An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

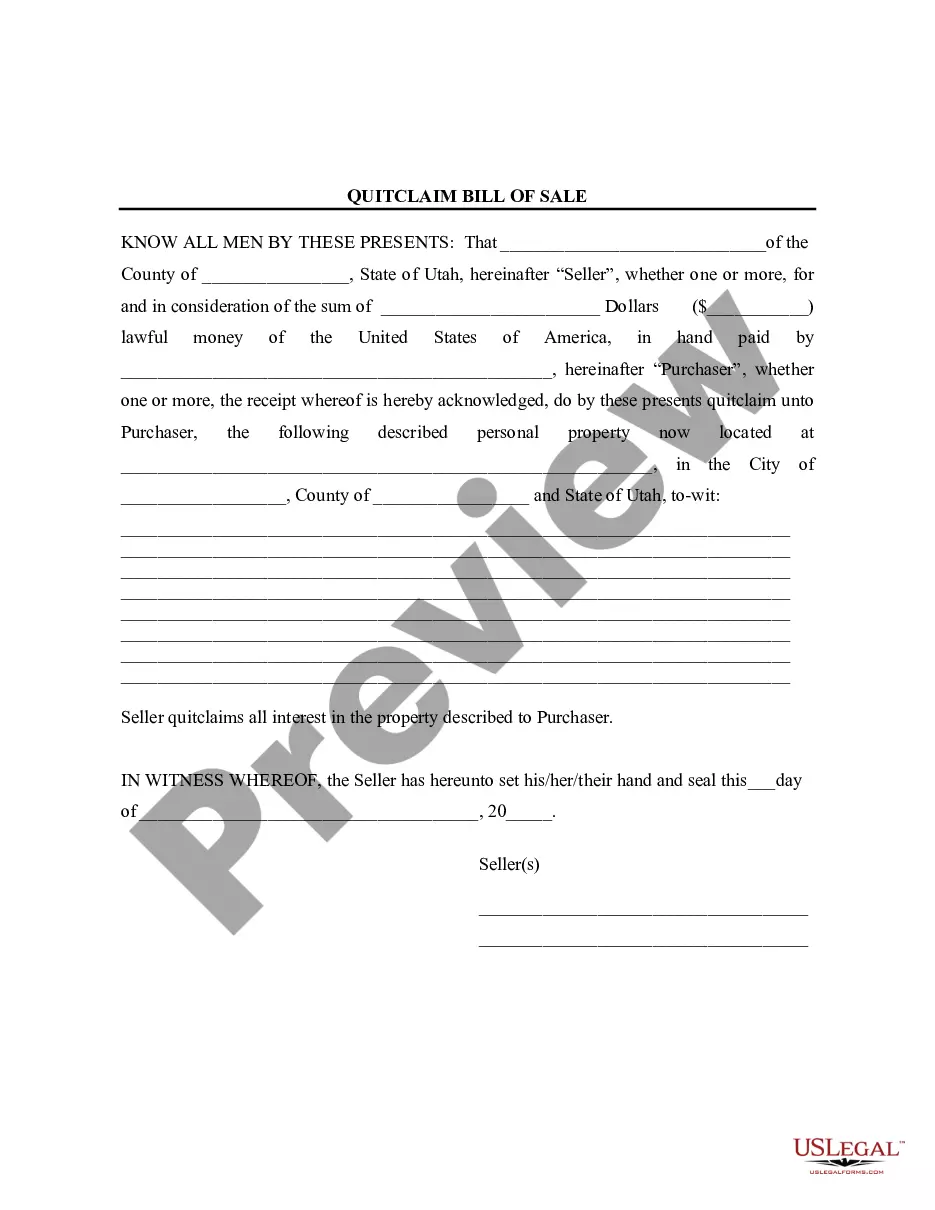

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

In Puerto Rico, an Independent Contractor Agreement with a Crew Member for a Television Production is a legally binding contract that establishes the working relationship between the production company and the crew member engaged to provide services for a television production. This agreement outlines the terms and conditions of the engagement, protecting the rights and responsibilities of both parties. Keywords: Puerto Rico, Independent Contractor Agreement, Crew Member, Television Production, terms and conditions. There are different types of Puerto Rico Independent Contractor Agreements with Crew Members for a Television Production, tailored to specific roles within the production. Some of these specialized agreements include: 1. Cinematographer Independent Contractor Agreement: This agreement is designed for crew members responsible for capturing images on camera, ensuring proper lighting, framing, and overall visual quality. 2. Sound Technician Independent Contractor Agreement: This type of agreement is meant for crew members specializing in recording, mixing, and editing audio for the television production, ensuring high-quality sound production. 3. Production Designer Independent Contractor Agreement: This agreement is created for crew members responsible for overseeing the overall visual appearance and design elements of the television production, including set design, props, and costumes. 4. Makeup Artist Independent Contractor Agreement: This type of agreement is specific to crew members specializing in providing makeup services to the actors and other individuals involved in the television production, enhancing their appearance and ensuring continuity. 5. Grip Independent Contractor Agreement: This agreement is tailored for crew members responsible for setting up and operating equipment such as cranes, dollies, and other mechanical devices essential for camera movement and positioning. 6. Production Assistant Independent Contractor Agreement: This agreement is designed for crew members providing general support and assistance to various departments within the television production, ensuring smooth operations and efficient coordination. Each of these agreements may have specific clauses pertaining to the nature of the work, payment terms, working hours, intellectual property ownership, confidentiality, termination conditions, and any additional provisions required. It is crucial for both the production company and the crew member to thoroughly review and negotiate the terms outlined in the Independent Contractor Agreement to ensure a clear understanding of their rights and obligations, minimizing the potential for disputes while protecting the best interests of all parties involved.