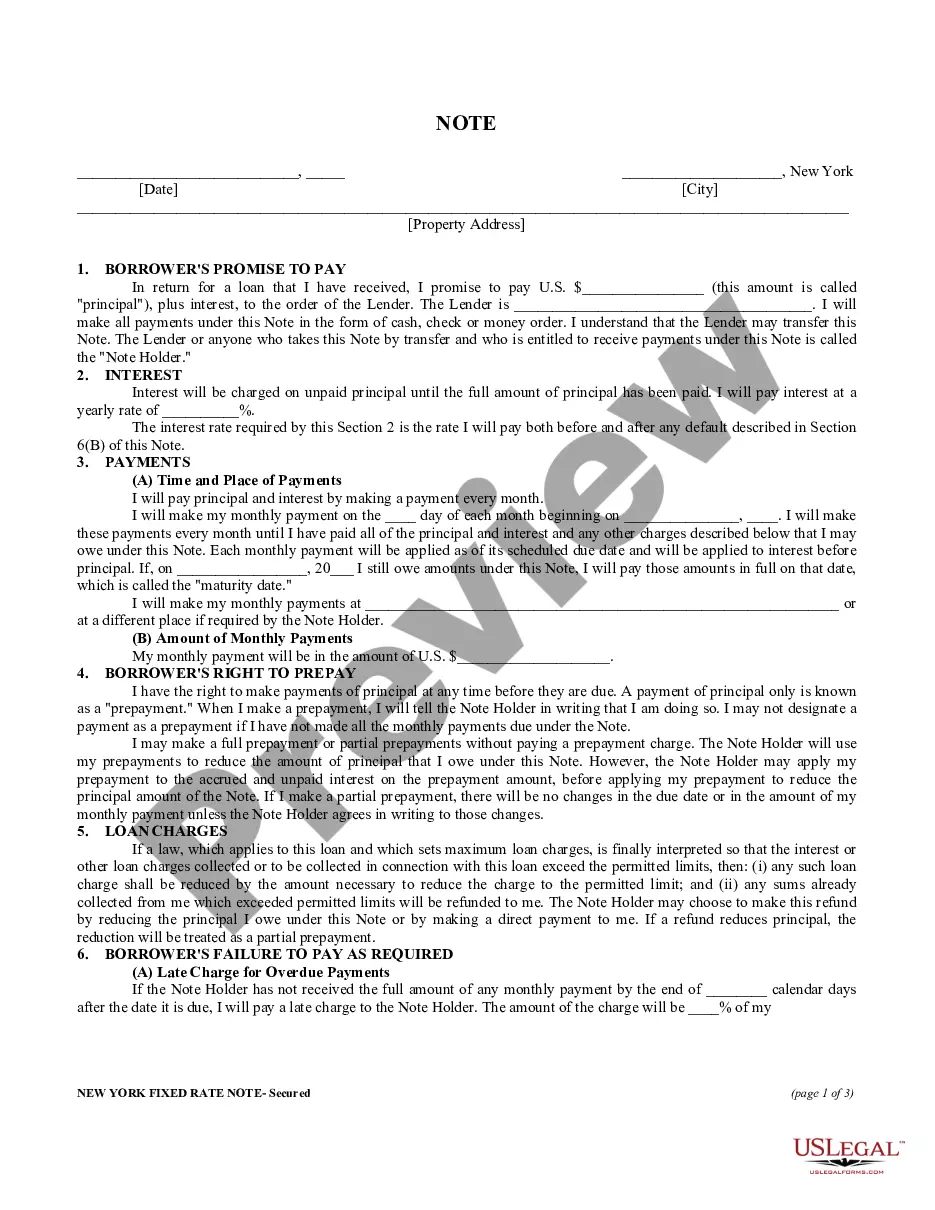

Closed-end transactions involve a fixed amount to be paid back over a period of time such as a note or a retail installment contract.

Puerto Rico General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures The Federal Truth In Lending Act (TILL) is a crucial federal legislation that regulates consumer credit transactions in the United States, including Puerto Rico. TILL aims to ensure transparency and fairness in lending practices by empowering consumers with vital information about the terms and costs associated with credit transactions. When entering into a retail installment contract in Puerto Rico, specific general disclosures must be provided to consumers under TILL. These disclosures help consumers understand the terms and conditions of the credit agreement they are entering into and enable them to make informed decisions. Let's explore some common Puerto Rico General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures: 1. Annual Percentage Rate (APR): The APR represents the cost of credit expressed as an annual rate. It includes both the interest rate charged and any additional fees associated with the credit transaction. The lender must disclose the APR to enable consumers to compare different credit offers and determine the overall cost of borrowing. 2. Finance Charge: The finance charge is the total cost of credit, including interest charges, fees, and any other charges associated with the credit transaction. This disclosure provides consumers with a clear understanding of the additional costs they are expected to pay. 3. Amount Financed: The amount financed refers to the actual amount of credit extended to the consumer. It excludes any finance charges or fees. This disclosure helps consumers understand the exact amount they will receive and potentially owe. 4. Total Payment Amount: The total payment amount represents the sum of all payments the consumer will make over the course of the credit agreement. It includes principal, interest, and any other charges. This disclosure allows consumers to understand the overall financial commitment associated with the credit transaction. 5. Payment Schedule: The payment schedule outlines the number of payments, amounts, and due dates. It helps consumers plan their budgets and ensures they are aware of their payment obligations. These are just a few examples of the Puerto Rico General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures. It is crucial for lenders to provide these disclosures in a clear and conspicuous manner to ensure consumers fully understand the terms and costs of their credit agreements. Failure to disclose required information accurately and completely may result in legal consequences, such as penalties or the consumer's right to rescind the credit agreement. Therefore, it is vital for lenders in Puerto Rico to adhere to these disclosure requirements to maintain compliance with TILL.