This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

Selecting the optimal valid document template can be a challenge. Naturally, there are numerous templates accessible online, but how do you locate the precise document you need.

Make use of the US Legal Forms website. The service offers thousands of templates, including the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities, which you can utilize for both business and personal purposes.

All of the forms are reviewed by experts and comply with federal and state requirements.

Once you are sure that the form is correct, click the Buy now button to obtain the form. Choose the pricing plan you prefer and input the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities. US Legal Forms is the largest library of legal forms where you can find a variety of document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- If you are already registered, sign in to your account and click the Download button to get the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities.

- Use your account to browse through the legal forms you have previously obtained.

- Visit the My documents tab in your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

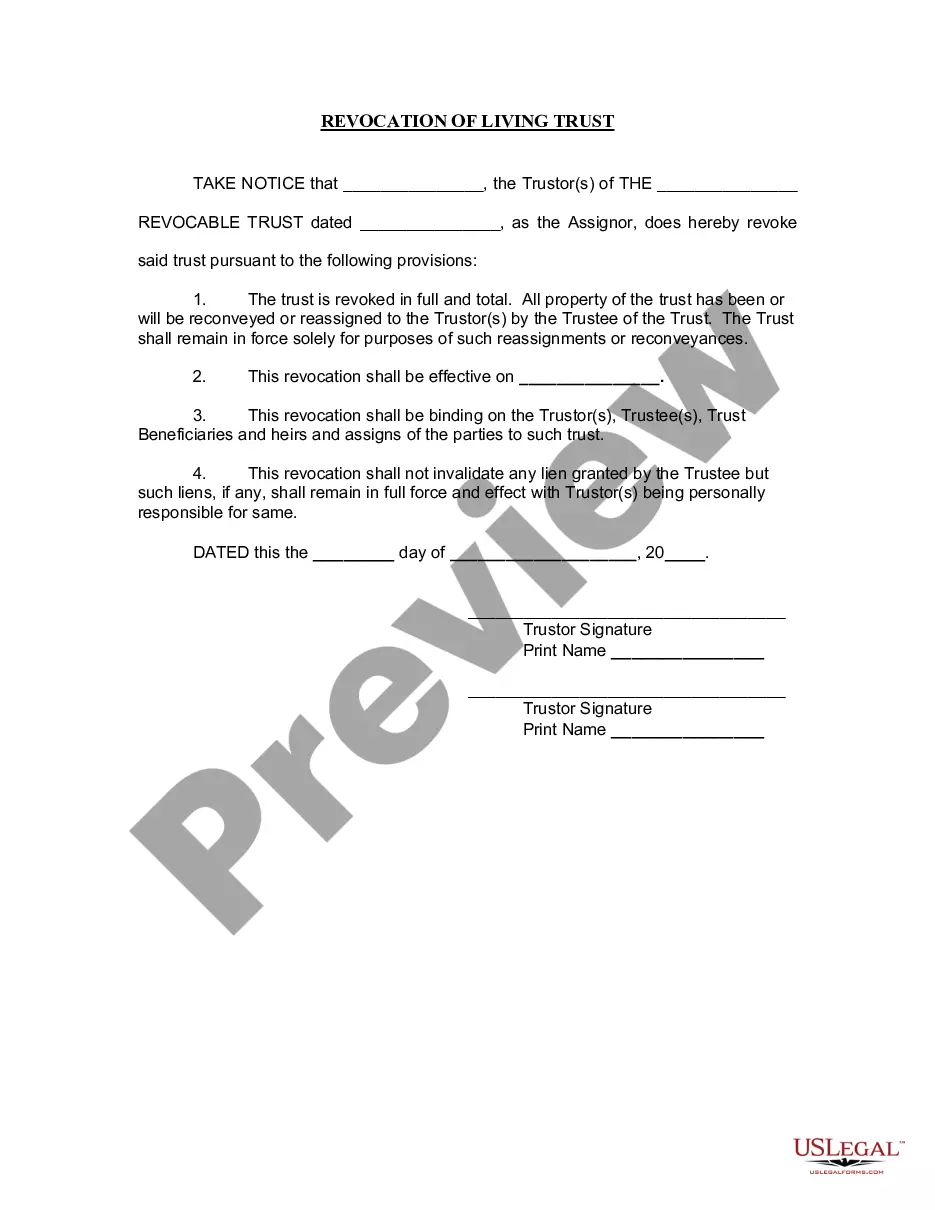

- First, ensure you have chosen the correct form for your city/county. You can view the form using the Preview button and read the form description to ensure it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

The new inheritance law in Puerto Rico includes significant changes aimed at simplifying the process of estate distribution. It focuses on protecting the rights of heirs while addressing modern family dynamics. For those interested in understanding their legal options regarding inheritance and potential debts, the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities plays a crucial role in safeguarding a spouse's interests.

A declaration of heirs in Puerto Rico identifies the rightful beneficiaries of a deceased person's estate. This legal declaration helps to ensure that all heirs receive their appropriate shares of the inheritance. It is often necessary when addressing estate matters and can be relevant when considering the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities.

The declaration of heirship in Puerto Rico serves to legally recognize the heirs of a deceased individual. This document is essential for managing the deceased's estate and distributing assets according to the law. If you are dealing with issues around debt and estate, understanding this declaration is important, especially as it relates to the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities.

Yes, Puerto Rico is a no-fault divorce state. This means that parties can file for divorce without needing to prove fault on the part of either spouse. This system streamlines the divorce process, allowing couples to separate amicably without alleging wrongdoing, which can significantly impact financial responsibilities outlined in the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities.

A declaration of heirs is a legal document that identifies the individuals who inherit a deceased person's property. This declaration serves to facilitate the distribution of assets according to the law. It ensures that heirs receive their rightful share, which can be particularly important in cases involving the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities.

In Puerto Rico, the statute of limitations on debt varies depending on the type of debt. For most personal debt, it typically ranges from 3 to 15 years. This means creditors have a limited time to file a lawsuit to collect unpaid debts. Understanding the statute of limitations is crucial, especially when considering the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities.

Currently, there is no state in the United States that entirely prohibits alimony; however, different states have varied laws and guidelines concerning its application. It is crucial for individuals to understand these regulations as they navigate divorce. Moreover, understanding the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities can play a key role in managing their financial commitments.

Divorce rules in Puerto Rico involve several legal guidelines, such as the grounds for divorce, division of property, and spousal support obligations. Couples can pursue either mutual or contested divorce procedures, which often require understanding financial responsibilities. Knowing about the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities can be essential in safeguarding your assets.

Indeed, there is alimony in Puerto Rico, and it serves to support a spouse who may be financially disadvantaged post-divorce. The court evaluates each case individually, ensuring considerations align with the legal framework that governs spousal support, including the implications of a Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities.

Yes, alimony does exist in Puerto Rico. Courts may award alimony to one spouse based on specific circumstances like financial need and marital contributions. If you are navigating these issues, consider consulting resources that address the Puerto Rico Notice of Non-Responsibility of Wife for Debts or Liabilities for better clarity.