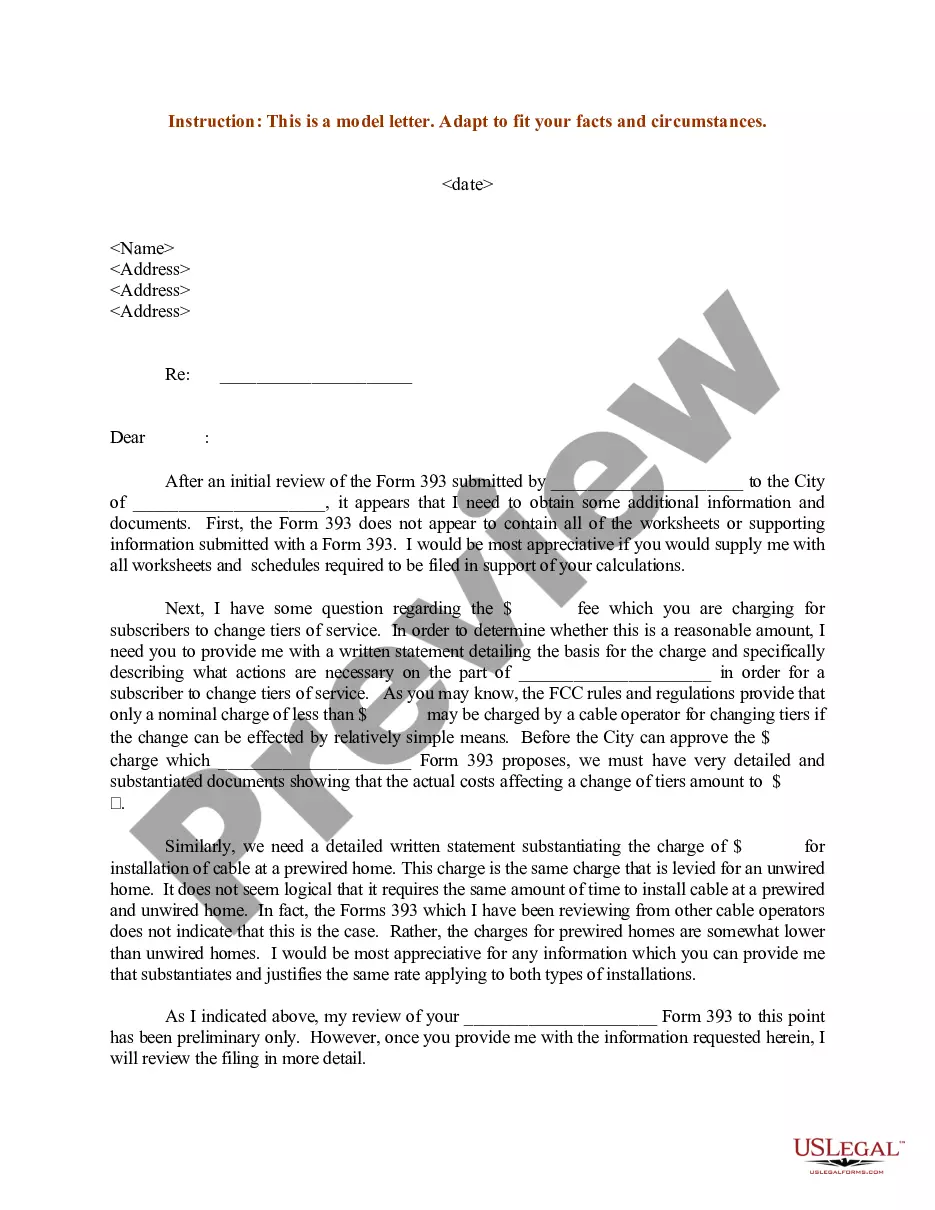

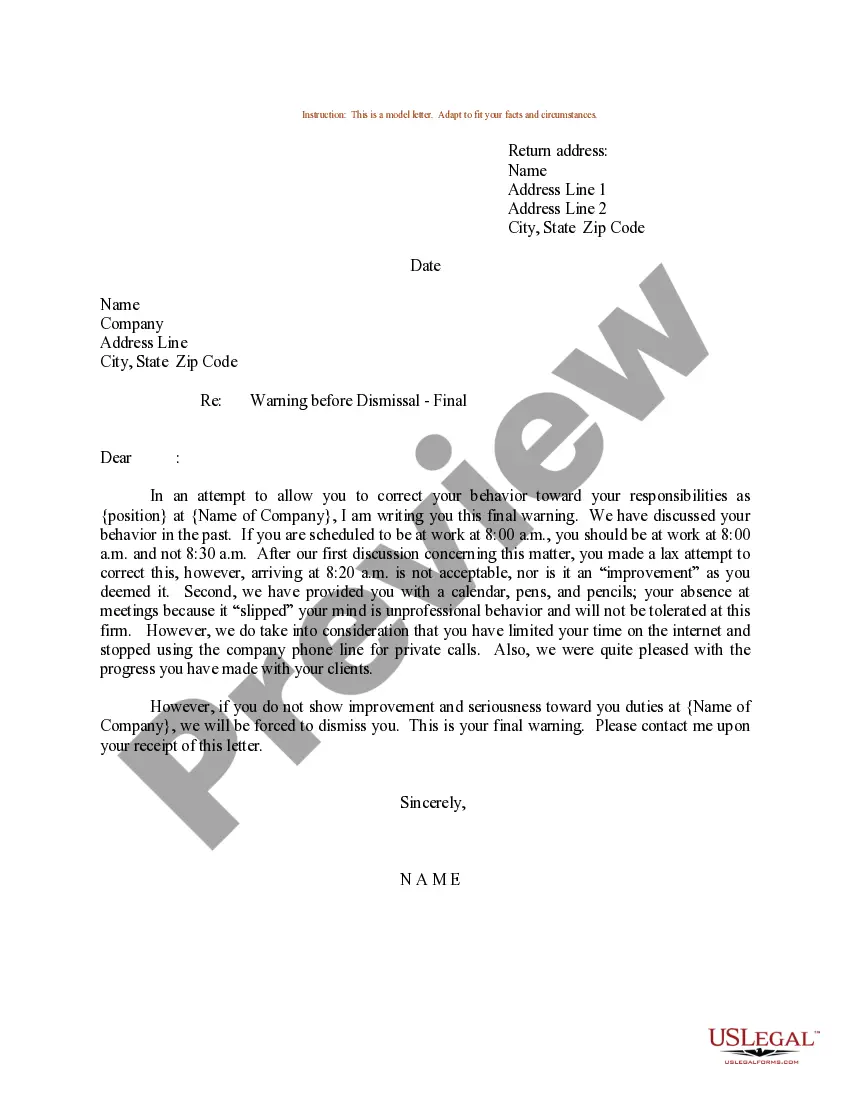

This form is a sample business credit application that can be used to take information from a business seeking a loan.

Puerto Rico Business Credit Application

Description

How to fill out Business Credit Application?

If you need to full, down load, or print legitimate document layouts, use US Legal Forms, the biggest collection of legitimate types, which can be found on-line. Take advantage of the site`s simple and easy convenient search to find the paperwork you want. Different layouts for business and specific uses are sorted by groups and says, or key phrases. Use US Legal Forms to find the Puerto Rico Business Credit Application with a handful of click throughs.

When you are presently a US Legal Forms customer, log in for your accounts and click the Obtain button to have the Puerto Rico Business Credit Application. You can also entry types you in the past acquired in the My Forms tab of your own accounts.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for that appropriate area/land.

- Step 2. Use the Preview solution to check out the form`s articles. Don`t overlook to read through the information.

- Step 3. When you are unhappy with all the kind, utilize the Look for industry at the top of the screen to get other variations from the legitimate kind format.

- Step 4. When you have identified the shape you want, select the Purchase now button. Opt for the prices program you like and add your qualifications to sign up for the accounts.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal accounts to accomplish the deal.

- Step 6. Choose the formatting from the legitimate kind and down load it in your product.

- Step 7. Total, modify and print or indicator the Puerto Rico Business Credit Application.

Every legitimate document format you purchase is yours forever. You might have acces to every kind you acquired in your acccount. Select the My Forms segment and pick a kind to print or down load again.

Be competitive and down load, and print the Puerto Rico Business Credit Application with US Legal Forms. There are millions of expert and status-certain types you can use for your business or specific needs.

Form popularity

FAQ

80 or over: A business credit score above 80 is typically considered excellent. It could also help you access better deals on financial products like business loans, including lower interest rates.

A good credit score for an LLC is typically considered to be in the range of 600?800, similar to your personal credit score. The higher your score, the better it looks to potential lenders and vendors who might want to do business with you.

Minimum credit score by business loan type Term loanWhile banks and credit unions typically require a score of 670 or above, online lenders may only require a score of 500SBA loanLenders offering SBA loans require credit scores between 620 and 6804 more rows ?

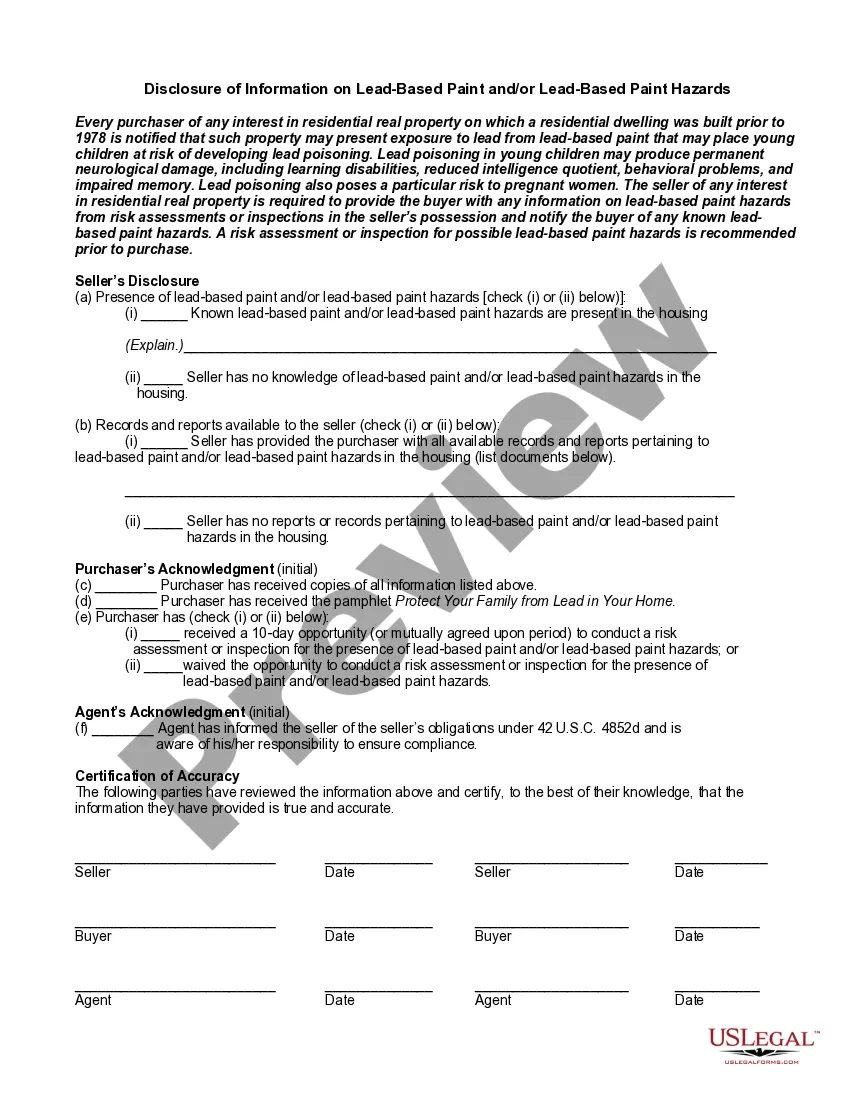

Eight steps to establishing your business credit Incorporate your business. ... Obtain an EIN. ... Open a business bank account. ... Establish a business phone number. ... Open a business credit file. ... Obtain business credit card(s) ... Establish a line of credit with vendors or suppliers. ... Pay your bills on time.

While there are several different factors that lenders consider, there are a few that are most vital, including: Credit history. Your credit history illustrates the likelihood of you defaulting. While most lenders require a personal credit score of around 680, some lenders accept scores as low as 580 to 600.

How do you build business credit fast? Registering your business and applying for a business credit card can help you start building business credit right away. As your business grows, establish trade lines with your suppliers and make sure to borrow from lenders that report payments to business credit bureaus.

Minimum credit score by business loan type Term loanWhile banks and credit unions typically require a score of 670 or above, online lenders may only require a score of 500SBA loanLenders offering SBA loans require credit scores between 620 and 6804 more rows ?

The minimum Biz2Credit loan requirements for a term loan are a business with a credit score of at least 660, produces at least $250,000 in annual revenue and has been operating for at least 18 months. Small business owners need at least a fair credit score, too, in order to qualify for financing in most cases.