Puerto Rico Installment Payment and Purchase Agreement

Description

How to fill out Installment Payment And Purchase Agreement?

Have you ever been in a situation where you require documents for both business or personal needs almost daily.

There are numerous legal document templates available online, but locating ones you can depend on is not easy.

US Legal Forms provides a vast array of template designs, including the Puerto Rico Installment Payment and Purchase Agreement, that are crafted to comply with state and federal requirements.

Once you find the correct template, click on Purchase now.

Choose the payment plan you prefer, provide the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Puerto Rico Installment Payment and Purchase Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for the correct city/state.

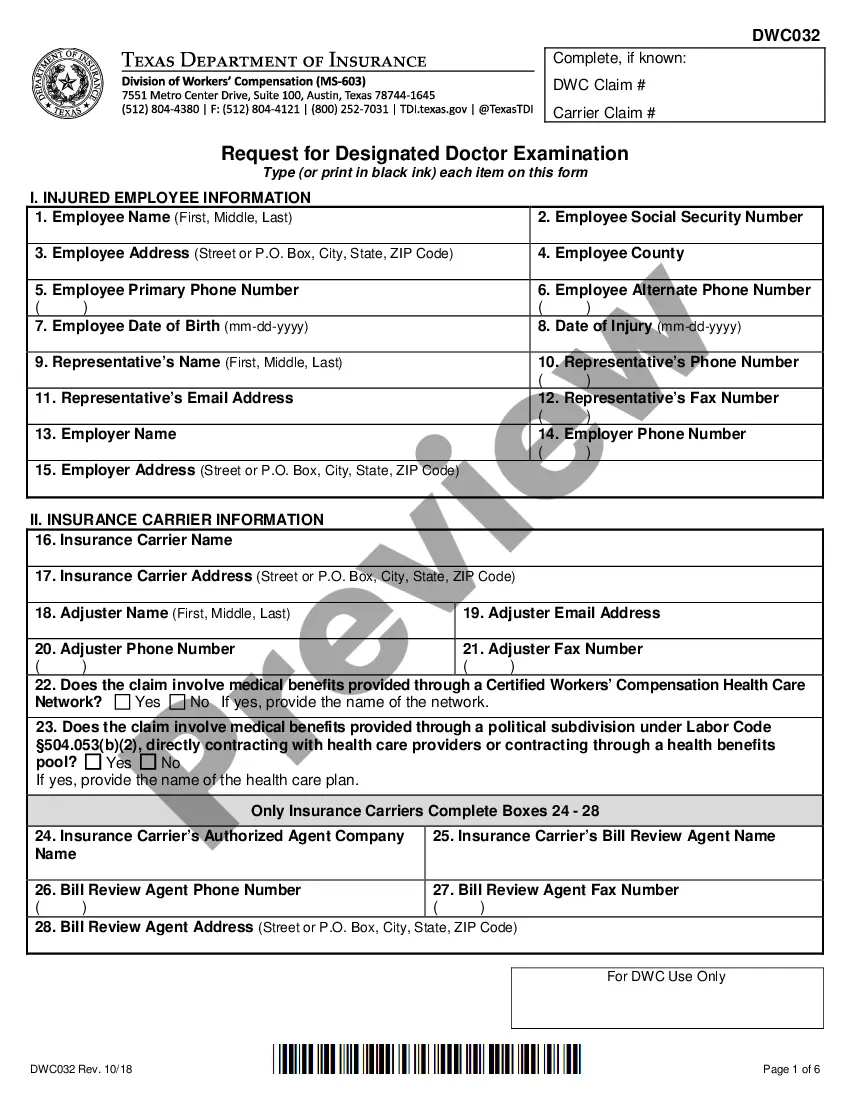

- Use the Review feature to examine the document.

- Read the description to ensure you have chosen the right template.

- If the template does not meet your needs, use the Search field to find the appropriate form that satisfies your requirements.

Form popularity

FAQ

Puerto Rico: Transition to SURI (Internal Revenue. Integrated System), updates. The Puerto Rico Treasury Department (PRTD) announced that beginning Monday, February 24, 2020, the third phase of integration to SURI (the Spanish acronym for the Internal Revenue Unified System) will be implemented.

Electronically: Send an email message through SURI. By phone: Call Hacienda Responde at 787-622-0123. In person: Visit one of PR Treasury's 360 Service Centers.

What is the Installment Method? When a seller allows a customer to pay for a sale over multiple years, the transaction is frequently accounted for by the seller using the installment method.

The installment method is usually used in situations where a customer has permission to pay off an invoice in periodic installments over multiple years. In those situations, there is significant risk to the seller that they may not collect the full amount owing.

You may elect out by reporting all the gain as income in the year of the sale in accordance with your method of accounting on Form 4797, Sales of Business Property, or on Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets.

With installment sales, the buyer makes payments to the seller over time, rather than handing over a lump sum at closing. The buyer's obligation to make future payments to the seller may be spelled out in a deed of trust, note, land contract, mortgage or other evidence of debt.

Installment Sales An installment sale is one in which customer payments extend into future years. You may agree to an installment sale without charging your customer interest, but you'll have to pay taxes on the imputed interest that you should have charged -- that is, the AFR.

An installment sale is a sale of property where you receive at least one payment after the tax year of the sale. If you realize a gain on an installment sale, you may be able to report part of your gain when you receive each payment. This method of reporting gain is called the installment method.

More In Forms and Instructions One purpose of the form is to report net earnings from self-employment (SE) to the United States and, if necessary, pay SE tax on that income. The Social Security Administration (SSA) uses this information to figure your benefits under the social security program.

Every merchant engaged in any business in Puerto Rico must register with the Puerto Rico Treasury Department by creating an account at the Unified System of Internal Revenues (SURI) website. Said registration must be made thirty (30) days before the commencement of business.