Puerto Rico Auto Expense Travel Report

Description

How to fill out Auto Expense Travel Report?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a broad selection of legal template documents that you can download or print.

By utilizing the website, you will gain access to thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can obtain the latest editions of forms such as the Puerto Rico Auto Expense Travel Report within minutes.

If you currently hold a monthly subscription, Log In to download the Puerto Rico Auto Expense Travel Report from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all of the previously downloaded forms within the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the downloaded Puerto Rico Auto Expense Travel Report.

Each template you added to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Puerto Rico Auto Expense Travel Report with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

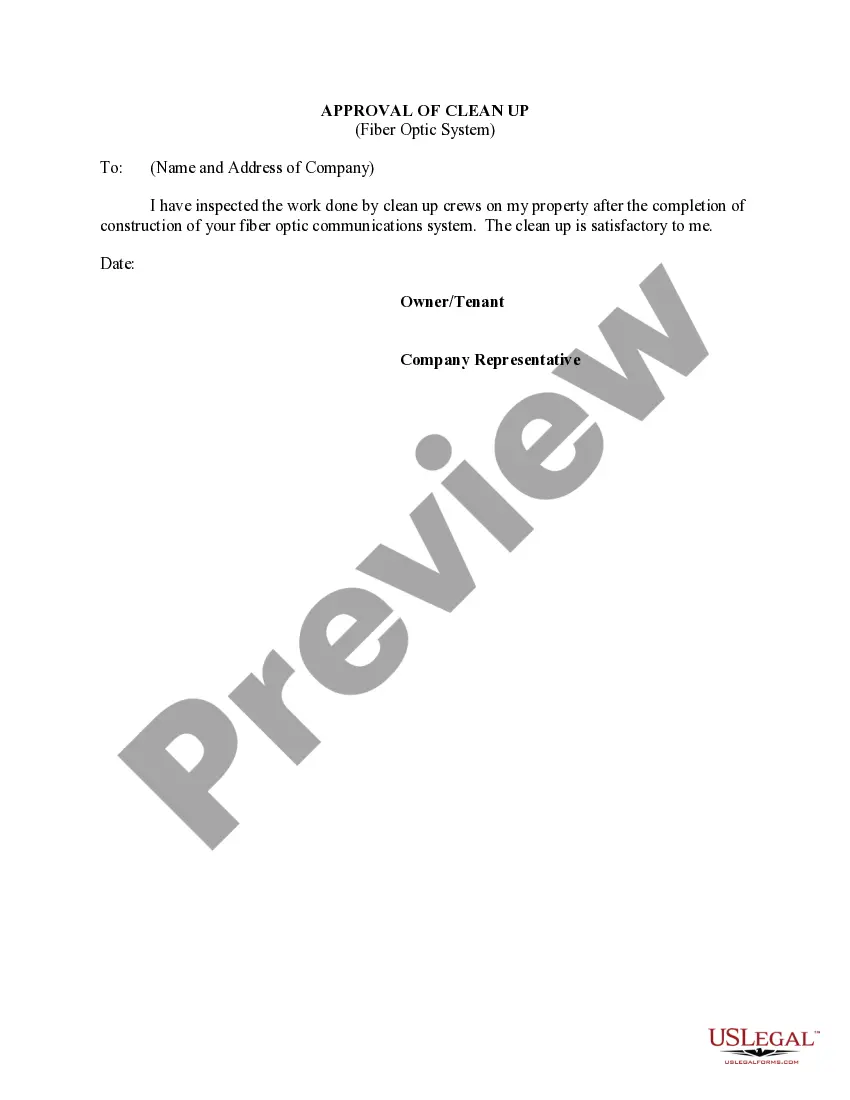

- Click the Preview button to review the form's content.

- Check the form description to confirm that you have chosen the right form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

To record travel expenses, begin with a detailed log of all expenditures associated with your travel. Categorize your expenses into clear sections such as transport, accommodation, and meals. Your Puerto Rico Auto Expense Travel Report should include dates, descriptions, and amounts to ensure comprehensive tracking for tax and reimbursement purposes.

An example of an expense report includes categories like transportation, meals, lodging, and miscellaneous expenses. Each entry lists the date, description, and amount spent. Using a template for your Puerto Rico Auto Expense Travel Report can simplify this process, making it easier to organize and submit your expenses.

To fill out a trip report, detail the purpose of your trip, significant activities, and outcomes. Include metrics or key findings that support your business objectives. A comprehensive Puerto Rico Auto Expense Travel Report can be beneficial in summarizing both your travel and the related expenses in a professional manner.

Filling in an expense report requires you to list each expense along with accompanying receipts. Make sure to include the date, amount, and purpose of the expense. By using a structured format, your Puerto Rico Auto Expense Travel Report will be clear and easy to understand, streamlining the reimbursement process.

To prove travel expenses for taxes, maintain clear records of all expenses, including receipts and invoices. A well-organized Puerto Rico Auto Expense Travel Report can help you document these expenses effectively. Additionally, include a travel itinerary and any necessary business purpose documentation to enhance your claims.

The IRS has specific guidelines regarding travel reimbursements to ensure compliance. Generally, you can reimburse employees for ordinary and necessary expenses incurred while traveling for business. When managing your Puerto Rico Auto Expense Travel Report, make sure to keep thorough records that align with these IRS rules.

Travel expenses can be considered 1099 reportable if they meet certain criteria. If the expenses are reimbursed and exceed a given amount, they may need to be reported to the IRS. It is important to consult the rules closely to understand how this applies to your Puerto Rico Auto Expense Travel Report.

To fill out a travel expense report, start by gathering all your receipts and documentation related to the trip. Clearly categorize your expenses, such as transportation, lodging, and meals. Ensure that you accurately record the amount spent, date, and purpose of each expense related to your Puerto Rico Auto Expense Travel Report.

Yes, travel agents can typically write off fam trips, or familiarization trips, as these are designed to enhance their knowledge of travel offerings and destinations. These trips can be vital for providing accurate recommendations to clients. Keeping comprehensive records using a solution like the Puerto Rico Auto Expense Travel Report can facilitate the deduction process for these kinds of business-related travel.

Deductible travel expenses often include transportation costs, lodging, meals, and other necessary expenses incurred while traveling for business purposes. To qualify, the travel must be directly related to business activities. To maximize your deductions effectively, using the Puerto Rico Auto Expense Travel Report can help you keep an accurate record of all allowable expenses.