Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

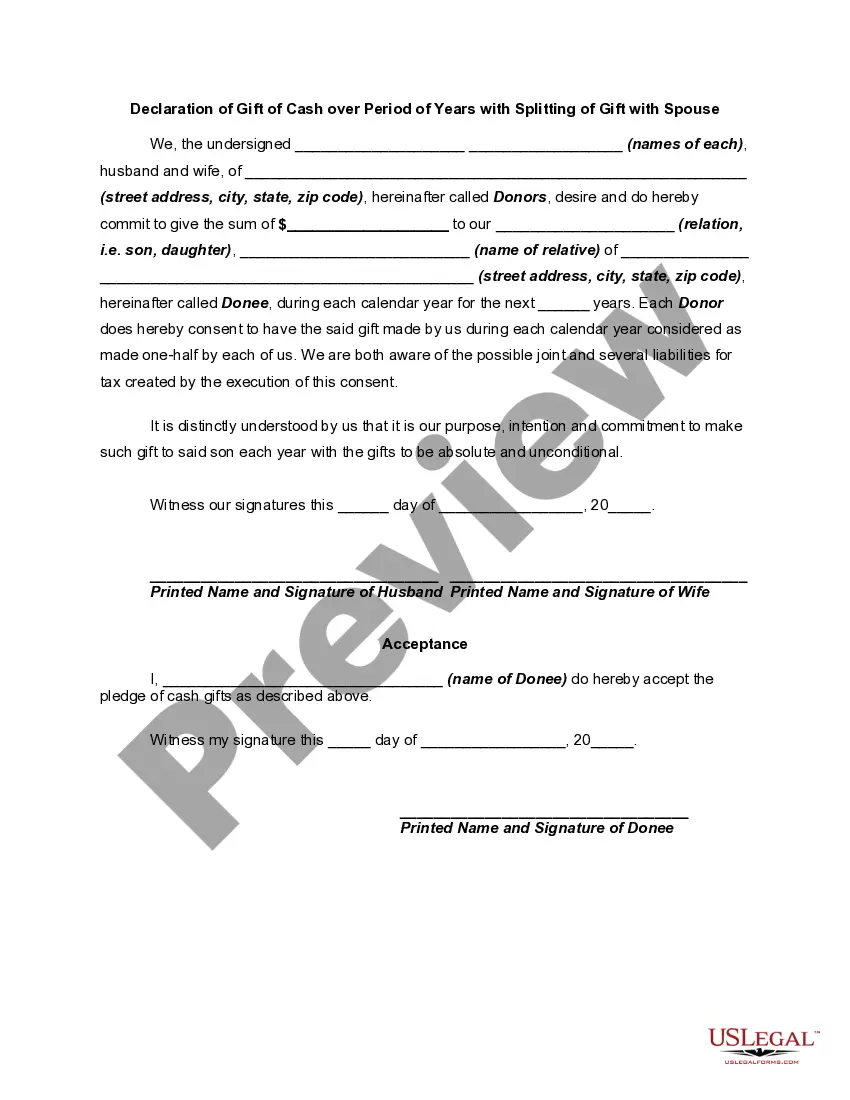

The Puerto Rico Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows individuals in Puerto Rico to make monetary gifts to family members or loved ones over a designated period of time while also involving their spouse in the gifting process. This declaration is essential for those who wish to distribute their assets and wealth in a controlled manner while taking advantage of Puerto Rico's unique tax laws. The declaration allows the donor to divide a substantial sum of money into smaller annual gifts, which are usually exempt from federal gift tax. By splitting the gift with their spouse, both individuals can maximize the benefits and reduce the overall tax liability. This can be an excellent strategy for those who want to transfer significant funds to their loved ones without incurring hefty tax burdens. There are various types of Puerto Rico Declarations of Gift of Cash over Period of Years with Splitting of Gift with Spouse that individuals can utilize depending on their specific circumstances. Some key types include: 1. Annual Gift Declaration: This type of declaration involves making regular cash gifts to chosen recipients over multiple years while keeping the total amount within the federal tax-free limits. By involving their spouse, the couple can effectively double the allowable tax-free gift amount. 2. Irrevocable Gift Declaration: This declaration involves making a series of cash gifts to the chosen recipients that cannot be revoked or altered once made. This type of declaration is often relied upon by individuals who wish to transfer wealth gradually over time while ensuring that the gifted funds are protected. 3. Lifetime Gift Declaration: This type of declaration allows individuals to make large cash gifts to their beneficiaries over the course of their lifetime. By involving their spouse in the splitting of the gift, the couple can take advantage of tax benefits and reduce the overall tax burden associated with such significant transfers. 4. Charitable Gift Declaration: This declaration involves making cash gifts to charitable organizations over a period of years, while also involving the spouse in the splitting of the gift. This allows individuals to support charitable causes close to their heart while minimizing the tax impact. In conclusion, the Puerto Rico Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse provides a strategic and tax-efficient way for individuals in Puerto Rico to transfer wealth to their loved ones. By utilizing this declaration, individuals can make regular cash gifts over time while involving their spouse and taking advantage of Puerto Rico's favorable tax laws. Whether it's an annual gift declaration, an irrevocable gift declaration, a lifetime gift declaration, or a charitable gift declaration, individuals can find the right type of declaration that suits their specific needs and goals.