Puerto Rico Consumer Loan Application — Personal Loan Agreement is a legally binding contract between a borrower and a lender that outlines the terms and conditions for obtaining and repaying a personal loan in Puerto Rico. This agreement is applicable for residents of Puerto Rico seeking financial assistance for personal expenses such as education, medical bills, home improvements, or consolidating debt. The Puerto Rico Consumer Loan Application — Personal Loan Agreement is designed to protect the rights and responsibilities of both parties involved in the loan transaction. It provides a comprehensive overview of the loan amount, interest rate, repayment schedule, and any additional fees or charges associated with the loan. The agreement also includes provisions regarding late payment penalties, prepayment options, and default consequences. Keywords: Puerto Rico, Consumer Loan Application, Personal Loan Agreement, borrower, lender, terms and conditions, personal loan, residents, financial assistance, education, medical bills, home improvements, debt consolidation, loan transaction, loan amount, interest rate, repayment schedule, fees, charges, late payment penalties, prepayment options, default consequences. Different Types of Puerto Rico Consumer Loan Application — Personal Loan Agreement: 1. Secured Personal Loan Agreement: This type of loan agreement requires the borrower to provide collateral, such as a property or a vehicle, to secure the loan. In case of default, the lender has the right to seize the collateral to recover the outstanding balance. 2. Unsecured Personal Loan Agreement: Unlike secured loans, unsecured personal loans do not require collateral. However, they may have higher interest rates due to the increased risk for the lender. The borrower's creditworthiness and income are crucial factors in determining eligibility for this type of loan. 3. Fixed-Rate Personal Loan Agreement: In this agreement, the interest rate remains constant throughout the loan term. Borrowers can anticipate the exact amount of monthly payments, providing stability and predictability for budgeting purposes. 4. Variable-Rate Personal Loan Agreement: This agreement features an interest rate that fluctuates over time, typically tied to a benchmark such as the prime rate or LIBOR. The interest rate may increase or decrease, impacting the borrower's monthly payments. This type of loan carries a certain level of interest rate risk. 5. Debt Consolidation Loan Agreement: This unique loan agreement is specifically designed to consolidate multiple debts into a single loan, simplifying the repayment process and potentially reducing the overall interest rate and monthly payment. It allows borrowers to combine credit card debts, medical bills, or other outstanding loans to manage their finances more effectively. Keywords: Secured Personal Loan Agreement, Unsecured Personal Loan Agreement, Fixed-Rate Personal Loan Agreement, Variable-Rate Personal Loan Agreement, Debt Consolidation Loan Agreement, collateral, default, interest rate, creditworthiness, income, monthly payments, benchmark, prime rate, LIBOR, interest rate risk.

Puerto Rico Consumer Loan Application - Personal Loan Agreement

Description

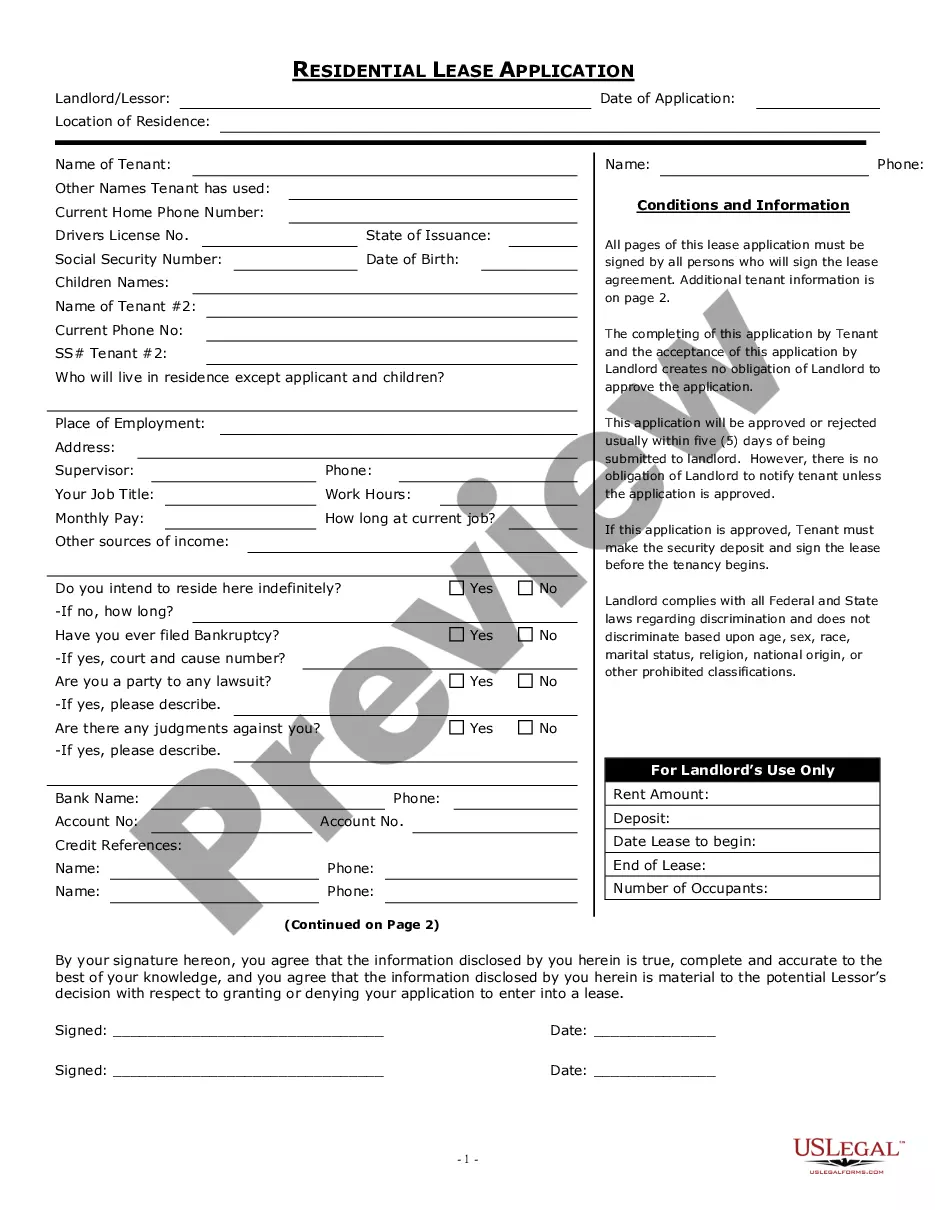

How to fill out Puerto Rico Consumer Loan Application - Personal Loan Agreement?

US Legal Forms - one of many greatest libraries of legal kinds in the United States - gives a wide range of legal file templates you may obtain or produce. Utilizing the internet site, you may get a large number of kinds for enterprise and specific purposes, sorted by classes, states, or keywords.You can get the newest types of kinds like the Puerto Rico Consumer Loan Application - Personal Loan Agreement within minutes.

If you already possess a membership, log in and obtain Puerto Rico Consumer Loan Application - Personal Loan Agreement from the US Legal Forms library. The Acquire option can look on each type you look at. You have access to all in the past delivered electronically kinds inside the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the first time, listed below are straightforward guidelines to help you began:

- Be sure you have picked the right type for the area/state. Select the Preview option to review the form`s content. Look at the type information to actually have chosen the proper type.

- If the type doesn`t satisfy your requirements, make use of the Lookup field on top of the display to find the one which does.

- When you are content with the shape, affirm your choice by simply clicking the Acquire now option. Then, select the rates program you want and provide your accreditations to register to have an accounts.

- Process the deal. Make use of your credit card or PayPal accounts to complete the deal.

- Pick the format and obtain the shape on your own product.

- Make modifications. Load, revise and produce and indicator the delivered electronically Puerto Rico Consumer Loan Application - Personal Loan Agreement.

Each format you put into your account lacks an expiry date and it is yours permanently. So, if you wish to obtain or produce yet another copy, just proceed to the My Forms portion and click on on the type you want.

Get access to the Puerto Rico Consumer Loan Application - Personal Loan Agreement with US Legal Forms, by far the most considerable library of legal file templates. Use a large number of professional and express-specific templates that meet your organization or specific needs and requirements.

Form popularity

FAQ

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.