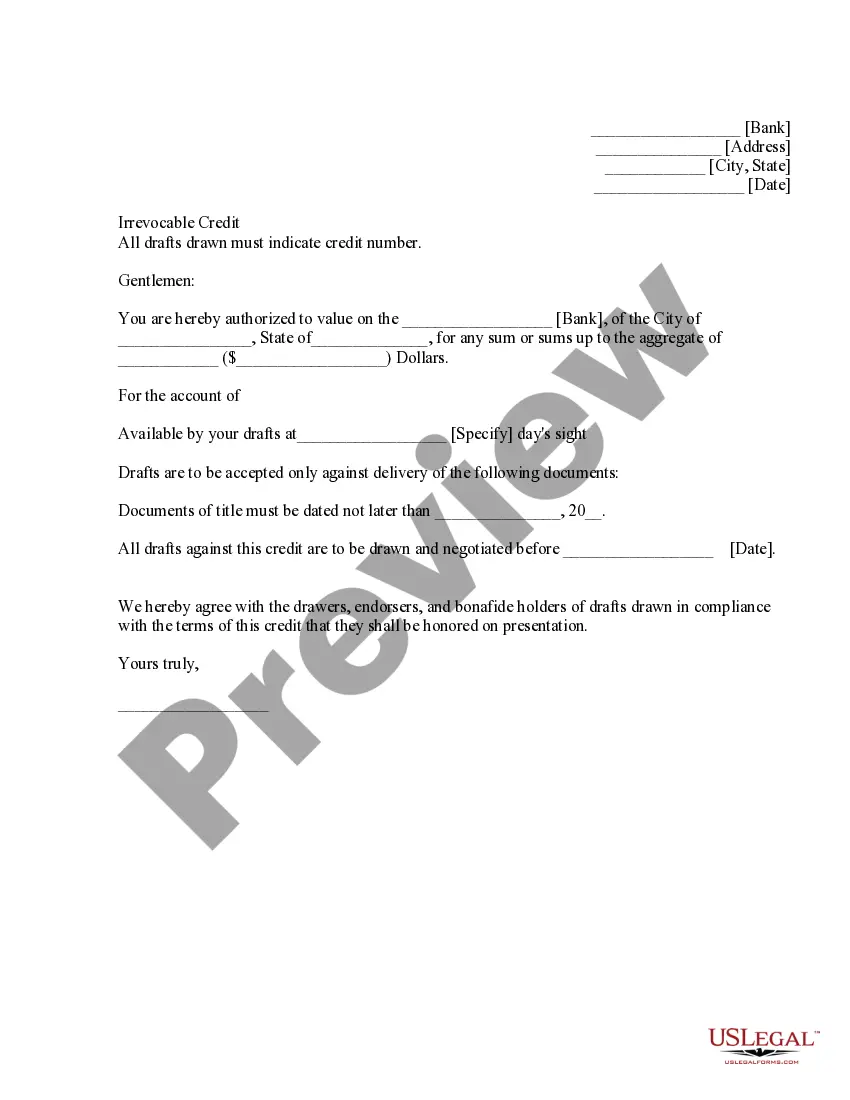

Puerto Rico General Letter of Credit with Account of Shipment

Description

How to fill out General Letter Of Credit With Account Of Shipment?

It is possible to invest several hours on the web searching for the lawful file template that meets the federal and state specifications you will need. US Legal Forms gives thousands of lawful varieties that are reviewed by experts. It is simple to acquire or printing the Puerto Rico General Letter of Credit with Account of Shipment from your services.

If you currently have a US Legal Forms accounts, it is possible to log in and click the Obtain button. Following that, it is possible to comprehensive, change, printing, or indication the Puerto Rico General Letter of Credit with Account of Shipment. Each lawful file template you buy is yours forever. To obtain yet another version of any purchased kind, visit the My Forms tab and click the corresponding button.

If you use the US Legal Forms web site the first time, adhere to the straightforward directions under:

- First, be sure that you have chosen the correct file template for the state/city of your choice. Look at the kind description to ensure you have picked the correct kind. If available, use the Preview button to appear with the file template too.

- If you want to find yet another version in the kind, use the Look for discipline to obtain the template that fits your needs and specifications.

- When you have located the template you desire, click Purchase now to proceed.

- Choose the rates prepare you desire, enter your qualifications, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your Visa or Mastercard or PayPal accounts to pay for the lawful kind.

- Choose the format in the file and acquire it in your device.

- Make adjustments in your file if possible. It is possible to comprehensive, change and indication and printing Puerto Rico General Letter of Credit with Account of Shipment.

Obtain and printing thousands of file layouts using the US Legal Forms web site, which offers the biggest variety of lawful varieties. Use specialist and status-specific layouts to take on your small business or personal needs.

Form popularity

FAQ

The most common types of letters of credit today are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit, revolving letters of credit, and red clause letters of credit, although there are several other types of letters of credit.

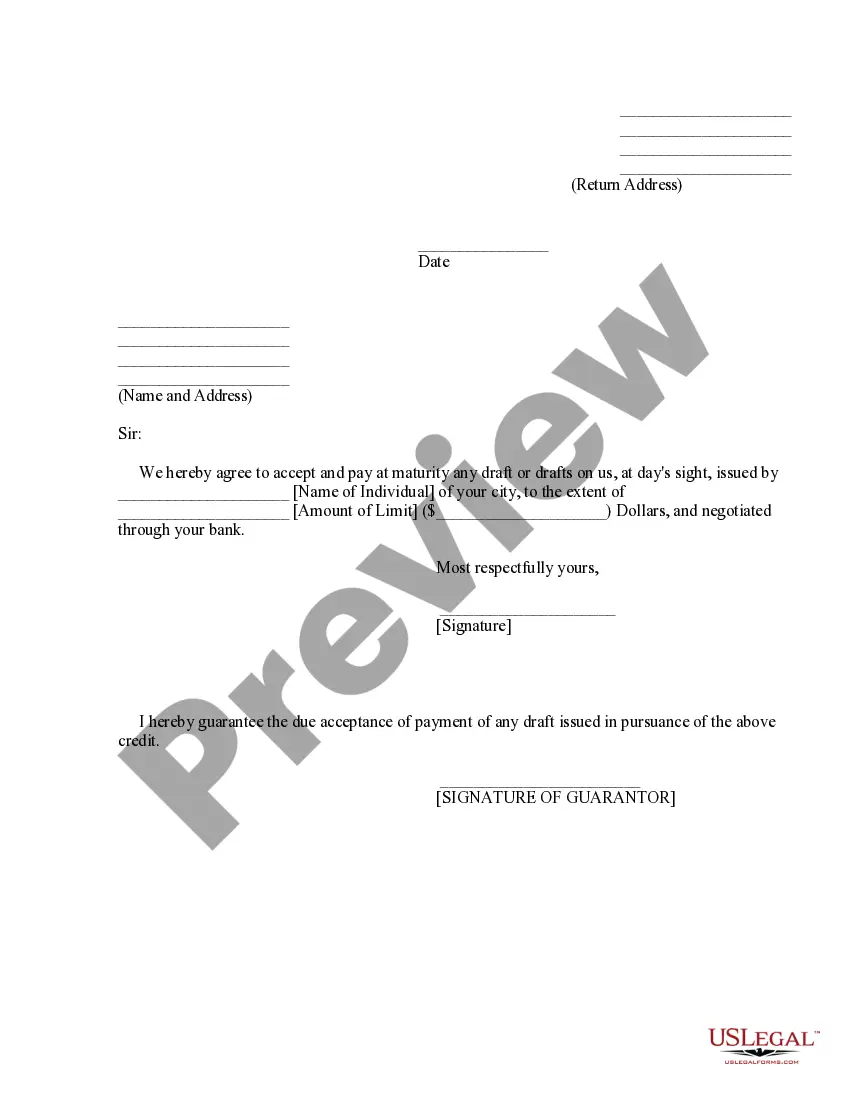

What is a Letter of Credit? A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

A letter of credit is essentially a financial contract between a bank, a bank's customer and a beneficiary. Generally issued by an importer's bank, the letter of credit guarantees the beneficiary will be paid once the conditions of the letter of credit have been met.

A bank guarantee is a promise from a lending institution that ensures the bank will step up if a debtor can't cover a debt. Letters of credit are also financial promises on behalf of one party in a transaction and are especially significant in international trade.

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

Export Letter of Credit (LC) LCs provide Exporters with the confidence to allow them to ship their goods in advance of the receipt of payment. An LC is a conditional payment guarantee provided by the Importer's bank to the Exporter. The Exporter normally receives the payment guarantee prior to the shipment of goods.