Puerto Rico Contract - Sale of Goods

Description

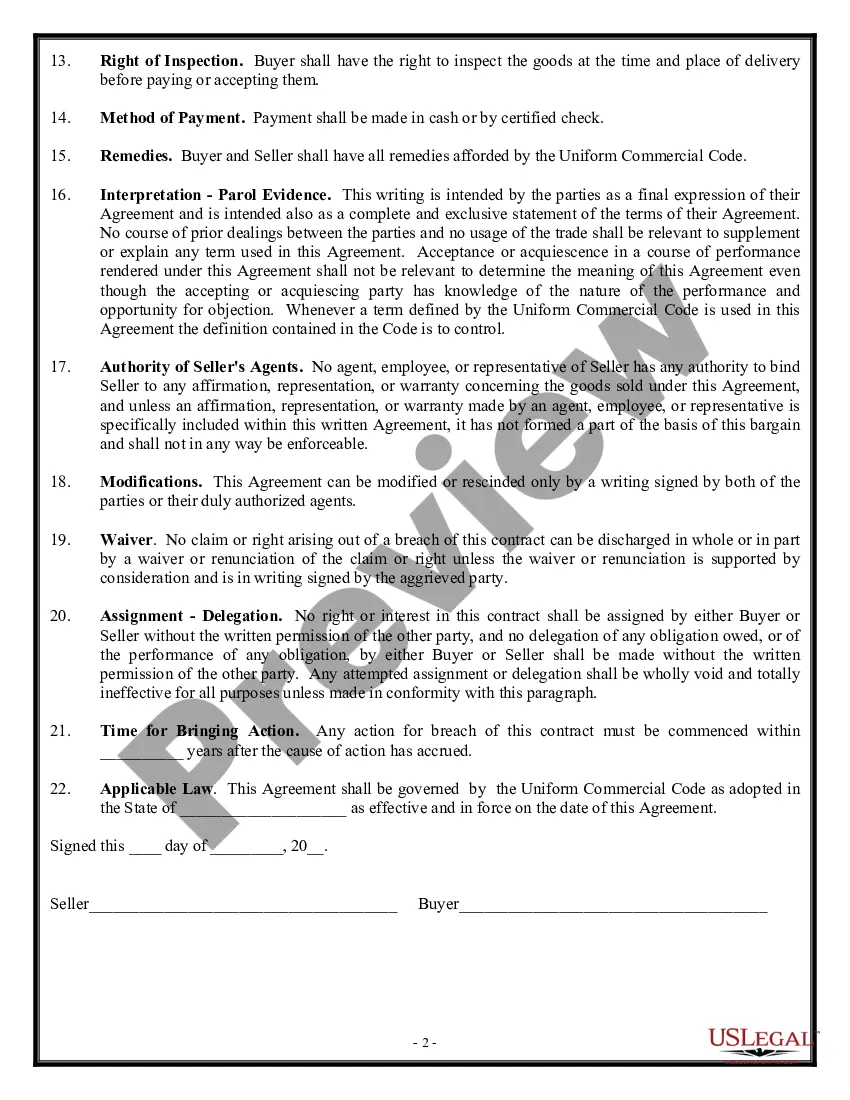

How to fill out Contract - Sale Of Goods?

US Legal Forms - one of the biggest repositories of legal documents in the USA - provides a broad array of legal form templates you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Puerto Rico Contract - Sale of Goods in just seconds.

Review the form description to ensure that you’ve selected the correct document.

If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you already have an account, Log In and retrieve the Puerto Rico Contract - Sale of Goods from the US Legal Forms library.

- The Download button will be available on every single form you view.

- You have access to all previously acquired forms in the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct form for your jurisdiction.

- Click the Preview button to examine the form's content.

Form popularity

FAQ

Yes, Puerto Rico is often referred to as a capital gains tax haven due to its unique tax incentives. Investors can benefit from significantly lower, or in some cases, zero capital gains taxes when they meet specific criteria. When structuring a Puerto Rico Contract - Sale of Goods, it is beneficial to understand these incentives fully. Resources like uslegalforms can help navigate these tax advantages to ensure compliance and maximize benefits.

In Puerto Rico, certain taxes, such as capital gains taxes for qualifying individuals, may be exempt under specific laws. This offers unique opportunities for investors and business owners. If you are engaging in business transactions, including a Puerto Rico Contract - Sale of Goods, it is crucial to be aware of these exemptions to maximize your profit. Consulting with professionals or using resources from uslegalforms can provide clarity on these requirements.

To apply for Act 22 in Puerto Rico, you'll need to submit your application to the Puerto Rico Department of Economic Development and Commerce. This act provides significant tax incentives for new residents moving to Puerto Rico. By utilizing a Puerto Rico Contract - Sale of Goods, you can strategically plan your business moves and benefit from these tax incentives. For detailed guidance through the application process, platforms like uslegalforms can be incredibly helpful.

While Puerto Rico is not a state, it offers unique tax benefits, including no capital gains tax for certain types of income. In the U.S., states like Texas, Florida, and Washington also do not impose state capital gains taxes. Understanding these tax structures can be beneficial, especially when entering agreements related to a Puerto Rico Contract - Sale of Goods. This knowledge can aid in financial planning and investment strategies.

In Puerto Rico, the equivalent form to the 1099 is the Form 480. This form is essential for reporting various types of income, including payments for services rendered. When engaging in business under a Puerto Rico Contract - Sale of Goods, understanding the proper tax forms helps ensure compliance with local regulations. If you're unsure how to complete these forms, consider using platforms like uslegalforms for guidance.

In Puerto Rico, sales tax applies to most transactions involving the sale of goods and certain services. The standard sales tax rate is currently set at 11.5%, but specific products may have additional exemptions or conditions. Understanding these rules can help you comply with local regulations while executing a Puerto Rico Contract - Sale of Goods. Consulting resources like uslegalforms can assist in ensuring your compliance.

Puerto Rico offers several tax advantages that can significantly benefit U.S. citizens. Residents may enjoy low corporate tax rates and exemptions on certain types of income. These financial incentives can influence the nature of a Puerto Rico Contract - Sale of Goods, making it a smart option for many entrepreneurs looking to optimize costs while complying with local regulations.

Act 73, also known as the Puerto Rico Incentives Code, offers various tax benefits for eligible businesses. This act aims to attract investors by providing tax credits and exemptions, particularly in specific industries. When drafting a Puerto Rico Contract - Sale of Goods, understanding Act 73 can be crucial for businesses looking to maximize their financial benefits.

Law 74 in Puerto Rico pertains to the promotion of the manufacturing industry. This legislation provides incentives for businesses to establish themselves in Puerto Rico, specifically targeting production and assembly operations. A Puerto Rico Contract - Sale of Goods may involve businesses that benefit from Law 74, as it encourages local manufacturing and economic growth.

Yes, Puerto Rico is a territory of the United States. While it is not a state, Puerto Rico has a unique legal status that allows it to operate under its own laws, including those governing contracts. This status means that when you engage in a Puerto Rico Contract - Sale of Goods, you must consider both federal and local laws.