Puerto Rico Credit Card Agreement and Disclosure Statement is a legal document that outlines the terms and conditions governing the use of credit cards issued in Puerto Rico. This agreement is designed to protect both the credit card issuer and the cardholder by establishing clear guidelines for credit card usage and repayment. The Puerto Rico Credit Card Agreement and Disclosure Statement typically includes the following key components: 1. Terms and Conditions: This section of the agreement details the rights and responsibilities of both the credit card issuer and the cardholder. It covers crucial aspects such as interest rates, billing cycles, minimum payments, and fees associated with the credit card. 2. Interest Rates: The Puerto Rico Credit Card Agreement and Disclosure Statement specify the annual percentage rate (APR) for purchases, cash advances, and balance transfers. It also outlines how the interest is calculated, whether it's a fixed rate or a variable rate tied to a specific index. 3. Fees and Charges: This section outlines any fees associated with the credit card, including annual fees, late payment fees, over-limit fees, and foreign transaction fees. It is essential for cardholders to review these fees to understand the cost implications of card usage. 4. Billing and Payments: The agreement provides details regarding the billing cycle, grace period, and payment due dates. It explains how minimum payments are calculated and any consequences for late or missed payments, such as increased interest rates or penalty fees. 5. Liability and Fraud Protection: This section clarifies the cardholder's liability for unauthorized transactions and the procedures to report lost or stolen cards. It also outlines the steps to dispute any billing errors and the cardholder's responsibility for promptly reviewing their statements. Different types of Puerto Rico Credit Card Agreements and Disclosure Statements may exist based on the specific credit card product and issuer. Some common variations may include: 1. Standard Credit Card Agreement: This type of agreement applies to regular, unsecured credit cards that offer a line of credit to the cardholder. 2. Secured Credit Card Agreement: When obtaining a secured credit card, where credit is extended against a cash deposit or collateral, a separate agreement may be provided to outline the terms and conditions specific to this type of credit card. 3. Rewards Credit Card Agreement: If the credit card offers reward points or cash-back incentives, the agreement may include additional sections outlining the terms and conditions applicable to these rewards programs. It is crucial for cardholders to carefully review the Puerto Rico Credit Card Agreement and Disclosure Statement before accepting and using a credit card. Understanding the terms and conditions helps cardholders manage their credit responsibly and make informed financial decisions.

Puerto Rico Credit Card Agreement and Disclosure Statement

Description

How to fill out Puerto Rico Credit Card Agreement And Disclosure Statement?

US Legal Forms - among the most significant libraries of authorized varieties in the United States - gives a wide array of authorized file templates you can acquire or produce. Using the site, you can find a large number of varieties for company and person reasons, categorized by categories, suggests, or keywords and phrases.You will discover the newest types of varieties such as the Puerto Rico Credit Card Agreement and Disclosure Statement in seconds.

If you currently have a membership, log in and acquire Puerto Rico Credit Card Agreement and Disclosure Statement through the US Legal Forms catalogue. The Obtain button will show up on every develop you look at. You get access to all earlier delivered electronically varieties inside the My Forms tab of your respective account.

If you wish to use US Legal Forms for the first time, here are easy recommendations to help you started out:

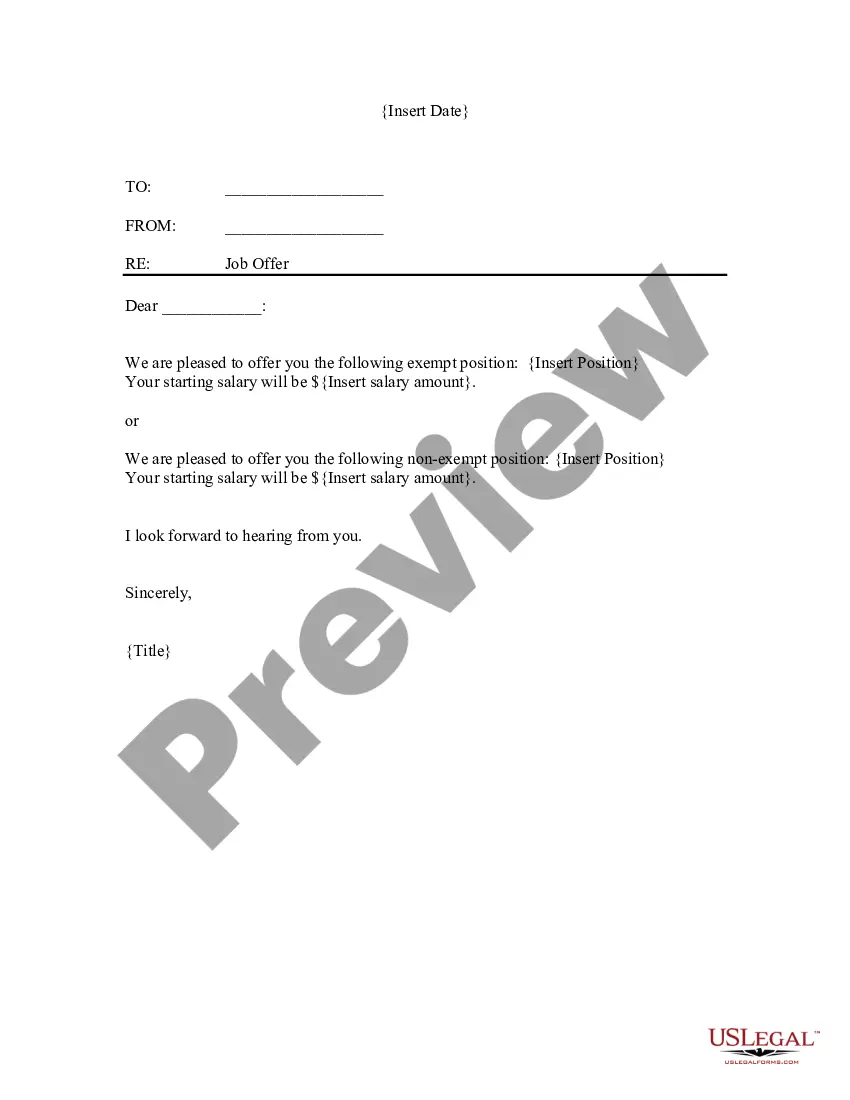

- Make sure you have selected the right develop for your personal metropolis/region. Click the Preview button to analyze the form`s articles. Browse the develop outline to ensure that you have chosen the correct develop.

- In case the develop doesn`t suit your specifications, take advantage of the Research discipline at the top of the display screen to find the one that does.

- If you are content with the form, validate your decision by simply clicking the Purchase now button. Then, pick the prices plan you like and provide your qualifications to register for the account.

- Method the deal. Use your bank card or PayPal account to perform the deal.

- Pick the structure and acquire the form on the product.

- Make modifications. Load, edit and produce and indicator the delivered electronically Puerto Rico Credit Card Agreement and Disclosure Statement.

Each and every format you added to your bank account does not have an expiry day and is the one you have for a long time. So, if you would like acquire or produce one more backup, just visit the My Forms segment and click about the develop you will need.

Obtain access to the Puerto Rico Credit Card Agreement and Disclosure Statement with US Legal Forms, the most considerable catalogue of authorized file templates. Use a large number of specialist and condition-specific templates that meet up with your company or person demands and specifications.