Puerto Rico Assignment of Debt

Description

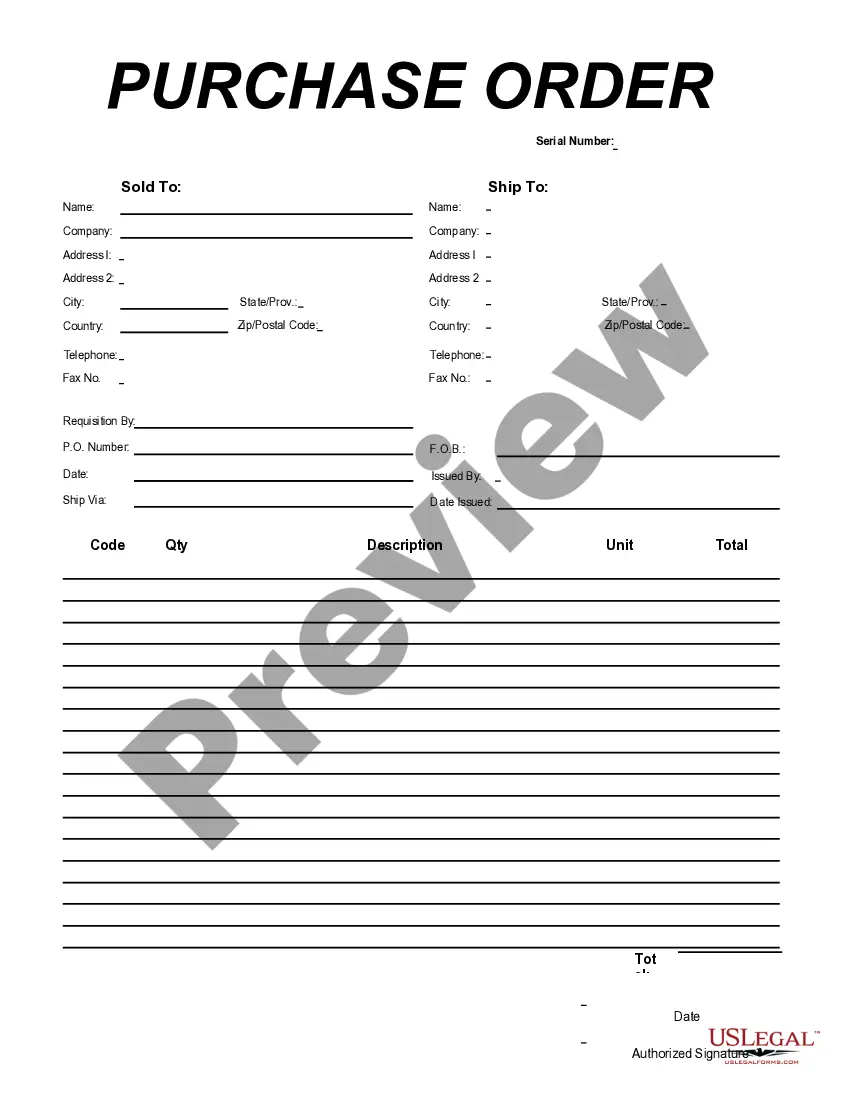

How to fill out Assignment Of Debt?

You can take time online trying to locate the authorized document template that meets the state and federal requirements you seek.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can easily download or print the Puerto Rico Assignment of Debt from my assistance.

To find another version of the form, utilize the Search feature to identify the template that fulfills your requirements.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you can complete, modify, print, or endorse the Puerto Rico Assignment of Debt.

- Every legal document template you receive is yours permanently.

- To obtain an additional copy of a purchased form, go to the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms site, follow the straightforward instructions outlined below.

- First, ensure that you have selected the appropriate document template for the state/city you choose.

- Review the document description to confirm you have selected the correct form.

Form popularity

FAQ

Puerto Rico's total debt exceeds $70 billion, a staggering figure that poses challenges for its economy. This high level of debt affects various aspects of life on the island, including public services and economic opportunities. The Puerto Rico Assignment of Debt is a critical issue as stakeholders seek pathways toward resolution. Understanding the extent of this debt is vital for anyone looking to navigate Puerto Rico's financial landscape.

Yes, the U.S. government allocates funds to Puerto Rico, mainly through federal programs. These funds are intended to help address specific needs such as disaster recovery, healthcare, and education. However, they often do not sufficiently cover the assessments made under the Puerto Rico Assignment of Debt. Managing these funds effectively is essential for Puerto Rico’s financial future.

Puerto Rico's debt is owned by a mixture of creditors, including hedge funds, bondholders, and the U.S. government. This diverse ownership complicates the negotiation process related to the Puerto Rico Assignment of Debt. Each group has different interests and priorities, making it difficult to reach a consensus. This variety makes understanding the implications of debt ownership crucial.

Puerto Rico's debt crisis stems from multiple factors, including economic downturns, high unemployment rates, and reliance on borrowed funds. Over years, this has accumulated into a significant financial burden. The Puerto Rico Assignment of Debt has become a crucial topic as stakeholders seek solutions. The combination of these factors led to a fiscal crisis that continues to be challenging.

The U.S. provides financial assistance to Puerto Rico, but it is often not enough to address its extensive debt. Financial aid comes in various forms, including grants and loans. Understanding the complexities of Puerto Rico's financial status is essential when discussing Puerto Rico Assignment of Debt. This financial aid can help with recovery, but it does not eliminate the debt problem.

Yes, the U.S. supports Puerto Rico in various ways. As a territory, Puerto Rico receives federal funding for healthcare, education, and infrastructure. This support helps alleviate some financial pressures from the Puerto Rico Assignment of Debt. However, the level of support often falls short of what is needed.

Form 480.6 C is used to report income that is exempt from Puerto Rico income tax, similar to the 480.6 A form but with different applications. This form plays a vital role for individuals looking to reduce their tax liability while managing their finances in relation to the Puerto Rico Assignment of Debt. Understanding how and when to use this form leads to better tax strategies. Consult tax professionals if you have questions about its use.

Form 480.7 C is utilized in Puerto Rico to report specific types of income for tax purposes. This form provides individuals with a means to disclose earnings that may relate to the Puerto Rico Assignment of Debt. Filing it correctly ensures that tax liabilities are accurately calculated. Familiarizing yourself with this form can enhance your financial planning.

To become bona fide in Puerto Rico, you need to establish residency by residing on the island for a certain period and demonstrating your intent to live there permanently. This status can affect your eligibility for various financial advantages, including those related to the Puerto Rico Assignment of Debt. Engaging with local communities and integrating into Puerto Rico's culture aids this process. Thoroughly understanding legal requirements is vital for a seamless transition.

The 480.6 A form is used in Puerto Rico to report sources of income that may be exempt from income tax. This is significant for individuals seeking to understand the implications of the Puerto Rico Assignment of Debt. Obtaining this form can help in highlighting income that qualifies for the tax exemption. Completing it accurately ensures compliance and minimizes tax liabilities.