Puerto Rico Private Annuity Agreement with Payments to Last for Life of Annuitant A Puerto Rico Private Annuity Agreement with Payments to Last for Life of Annuitant is a contractual arrangement that provides a regular income stream to an individual (annuitant) for the duration of their lifetime. This private annuity agreement is specific to Puerto Rico and offers unique benefits and advantages for both the annuitant and the issuer. One type of Puerto Rico Private Annuity Agreement is a Single Premium Immediate Annuity. In this agreement, the annuitant makes a lump-sum payment to the issuer in exchange for guaranteed payments that will last for the annuitant's entire life. The annuitant can customize the payment frequency, such as monthly, quarterly, or annually, based on their financial needs and goals. The amount of each payment is determined by several factors, including the annuitant's age, gender, and prevailing interest rates. Another type of Puerto Rico Private Annuity Agreement is a Deferred Annuity. This agreement allows the annuitant to make a series of premium payments into the annuity, which will accumulate over time and earn interest. The annuitant can choose to defer the commencement of payments until a later date, typically upon retirement. The longer the deferral period, the greater the potential for the accumulated value to grow, leading to higher annuity payments in the future. One of the key advantages of a Puerto Rico Private Annuity Agreement is its tax efficiency. Puerto Rico offers unique tax benefits, including favorable tax treatment for annuity payments received by non-resident individuals. Under current Puerto Rico tax laws, annuity income received from a Puerto Rico Private Annuity Agreement may be exempt from federal income taxes, allowing the annuitant to retain more of their income. Moreover, Puerto Rico's financial stability, strong legal framework, and regulatory environment make it an attractive jurisdiction for private annuity agreements. The issuer of the annuity must be a licensed insurance company in Puerto Rico, ensuring the annuitant's funds are protected and backed by the insurer's assets and reserves. When considering a Puerto Rico Private Annuity Agreement with Payments to Last for Life of Annuitant, it is crucial to consult with financial advisors and legal professionals with expertise in Puerto Rico's tax and legal regulations. They can help determine if such an agreement aligns with the annuitant's financial objectives, provide guidance on the appropriate payment structure, and ensure compliance with all applicable laws and regulations. In conclusion, a Puerto Rico Private Annuity Agreement with Payments to Last for Life of Annuitant is a valuable financial tool that offers a secure and reliable income source for individuals throughout their lifetime. It provides peace of mind, tax advantages, and financial stability, making it an appealing option for those seeking long-term financial security in Puerto Rico.

Puerto Rico Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

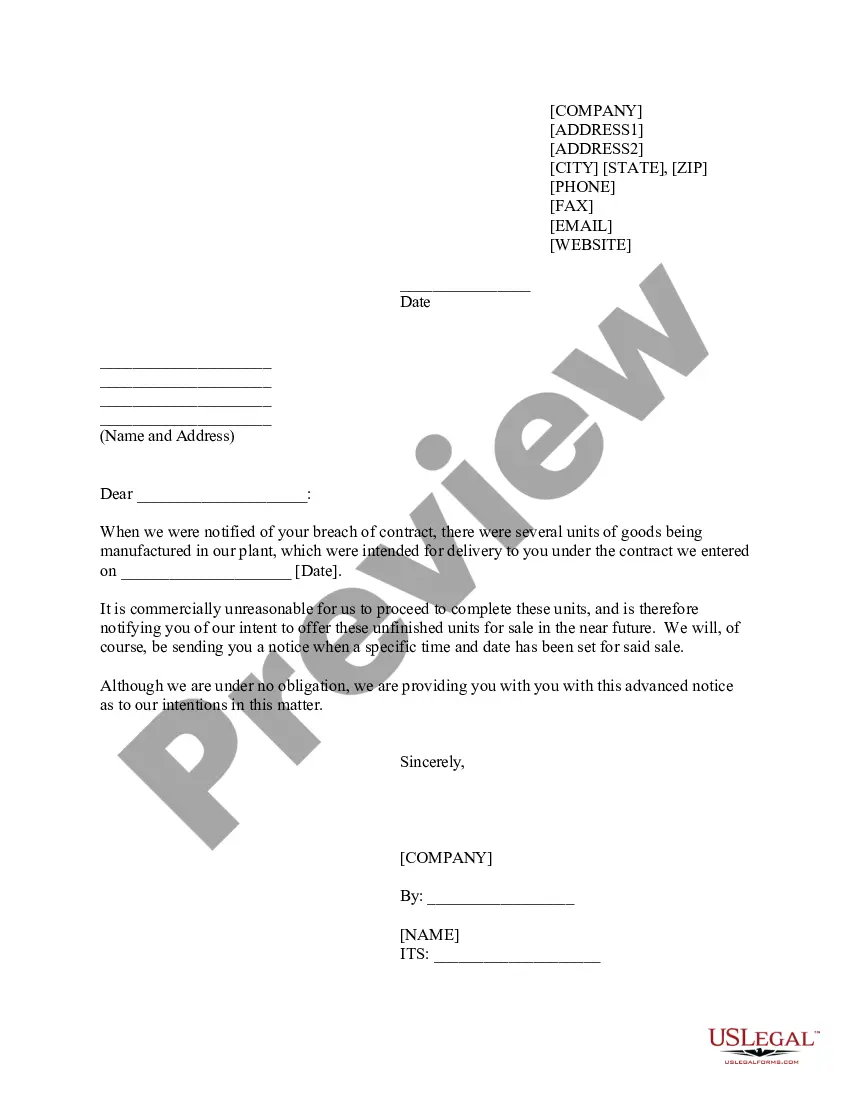

How to fill out Puerto Rico Private Annuity Agreement With Payments To Last For Life Of Annuitant?

Are you within a position where you need to have files for both enterprise or specific uses just about every time? There are a variety of legitimate record layouts available on the Internet, but finding types you can depend on isn`t effortless. US Legal Forms delivers thousands of form layouts, just like the Puerto Rico Private Annuity Agreement with Payments to Last for Life of Annuitant, that are written to satisfy state and federal needs.

When you are previously acquainted with US Legal Forms internet site and possess a free account, simply log in. Next, you can obtain the Puerto Rico Private Annuity Agreement with Payments to Last for Life of Annuitant design.

Should you not come with an accounts and want to start using US Legal Forms, abide by these steps:

- Get the form you require and make sure it is for the correct area/county.

- Make use of the Review button to check the form.

- Browse the description to actually have chosen the right form.

- In case the form isn`t what you are looking for, make use of the Look for industry to obtain the form that fits your needs and needs.

- Once you find the correct form, click on Purchase now.

- Pick the prices strategy you would like, fill out the desired info to create your bank account, and pay for the order utilizing your PayPal or bank card.

- Choose a practical file structure and obtain your duplicate.

Discover every one of the record layouts you have purchased in the My Forms food selection. You can aquire a further duplicate of Puerto Rico Private Annuity Agreement with Payments to Last for Life of Annuitant at any time, if possible. Just go through the essential form to obtain or produce the record design.

Use US Legal Forms, by far the most considerable assortment of legitimate varieties, in order to save some time and avoid mistakes. The service delivers expertly manufactured legitimate record layouts which can be used for an array of uses. Create a free account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

Payout Phase With a single-life or immediate annuity, the payments will simply cease at that point. However, you can purchase contracts that will provide payments to one or more beneficiaries after the annuitant's passing.

The life with period certain option is designed to pay the annuitant an income for life, but guarantees a minimum period of payments whether the individual is alive or not. Before he died, Gary received a total of $9,200 in monthly income payments from his $15,000 straight life annuity.

Annuity payout options include:Life Annuity with Period Certain (Fixed Period/Guaranteed Term) Joint and Survivor Annuity. Lump-Sum Payment. Systematic Annuity Withdrawal. Early Withdrawal.

A lifetime payout annuity is a type of retirement investment that pays a portion of the underlying portfolio of assets for the life of the investor. The guaranteed payments associated with lifetime payout annuities eliminate the risk for investors of outliving their retirement funds.

The straight life income annuity option pays the annuitant a guaranteed income for his or her lifetime.

Joint life annuity settlement option pays benefits to two or more annuitants, but stops upon the death of the first.

Key Takeaways. A life annuity is a financial product that features a predetermined periodic payout amount until the death of the annuitant. Annuitants pay premiums or make a lump-sum payment to secure a life annuity. Life annuities are commonly used to provide or supplement retirement income.

Also known as a straight-life or life-only annuity, a single-life annuity allows you to receive payments your entire life. Unlike some other options that allow for beneficiaries or spouses, this annuity is limited to the lifetime of the annuitant with no survivor benefit.

Our data revealed that a $1,000,000 annuity will pay between $4,583.32 and $12,732.00 per month for life if you use a lifetime income rider.

A lifetime annuity is a financial product you can buy with a lump sum of money. In return, you will receive income for the rest of your life. A lifetime annuity guarantees payment of a predetermined amount for the rest of your life. This is different from a term annuity which only pays you for a fixed amount of time.