Are you currently within a placement where you need files for sometimes organization or personal uses just about every working day? There are a lot of lawful papers web templates available on the net, but getting types you can depend on isn`t straightforward. US Legal Forms provides a huge number of kind web templates, much like the Puerto Rico Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles, that are written to meet federal and state demands.

When you are already informed about US Legal Forms web site and get a merchant account, merely log in. After that, you may obtain the Puerto Rico Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles template.

If you do not offer an bank account and need to start using US Legal Forms, abide by these steps:

- Get the kind you need and ensure it is to the proper city/area.

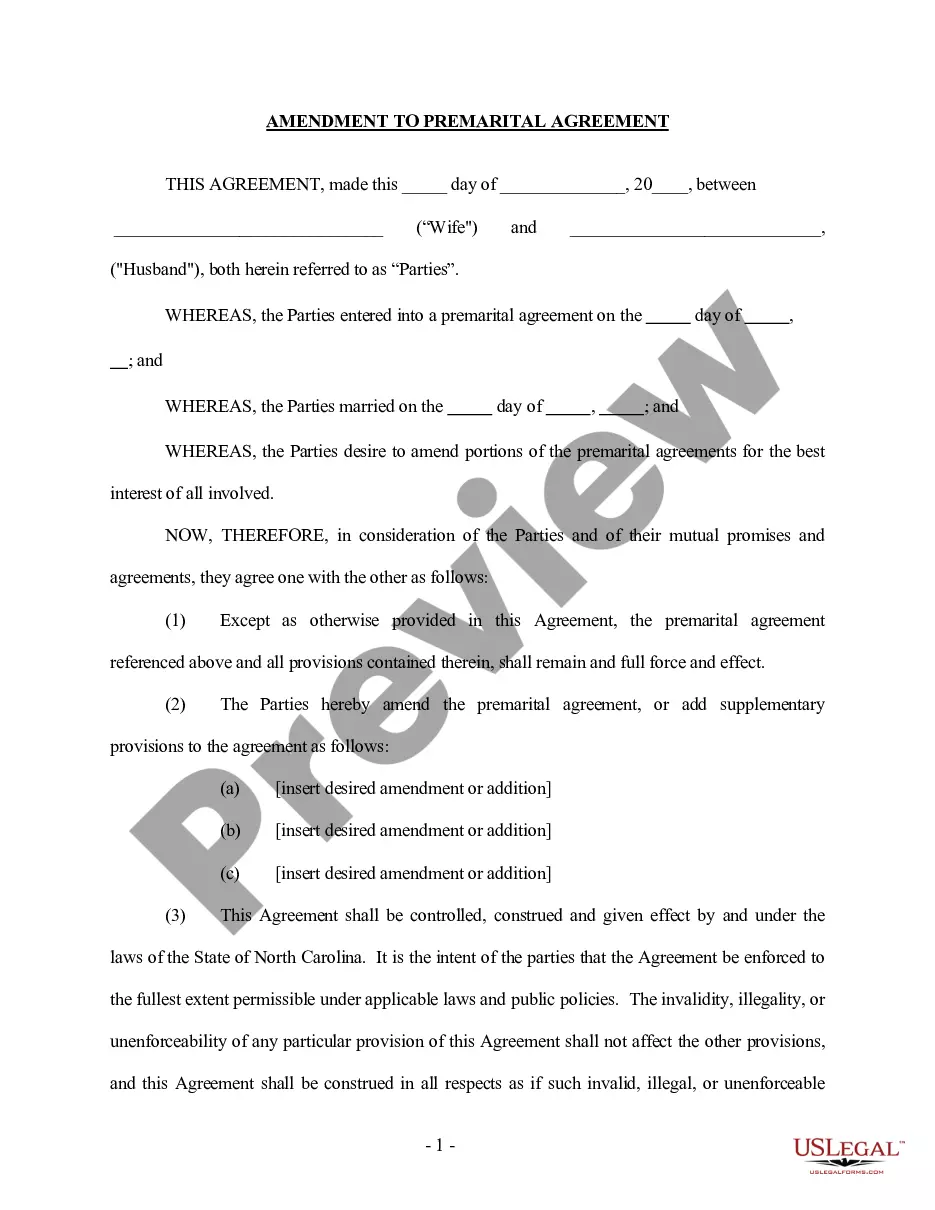

- Make use of the Preview option to check the shape.

- Read the explanation to ensure that you have selected the right kind.

- In case the kind isn`t what you`re trying to find, use the Research area to get the kind that fits your needs and demands.

- Once you obtain the proper kind, click on Purchase now.

- Opt for the pricing strategy you would like, complete the required info to produce your money, and pay for your order with your PayPal or Visa or Mastercard.

- Select a hassle-free paper format and obtain your duplicate.

Find all of the papers web templates you might have purchased in the My Forms food selection. You can obtain a extra duplicate of Puerto Rico Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles any time, if necessary. Just click on the necessary kind to obtain or print the papers template.

Use US Legal Forms, probably the most considerable variety of lawful kinds, to conserve time and steer clear of mistakes. The service provides expertly manufactured lawful papers web templates that you can use for a selection of uses. Generate a merchant account on US Legal Forms and begin producing your life easier.