Puerto Rico Partnership Agreement Involving Silent Partner

Description

How to fill out Partnership Agreement Involving Silent Partner?

Selecting the optimal legal document format can be a challenge.

Clearly, there are numerous templates accessible online, but how do you locate the legal form you require? Utilize the US Legal Forms website. The service offers a vast array of templates, including the Puerto Rico Partnership Agreement Involving Silent Partner, which can be utilized for business and personal purposes.

All of the forms are verified by experts and comply with federal and state regulations.

If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident the form is correct, click the Get now button to obtain the form. Select the pricing plan you want and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Complete, modify, print, and sign the obtained Puerto Rico Partnership Agreement Involving Silent Partner. US Legal Forms is the largest library of legal forms where you can find various document templates. Use the service to obtain properly crafted documents that comply with state requirements.

- If you are already a member, sign in to your account and click the Get button to locate the Puerto Rico Partnership Agreement Involving Silent Partner.

- Use your account to browse the legal forms you may have previously purchased.

- Go to the My documents section of your account and obtain another copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your specific city/state.

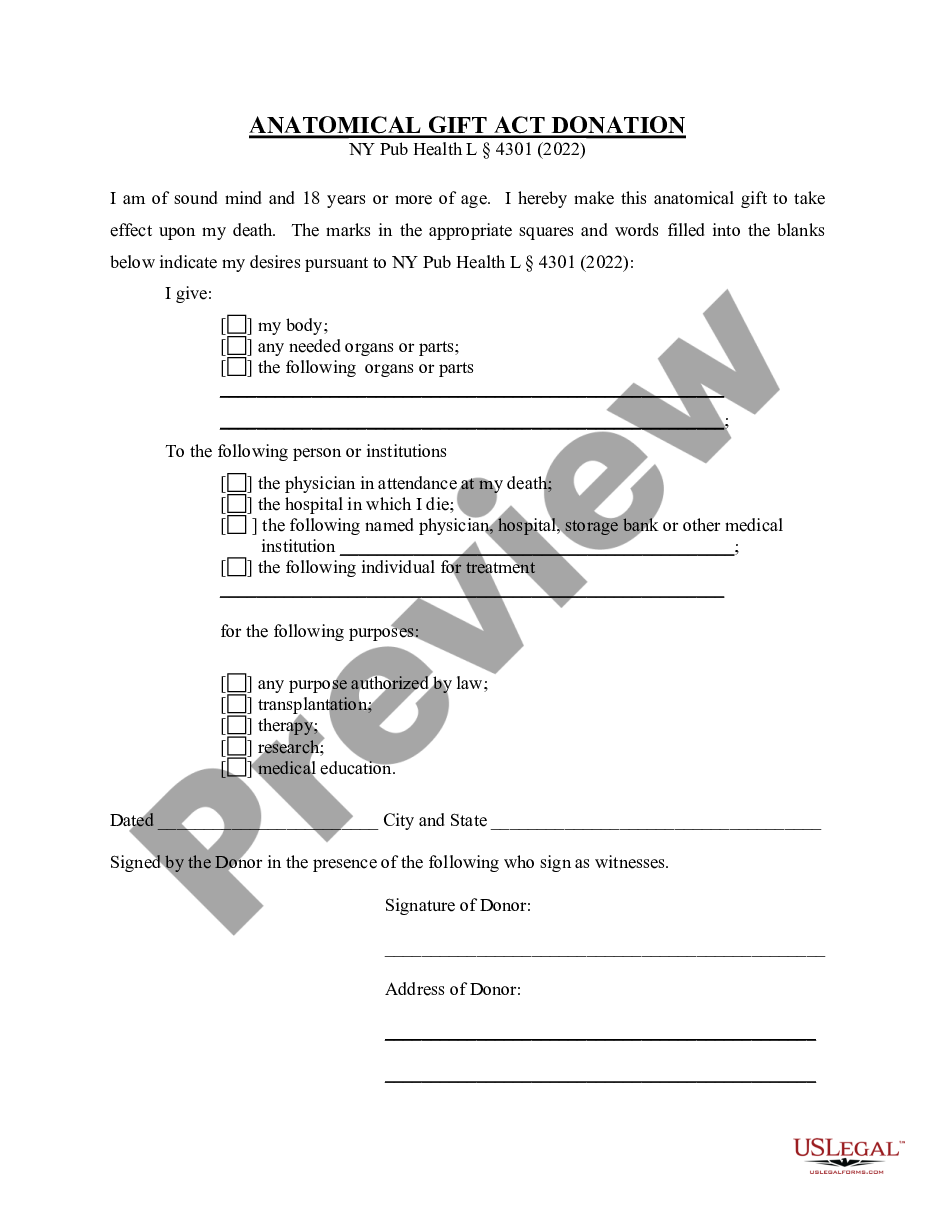

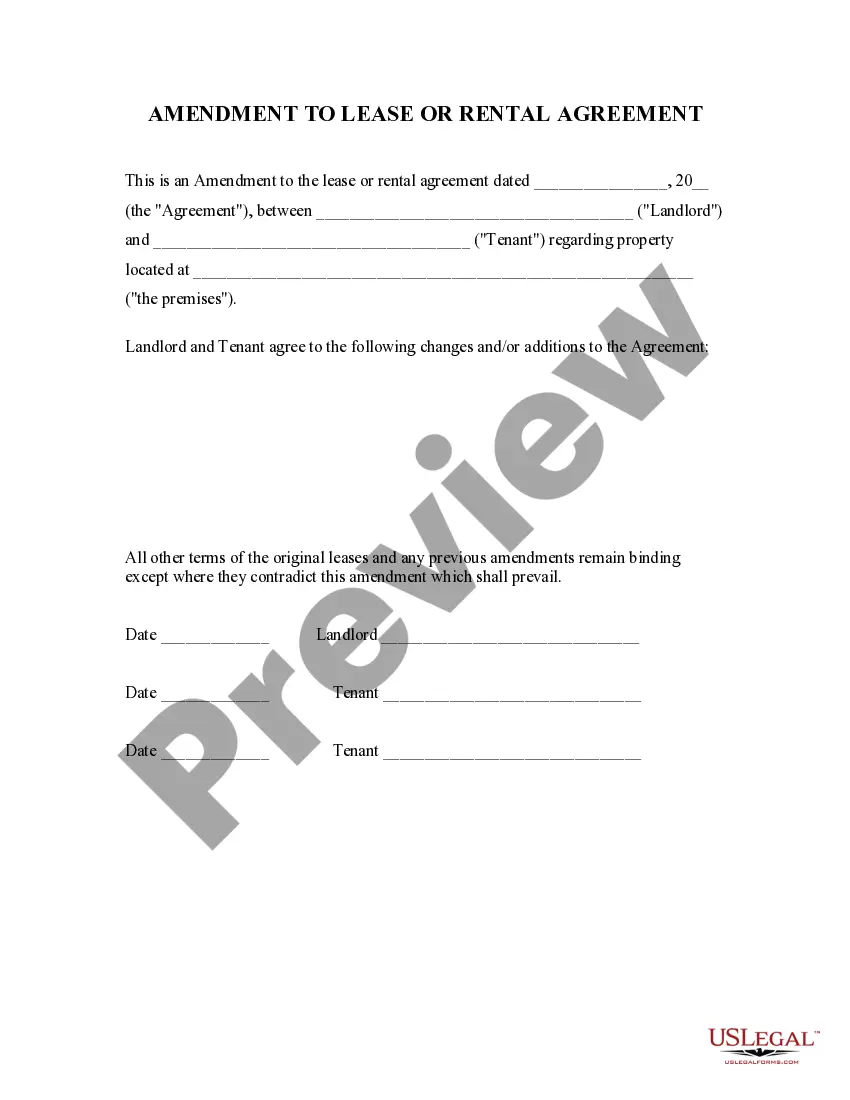

- You may browse the form using the Preview option and review the form description to confirm this is the right one for you.

Form popularity

FAQ

Yes, having a silent partner in a partnership is not only possible but can also be beneficial. A silent partner contributes capital and shares in profits but does not engage in day-to-day operations. Including a silent partner can enhance the financial stability of your business, and formalizing this collaboration through a Puerto Rico Partnership Agreement Involving Silent Partner ensures that all terms are clear and legally binding.

Determining how much percentage a silent partner should receive often involves negotiation among partners. Common factors include the silent partner's capital contribution and the level of risk they assume. It’s best to document this percentage explicitly in your Puerto Rico Partnership Agreement Involving Silent Partner to foster trust and clarity among all partners.

If the partnership deed is silent regarding certain terms, such as the involvement or profits of a silent partner, it’s important to discuss and document these details. Adjustments may be needed to outline expectations clearly, ensuring that all parties are aligned. Creating or amending your Puerto Rico Partnership Agreement Involving Silent Partner can provide a comprehensive solution, filling in any gaps left in the initial deed.

The percentage a silent partner receives typically depends on the terms outlined in the Puerto Rico Partnership Agreement Involving Silent Partner. Generally, this percentage is negotiated by the partners, often based on the silent partner's initial investment and the overall revenue distribution plans. It's essential to clarify this percentage in your agreement to prevent misunderstandings in the future.

The silent partner clause in a partnership deed defines the role and responsibilities of a silent partner in a partnership. A silent partner is not involved in the day-to-day operations but contributes capital and shares in the profits. This clause outlines how profits and losses will be distributed, as well as any specific rights or limitations the silent partner may have. Understanding this clause is essential when drafting a Puerto Rico Partnership Agreement Involving Silent Partner, as it helps clarify each partner's expectations and contributions.

Silent partners typically cannot bind the partnership because they are not involved in day-to-day operations. However, any authority they may have should be explicitly outlined in the Puerto Rico Partnership Agreement Involving Silent Partner to avoid any confusion. Addressing this aspect early in the partnership formation can lead to smoother operations in the future.

To add a silent partner, first, assess your business needs and ensure this addition aligns with your strategic goals. Then, outline the terms for their involvement, such as investment amount and profit-sharing methods, in the Puerto Rico Partnership Agreement Involving Silent Partner. This formal documentation will ensure clarity and protect the interests of all parties involved.

Yes, a partner can bind the partnership when they act within the scope of their authority in the everyday operations of the business. This typically applies to managing partners who handle business dealings directly. It’s crucial for all partners to understand these binding implications when drafting the Puerto Rico Partnership Agreement Involving Silent Partner.

To structure a silent partnership agreement effectively, start by specifying the roles of each partner, including the silent partner’s rights and obligations. Clearly define profit sharing, decision-making processes, and communication expectations to prevent future discord. Utilizing templates from USLegalForms can help create a comprehensive Puerto Rico Partnership Agreement Involving Silent Partner tailored to your specific needs.

Generally, silent partners do not have the authority to bind the partnership unless specified otherwise in the partnership agreement. Their lack of involvement in daily management usually prevents them from making decisions on behalf of the business. However, it is critical to clarify these rights in the Puerto Rico Partnership Agreement Involving Silent Partner to ensure all partners understand their limitations.