Puerto Rico Marketing and Participating Internet Agreement

Description

How to fill out Marketing And Participating Internet Agreement?

Selecting the optimal authorized document template can be challenging.

Certainly, there are numerous templates available online, but how do you find the legal document you require.

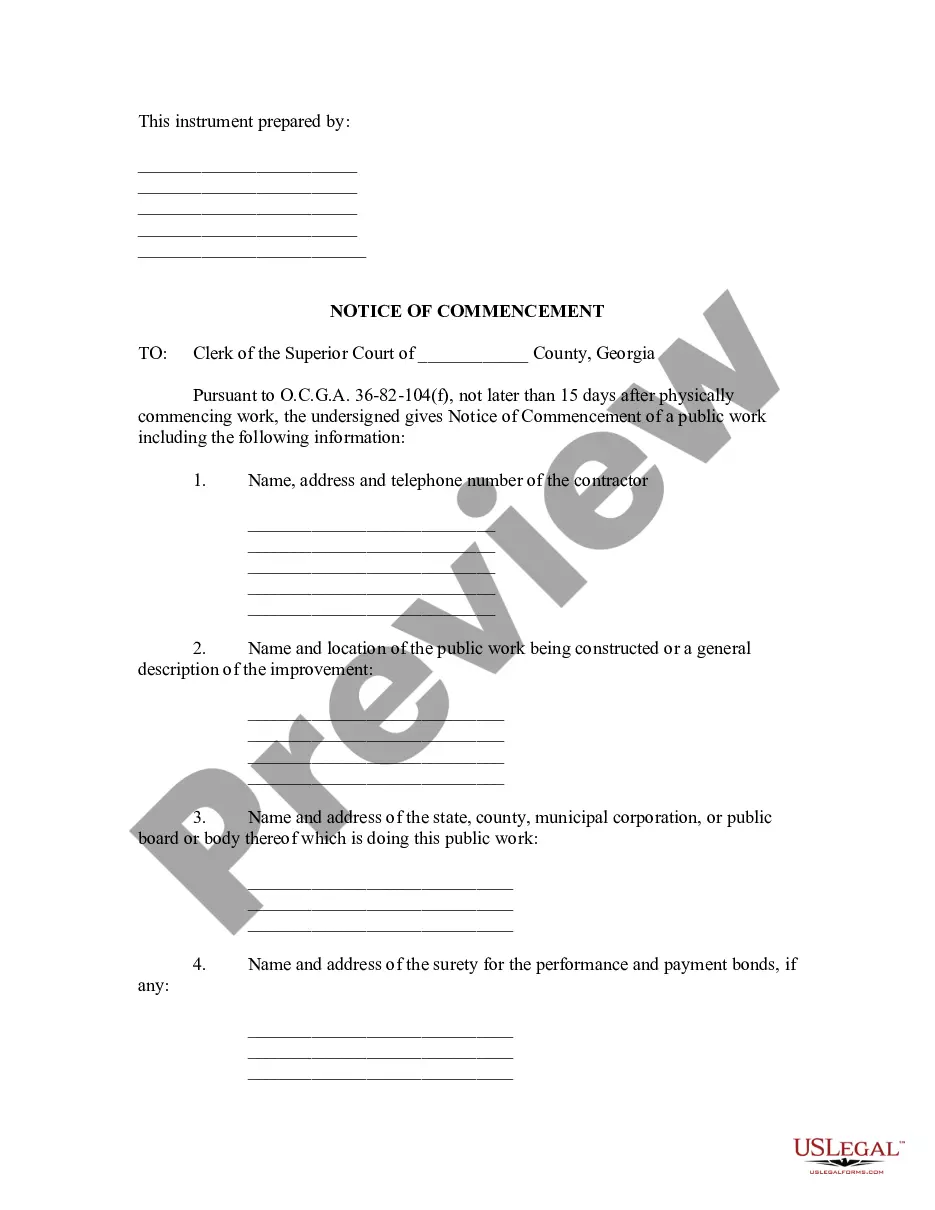

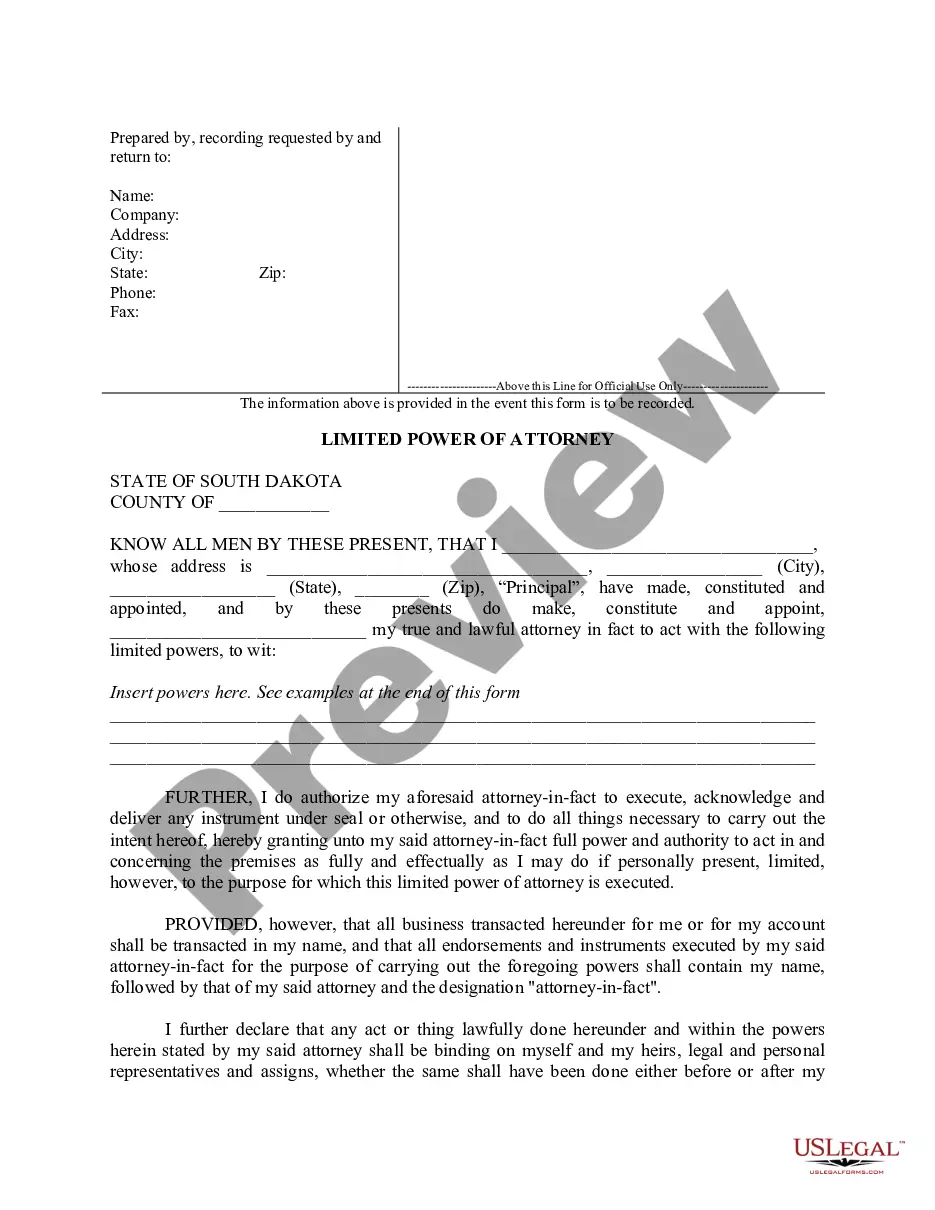

Utilize the US Legal Forms website. This service offers thousands of templates, including the Puerto Rico Marketing and Participating Internet Agreement, suitable for both business and personal use.

If the form does not meet your requirements, use the Search field to find the appropriate document.

- All forms are verified by professionals and comply with state and federal requirements.

- If you're already registered, Log In to your account and click on the Download button to obtain the Puerto Rico Marketing and Participating Internet Agreement.

- Use your account to review the legal forms you have previously acquired.

- Navigate to the My documents section of your account to download an additional copy of the document you need.

- If you're a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city or county. You can view the form using the Review option and read the form description to make sure it is the right choice for you.

Form popularity

FAQ

The Puerto Rico tax loophole often refers to the tax incentives available under specific laws that allow U.S. citizens to significantly reduce or eliminate certain federal tax obligations by residing in Puerto Rico. This loophole can attract businesses and individuals alike, promoting economic growth in the territory. Understanding its implications is key for effective participation in the Puerto Rico Marketing and Participating Internet Agreement.

Common exemptions from sales tax in Puerto Rico include basic groceries, certain medical equipment, and educational materials. Additionally, some services and government transactions may qualify for these exemptions. Recognizing these specifics allows businesses to navigate the Puerto Rico Marketing and Participating Internet Agreement effectively.

Americans can benefit from various tax breaks in Puerto Rico, including significantly reduced federal income tax rates, deductions, and credits. The incentive programs, specifically designed to stimulate investment, can help businesses thrive. Entrepreneurs engaging in the Puerto Rico Marketing and Participating Internet Agreement should take advantage of these opportunities.

To establish sales tax nexus in Puerto Rico, businesses must have a physical presence, such as a store, office, or distribution center, in the territory. Additionally, making sales of taxable goods or services may create nexus regardless of an actual physical location. Adhering to these nexus requirements is essential for businesses involved in the Puerto Rico Marketing and Participating Internet Agreement.

Generally, sales tax does not apply to the sale of most food items in Puerto Rico, making essential groceries more affordable for residents. However, prepared food items, drinks, and certain restaurant meals may be subject to tax. Businesses need to clearly understand these rules to comply with the Puerto Rico Marketing and Participating Internet Agreement.

Puerto Ricans enjoy exemptions from several types of taxes, including federal income tax under specific circumstances. Additionally, exemptions may apply to certain capital gains, estate taxes, and some import duties. Knowing these exemptions can greatly benefit businesses working within the framework of the Puerto Rico Marketing and Participating Internet Agreement.

The IVU tax, or Impuesto de Ventas y Uso, is a combination of sales and use tax in Puerto Rico, currently set at 11.5%. It applies to the sale of goods and services throughout the island. For businesses engaged under the Puerto Rico Marketing and Participating Internet Agreement, understanding the IVU tax implications is vital for compliance and financial planning.

Several goods and services are exempt from Puerto Rico sales tax, including prescription medications, certain groceries, and some educational materials. These exemptions help to reduce the tax burden on residents and encourage spending in essential areas. Businesses must stay informed about these exemptions to navigate the Puerto Rico Marketing and Participating Internet Agreement effectively.

In Puerto Rico, items such as certain medical supplies, certain educational services, and certain services performed by professionals may be exempt from sales and use tax. Additionally, some transactions involving government entities or nonprofits also qualify for tax exemption. Understanding these exemptions is crucial for businesses following the Puerto Rico Marketing and Participating Internet Agreement.

Section 1 of the Internal Revenue Code specifies the rates of tax that apply to individuals and corporations in the United States. It lays down the foundation for how federal income tax is structured. This section can significantly impact businesses operating under the Puerto Rico Marketing and Participating Internet Agreement by determining tax liabilities.