Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

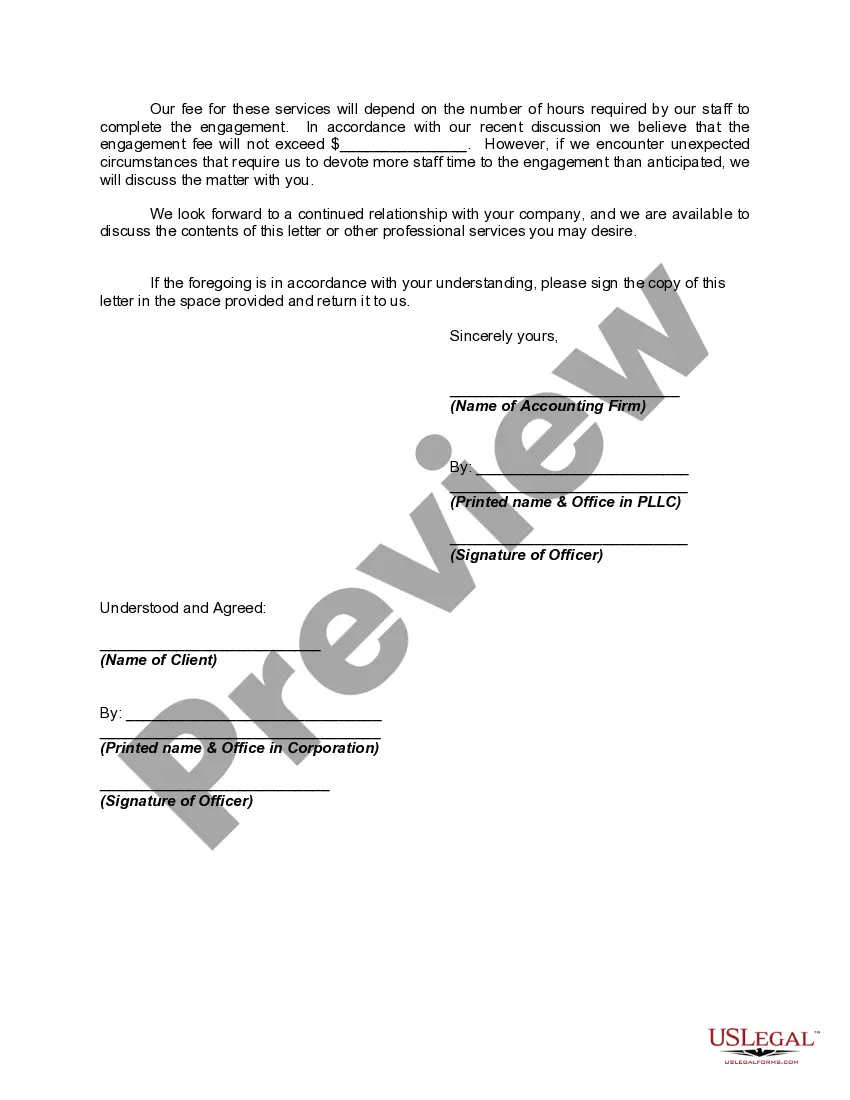

Puerto Rico Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm In Puerto Rico, an engagement letter for the review of financial statements and compilation is a crucial document that establishes the terms and scope of work between an accounting firm and its client. This letter outlines the responsibilities of both parties involved, ensuring a clear understanding of the services to be performed. Keywords: Puerto Rico, engagement letter, review of financial statements, compilation, accounting firm Types of Puerto Rico Engagement Letters for Review of Financial Statements and Compilation by Accounting Firm: 1. General Engagement Letter: A standard engagement letter that outlines the agreement between the accounting firm and the client for the review of financial statements and compilation services. It establishes the objectives, responsibilities, and limitations of the engagement, providing a clear framework for the work to be conducted. 2. Limited Scope Engagement Letter: This type of engagement letter specifies a restricted scope of services within the review of financial statements and compilation. It outlines the specific areas to be reviewed or compiled, limiting the scope to meet the client's needs or regulatory requirements. 3. Comprehensive Engagement Letter: In some cases, a comprehensive engagement letter may be necessary, especially for larger organizations or complex financial situations. This type of engagement letter includes an in-depth scope of work, encompassing multiple divisions or subsidiaries of the client's business. It requires careful coordination between the accounting firm and the client to ensure all necessary financial statements are reviewed and compiled accurately. 4. Compilation-Only Engagement Letter: This engagement letter focuses solely on the compilation of financial statements without the inclusion of a review. It outlines the responsibilities of the accounting firm in organizing and presenting the client's financial information in the appropriate format. This type of engagement letter is typically used when a review is not required by regulatory bodies or when the client simply needs to be compiled financial statements for internal purposes. Important Considerations in a Puerto Rico Engagement Letter for Review of Financial Statements and Compilation: 1. Scope of Work: The engagement letter should clearly define the extent of the review and compilation services to be provided. It should outline the specific financial statements or periods covered and any additional procedures to be performed. 2. Responsibilities of the Accounting Firm: The letter should specify the duties and obligations of the accounting firm, including adherence to professional standards, independence requirements, and the timeframe for completing the engagement. 3. Responsibilities of the Client: The client's responsibilities, such as providing accurate and complete financial records, internal control documentation, and access to relevant personnel, should be clearly stated in the engagement letter. 4. Limitations of the Engagement: The engagement letter should address any limitations or restrictions on the scope of work, such as time constraints, reliance on representations, and inherent limitations of the review or compilation process. 5. Reporting: The engagement letter should detail the expected form and content of the final report, including the format of financial statements, disclosure requirements, and any additional reporting obligations. 6. Fees and Payment Terms: The engagement letter should clearly outline the fee structure, billing rates, payment terms, and any additional expenses that may be incurred during the engagement. In conclusion, a Puerto Rico engagement letter for the review of financial statements and compilation by an accounting firm plays a crucial role in establishing clear expectations and ensuring a well-defined working relationship between the firm and the client. The specific type of engagement letter varies depending on the scope of work required and the complexity of the client's financial situation.