Puerto Rico Partnership Dissolution Agreement is a legal document that outlines the process of terminating a partnership in Puerto Rico. This agreement is designed to protect the rights and interests of the partners involved in the dissolution of a business partnership. It provides a framework for the orderly liquidation of assets, allocation of debts, and distribution of profits among the partners. There are two common types of Puerto Rico Partnership Dissolution Agreements: 1. General Partnership Dissolution Agreement: This agreement is applicable to a general partnership where all partners are actively involved in managing the business. It sets out the terms and conditions for winding up the partnership affairs, including the sale of assets, payment of liabilities, and the division of remaining profits or losses among partners. 2. Limited Partnership Dissolution Agreement: This type of agreement is specifically designed for limited partnerships in Puerto Rico, where there are both general partners who actively manage the business and limited partners who have a passive role. This agreement outlines the process for the liquidation of assets, repayment of debts, and distribution of remaining proceeds in accordance with the partnership agreement and Puerto Rico partnership laws. Key provisions that may be included in a Puerto Rico Partnership Dissolution Agreement are: 1. Effective Date: This section specifies the date when the dissolution agreement becomes effective. 2. Statement of Dissolution: It includes a clear statement declaring the dissolution of the partnership. 3. Partners' Rights and Obligations: This outlines the rights and responsibilities of each partner during the liquidation process. 4. Asset Liquidation: The agreement stipulates how the partnership assets will be sold or disposed of, including any necessary approvals or consents required. 5. Debt Payment: It addresses how the partnership's debts and liabilities will be settled, including prioritizing certain creditors, if necessary. 6. Profit or Loss Distribution: This section determines how the remaining profits or losses will be distributed among the partners, considering any predetermined ratios or agreed-upon formulae. 7. Tax and Legal Obligations: The agreement ensures that partners fulfill any outstanding tax or legal obligations resulting from the dissolution, including filing necessary tax returns or notifying government authorities. 8. Partnership Termination: It encompasses the steps required to legally terminate the partnership, including cancelling business registrations and licenses. A well-drafted Puerto Rico Partnership Dissolution Agreement is crucial for a smooth and fair dissolution process, mitigating conflicts and providing clarity for partners. It is advisable to consult with an experienced attorney specializing in Puerto Rico partnership laws to ensure compliance with legal requirements and protect the interests of all parties involved.

Puerto Rico Partnership Dissolution Agreement

Description

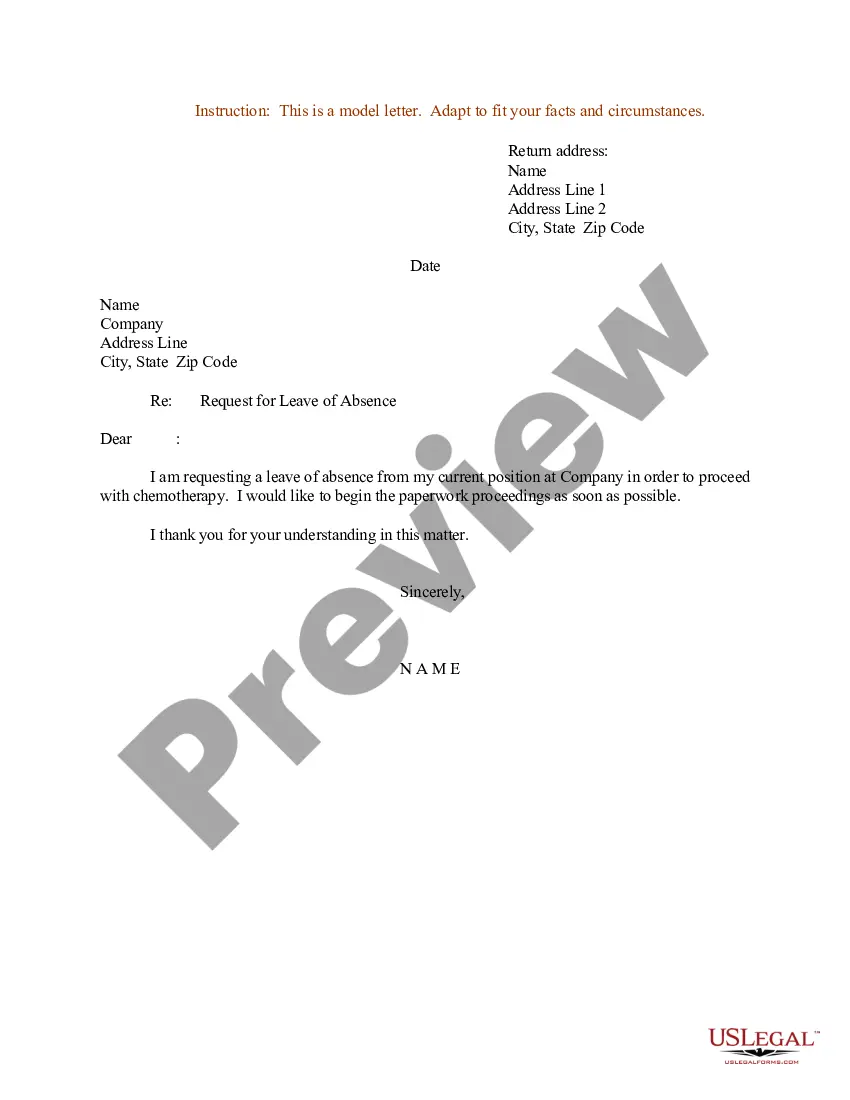

How to fill out Puerto Rico Partnership Dissolution Agreement?

Finding the right legitimate document design can be a battle. Naturally, there are a lot of templates available on the Internet, but how can you obtain the legitimate form you will need? Utilize the US Legal Forms site. The service gives a huge number of templates, including the Puerto Rico Partnership Dissolution Agreement, which you can use for business and personal requirements. Every one of the types are examined by pros and meet up with federal and state needs.

In case you are presently signed up, log in in your bank account and click the Acquire button to find the Puerto Rico Partnership Dissolution Agreement. Use your bank account to look throughout the legitimate types you possess acquired earlier. Check out the My Forms tab of your respective bank account and get one more backup of the document you will need.

In case you are a new end user of US Legal Forms, allow me to share basic instructions that you should comply with:

- Initial, make certain you have selected the proper form for the town/state. You can check out the form using the Review button and study the form outline to make sure it is the best for you.

- If the form does not meet up with your expectations, utilize the Seach industry to find the right form.

- Once you are certain the form is acceptable, click the Buy now button to find the form.

- Pick the costs plan you want and enter the necessary information and facts. Build your bank account and pay for the order utilizing your PayPal bank account or credit card.

- Select the data file format and download the legitimate document design in your product.

- Comprehensive, revise and printing and signal the acquired Puerto Rico Partnership Dissolution Agreement.

US Legal Forms will be the most significant catalogue of legitimate types where you will find a variety of document templates. Utilize the company to download expertly-produced paperwork that comply with condition needs.

Form popularity

FAQ

Annual reports must be filed electronically by accessing the Department of State website at . A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

U.S. citizens who have lived all year on the island are exempt from filing taxes to the federal government of the United States as long as all of your income was from Puerto Rican sources only.

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

Further, U.S. citizens and resident aliens living in Puerto Rico are generally subject to U.S. tax on worldwide income. However, a bona fide resident of Puerto Rico for an entire taxable year may exclude income from sources within Puerto Rico for U.S. federal income tax purposes.

A formal 16-page typical annual report can cost anywhere from $7,500 to $20,000. Having staff take care of internal coordination and writing can lower the price to a $6,000 $10,000 range. If your annual report needs to be bilingual, add 30-40% for producing the second language.

How to File an Annual ReportDetermine If You Need To File an Annual Report.Find Out When the Annual Report is Due.Complete the Annual Report Form.File Annual Report.Repeat the Process for Other States Where You're Registered to Do Business.Set Up Reminders for Your Next Annual Report Deadline.

Bona fide residents of Puerto Rico generally do not report income received from sources within Puerto Rico on their U.S. income tax return. However, they should report all income received from sources outside Puerto Rico on their U.S. income tax return.

An annual report begins with a letter to the shareholders, then a brief description of the business and industry. Following that, the report should include the audited financial statements: balance sheet, income statement, and statement of cash flows.

An Annual report is a filing that details a company's activities throughout the prior year. Annual reports are intended to give state governing authorities information regarding the names and addresses of directors or managing members of a corporation or LLC as well as the company and registered agent address.

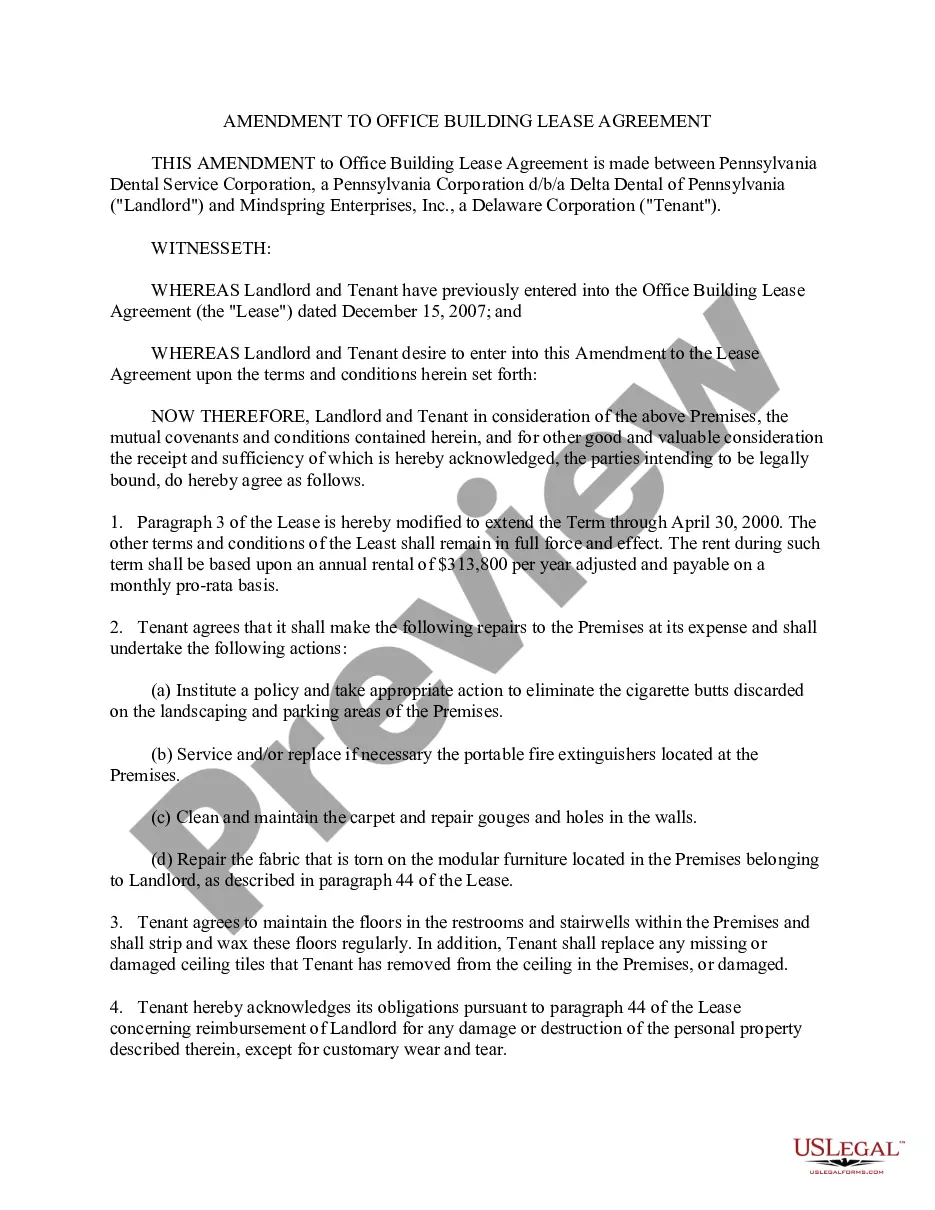

Dissolution is permitted by an authorised officer of a business entity can dissolve the registered corporation. A corporate resolution at the time of the dissolution action must be filed. When dissolution is made effective, the name of the corporation is reserved for a maximum of 30 days since the day of dissolution.