Puerto Rico Judgment Foreclosing Mortgage and Ordering Sale

Description

How to fill out Judgment Foreclosing Mortgage And Ordering Sale?

It is possible to commit hrs on the web trying to find the legitimate record design that meets the federal and state needs you will need. US Legal Forms supplies a huge number of legitimate forms which are evaluated by specialists. You can actually down load or produce the Puerto Rico Judgment Foreclosing Mortgage and Ordering Sale from the service.

If you have a US Legal Forms accounts, you may log in and click on the Down load switch. After that, you may full, edit, produce, or sign the Puerto Rico Judgment Foreclosing Mortgage and Ordering Sale . Every legitimate record design you acquire is yours permanently. To acquire yet another version of any acquired type, go to the My Forms tab and click on the related switch.

If you work with the US Legal Forms internet site the first time, keep to the straightforward directions beneath:

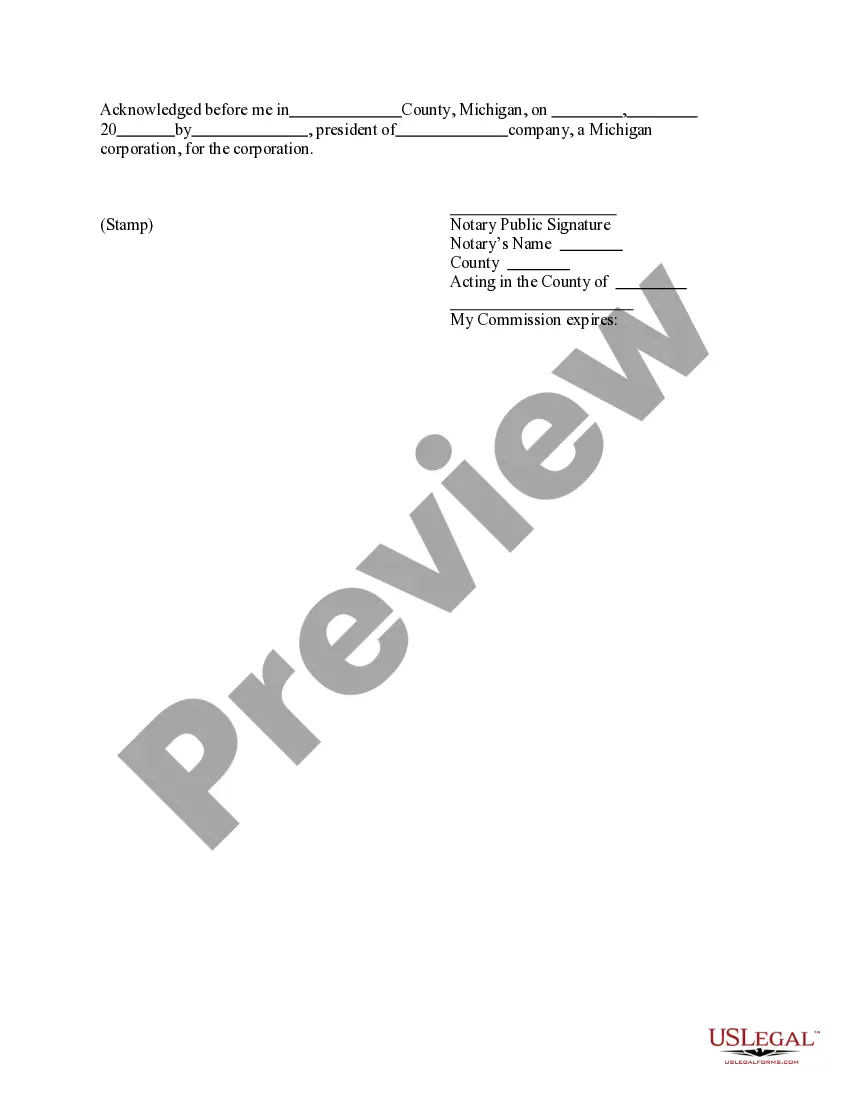

- Initial, be sure that you have selected the best record design to the county/area that you pick. Browse the type explanation to make sure you have picked out the right type. If readily available, make use of the Review switch to check with the record design at the same time.

- If you would like locate yet another edition of your type, make use of the Search field to discover the design that suits you and needs.

- When you have discovered the design you would like, click Purchase now to carry on.

- Pick the costs prepare you would like, type in your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You may use your credit card or PayPal accounts to cover the legitimate type.

- Pick the format of your record and down load it to the gadget.

- Make changes to the record if necessary. It is possible to full, edit and sign and produce Puerto Rico Judgment Foreclosing Mortgage and Ordering Sale .

Down load and produce a huge number of record themes while using US Legal Forms website, that offers the greatest selection of legitimate forms. Use skilled and status-particular themes to deal with your organization or individual requirements.

Form popularity

FAQ

This act of selling the property to pay the borrower's debt is called a foreclosure: It is the pre-emptive or premature closing of a loan transaction by summary sale of the collateral that secured the loan, with an immediate pay-off of the entire loan obligation from the sale proceeds.

Foreclosure is a legal process that allows lenders to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property.

A writ of seizure and sale can occur when a borrower defaults on a mortgage, and as a result, the loan goes into foreclosure. Foreclosure is a legal process by which a bank, creditor, or lender assumes control of a property and sells the home.

Foreclosure is a legal process that allows lenders to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property.

In a judicial foreclosure, after the judge orders the sale of a home, it's usually auctioned off to the highest bidder. The homeowner has some time after the sale to buy the home back from the successful bidder (called the right of redemption). The amount of time depends on whether the sale satisfied the debt.

Foreclosure is the process that allows a lender to recover the amount owed on a defaulted loan by selling or taking ownership of the property.

Judicial foreclosure refers to foreclosure proceedings that take place through the court system. This type of foreclosure process often occurs when a mortgage note lacks a power of sale clause, which would legally authorize the mortgage lender to sell the property if a default occurred.

Foreclosures in Puerto Rico go through a judicial process in the court system. The lender initiates the foreclosure by filing a brief in court, along with certain documents. The brief must contain an exact breakdown of the following: the principal balance owed.