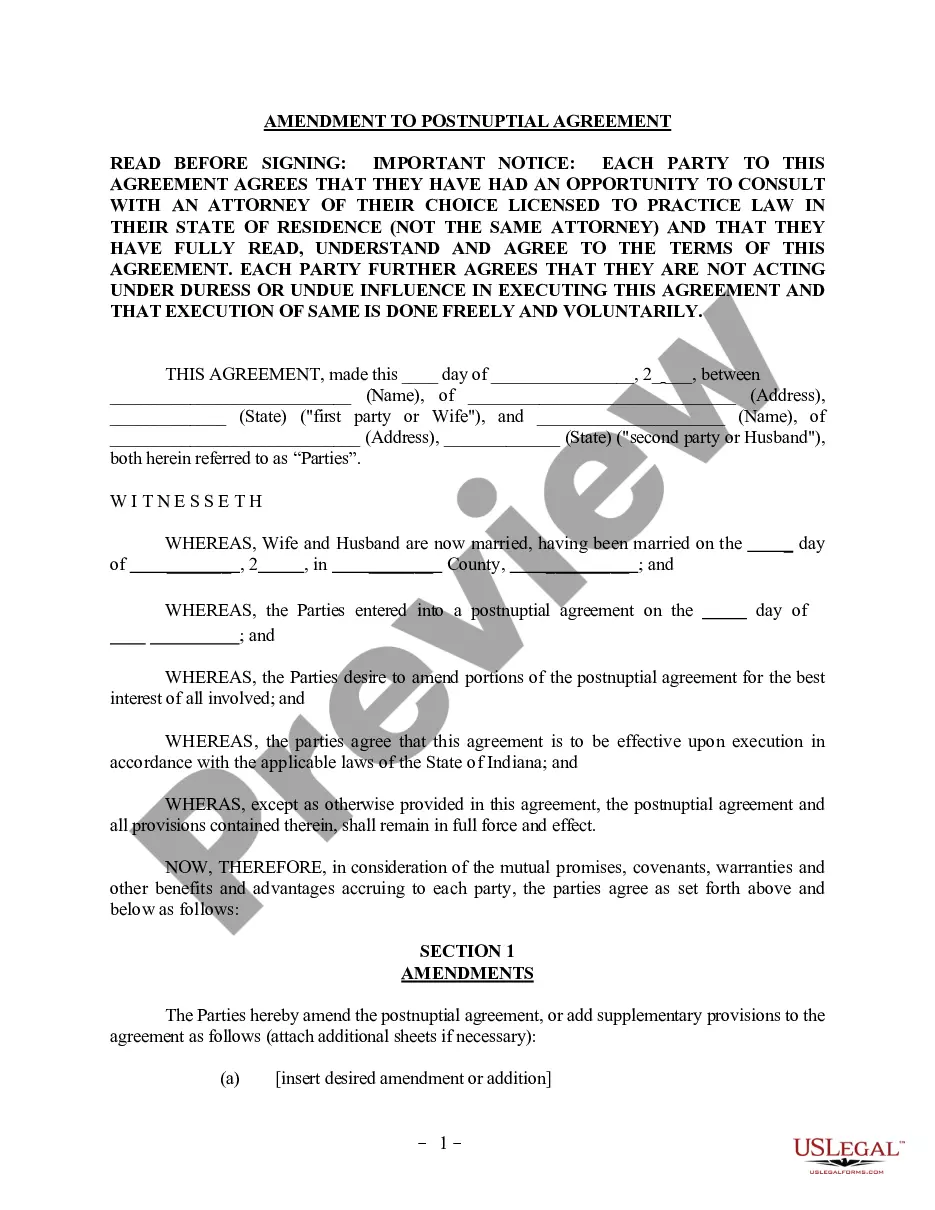

- Utilize the Preview button to examine the form.

- Read the description to confirm you have selected the appropriate form.

- If the form does not meet your requirements, make use of the Search field to find the form that suits your needs.

Form popularity

FAQ

The greatest advantage of an irrevocable trust lies in asset protection. Once you place assets into a Puerto Rico Revocable Trust for Property and opt for irrevocability, these assets are generally shielded from creditors. This unique feature can offer peace of mind, particularly for individuals concerned about potential legal claims against their estate.

One significant downside of an irrevocable trust is the loss of control over the assets once the trust is created. With a Puerto Rico Revocable Trust for Property, you can make changes as needed, but an irrevocable trust holds you to its original terms. This can lead to challenges if your circumstances or intentions change over time.

Choosing between a revocable and an irrevocable trust depends on your personal financial goals. A Puerto Rico Revocable Trust for Property offers greater flexibility, making it a suitable option for those wanting control. However, if asset protection and tax benefits are your priorities, an irrevocable trust may serve you better.

The key difference lies in control and flexibility. A Puerto Rico Revocable Trust for Property allows you to modify or revoke the trust during your lifetime, providing you with adaptability. In contrast, an irrevocable trust cannot be changed once established, which may be beneficial for asset protection and tax advantages.

Yes, a Puerto Rico Revocable Trust for Property typically becomes irrevocable upon your death. This change ensures that the assets within the trust are managed according to your wishes and cannot be altered. After your passing, the trust becomes a permanent fixture, focusing on asset distribution according to your directives.

Filing taxes for a Puerto Rico Revocable Trust for Property is generally straightforward, as the trust remains a disregarded entity for tax purposes. This means you report income generated by the trust assets on your personal tax return. However, it's essential to keep accurate records of all transactions related to the trust. For assistance with tax filings and ensuring compliance, you may benefit from the resources available on uslegalforms.

When someone dies in Puerto Rico, their property generally goes through a legal process called succession. If the person had a Puerto Rico Revocable Trust for Property, the assets would typically bypass the lengthy probate process, allowing for a smoother distribution to beneficiaries. Without a trust, the court oversees the distribution according to the deceased's will or the intestacy laws. Using a trust can significantly ease this transition for your loved ones.

The Puerto Rico Trust Act governs the creation and administration of trusts in Puerto Rico, including the Puerto Rico Revocable Trust for Property. This legislation outlines the legal framework for setting up trusts, detailing the responsibilities of trustees and the rights of beneficiaries. Understanding this act is crucial for establishing a compliant and effective trust. For comprehensive guidance, consider resources from uslegalforms to ensure your trust aligns with legal standards.

While a Puerto Rico Revocable Trust for Property can hold various types of assets, there are some that should generally be avoided. For instance, retirement accounts, such as IRAs and 401(k)s, typically have specific beneficiary designations that may not align with a trust. Additionally, assets requiring a significant amount of management or specific legal restrictions may not be suitable. It's essential to consult a professional to determine the best approach for your unique situation.

Yes, you can set up a Puerto Rico Revocable Trust for Property. This process allows you to manage your assets during your lifetime and simplify the transition of those assets after death. By using a revocable trust, you maintain control over your property, allowing you to make changes as needed. To create a trust, consider using a reliable platform like uslegalforms, where you can find the necessary resources and templates.