Puerto Rico Employee Information Form

Description

How to fill out Employee Information Form?

Are you currently in a situation where you need documents for business or personal needs almost every day.

There are numerous legal document templates available online, but finding trustworthy ones isn’t easy.

US Legal Forms offers a vast selection of document templates, including the Puerto Rico Employee Information Form, designed to satisfy state and federal regulations.

Once you find the appropriate form, click Get now.

Select the pricing plan you want, enter the required information to create your account, and complete the payment using your PayPal or Visa/MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Puerto Rico Employee Information Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/area.

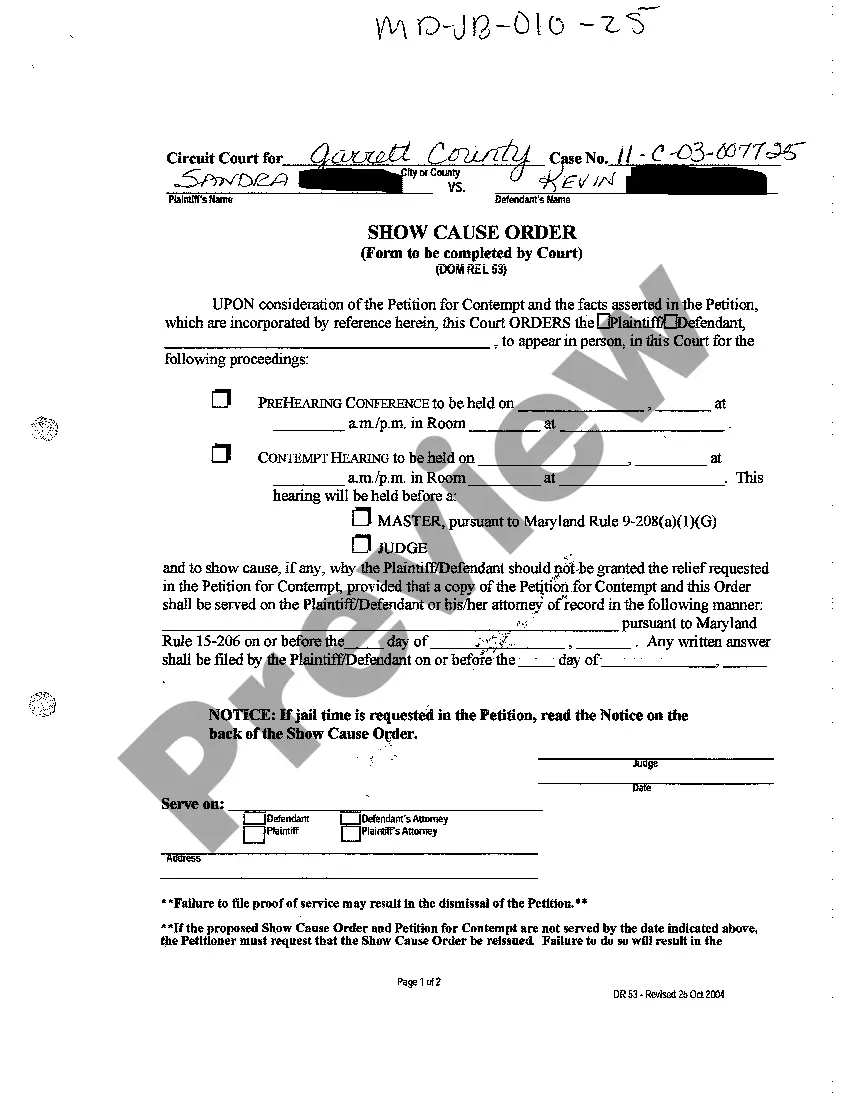

- Use the Review button to examine the form.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to locate the form that meets your criteria.

Form popularity

FAQ

To complete an employee withholding certificate form, first, gather your tax information, such as your filing status and number of dependents. Fill in the form carefully, ensuring your entries align with current tax regulations. The Puerto Rico Employee Information Form provides valuable guidance to help you understand the withholding process and ensure accurate tax deductions from your paychecks.

A 499R 2 is a tax form used in Puerto Rico to report income and withholding for various types of payments, primarily for hiring individuals. This form is crucial for employers to accurately reflect the payments made and ensure proper endorsement of tax obligations. Completing the Puerto Rico Employee Information Form alongside the 499R 2 helps maintain clarity and compliance in employee financial records.

Form 480.6 A is a document used in Puerto Rico for reporting withholding tax on payments made to resident individuals and entities. This form is essential for employers who must report salaries, wages, and other compensations. When correctly filled in conjunction with the Puerto Rico Employee Information Form, it ensures your tax responsibilities are met efficiently.

A safe harbor for tax purposes provides protection from penalties if taxpayers follow specific guidelines set by the tax authority. This means that if you comply with these guidelines, you can avoid additional taxes or penalties. Understanding this concept is crucial, especially when dealing with the Puerto Rico Employee Information Form, as it ensures accurate tax reporting and compliance.

An employee information form should include essential details such as the employee's full name, address, Social Security number, and job title. This form should also capture tax withholding preferences and additional personal information relevant to payroll processing. By accurately filling out the Puerto Rico Employee Information Form, employers ensure compliance and efficient record-keeping.

Individuals who meet specific residency and income requirements may qualify for Puerto Rico tax exemption. This typically includes residents who earn income solely from sources within Puerto Rico. Additionally, certain professionals and businesses may also be eligible, depending on their operations. Utilizing the Puerto Rico Employee Information Form helps determine the necessary criteria for exemption effectively.

To become a tax resident of Puerto Rico, you generally need to reside there for more than 183 days during a tax year and establish a physical presence. You may also need to meet specific financial and legal criteria. Using resources like the Puerto Rico Employee Information Form can clarify the steps necessary for becoming a tax resident and maintaining compliance.

Non-residents working in Puerto Rico typically face different withholding rates than residents. The withholding may include federal taxes and some local taxes, depending on the employee's earnings and residency. For accurate information, consider utilizing the Puerto Rico Employee Information Form for guidance on managing withholdings effectively.

To register for Puerto Rico payroll taxes, you must complete the necessary application forms through the Department of Treasury. It's also important to gather your employee information, which can be made easier with the Puerto Rico Employee Information Form. This helps ensure that you are compliant with local tax laws from the beginning.

The amount of tax deducted from a paycheck in Puerto Rico depends on various factors, including your income level and tax residency status. Typically, Puerto Rico withholds a portion of income for local and federal taxes. Being familiar with the Puerto Rico Employee Information Form will help you understand the specific deductions that apply to your situation.