A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

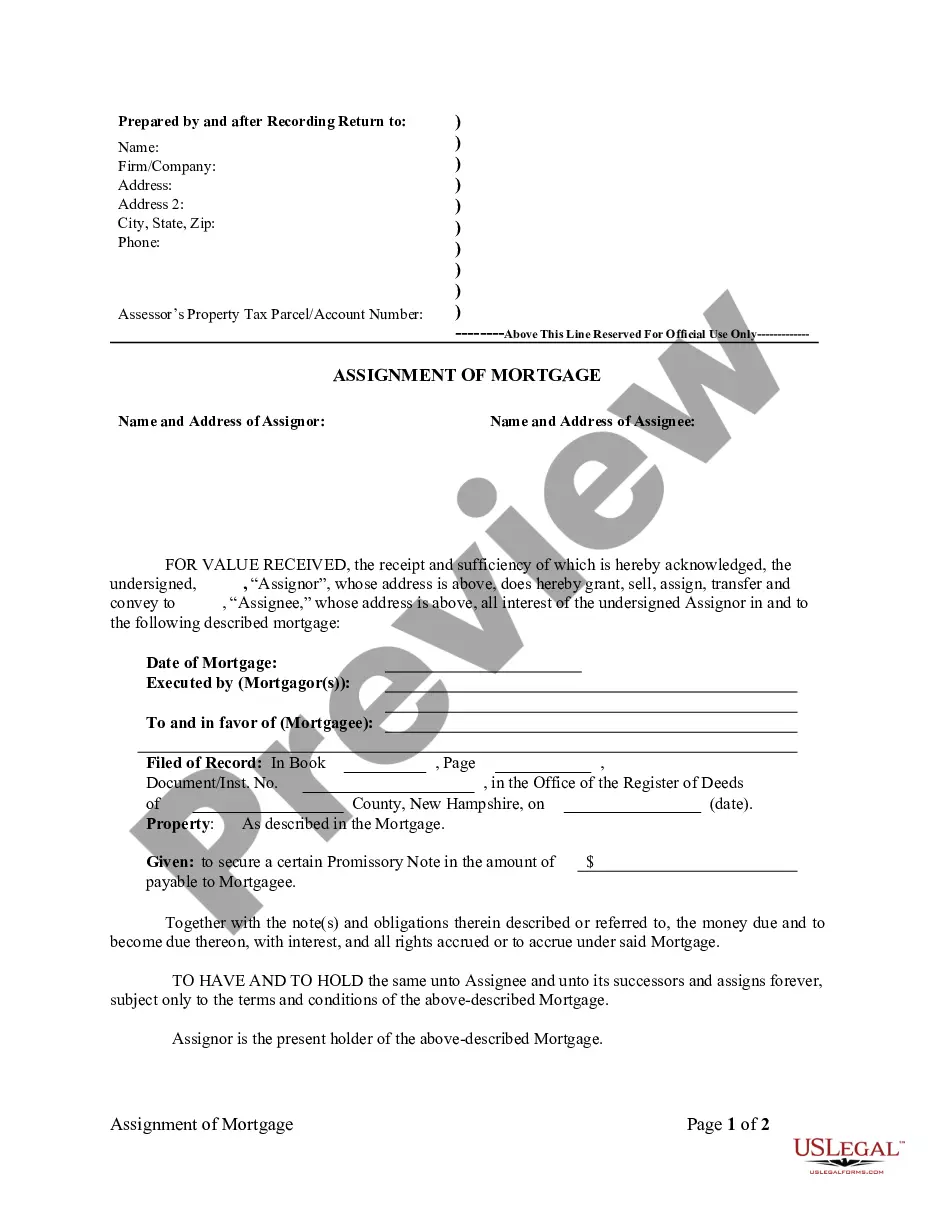

Puerto Rico Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that establishes a security interest in equipment as collateral for a promissory note in Puerto Rico. This agreement ensures that in case of default, the lender has a right to seize and sell the equipment to recover the outstanding debt. This type of security agreement is commonly used by businesses in Puerto Rico to secure financing for the acquisition of equipment necessary for their operations. By entering into this agreement, the borrower consents to grant the lender a security interest in the equipment specified in the agreement. It provides a level of assurance to the lender that they have recourse in case of non-payment. There are several types of Puerto Rico Security Agreement in Equipment for Business Purposes — Securing Promissory Note, each tailored to specific circumstances: 1. Fixed equipment security agreement: This type of security agreement is used when the equipment being financed is certain, identifiable, and can be permanently attached to a business property. Examples include machinery, vehicles, or large equipment. 2. Floating equipment security agreement: This agreement covers equipment that is not permanently attached or constantly changing, such as inventory or office equipment. It allows the lender to have a security interest in a fluctuating pool of equipment, ensuring they can seize and sell collateral in case of default. 3. Purchase money security agreement (PSA): This agreement is used when the lender provides financing specifically for the purchase of equipment. It grants the lender a security interest in that particular equipment, giving them priority over other creditors in case of default. 4. Master equipment security agreement: This agreement is a framework document that outlines the general terms and conditions for multiple financing transactions involving equipment. It allows businesses to streamline the process of securing financing for various equipment purchases. 5. Subordination agreement: In certain cases, a borrower may already have a prior security interest in their equipment due to an existing agreement. In such situations, a subordination agreement is used to establish the priority of the newly created security interest in favor of the lender providing the financing. Overall, a Puerto Rico Security Agreement in Equipment for Business Purposes — Securing Promissory Note is an essential legal document that protects the interests of both lenders and borrowers. It ensures that businesses can acquire the necessary equipment while providing lenders with a means to recover their investment in case of default.