Puerto Rico Credit Memo

Description

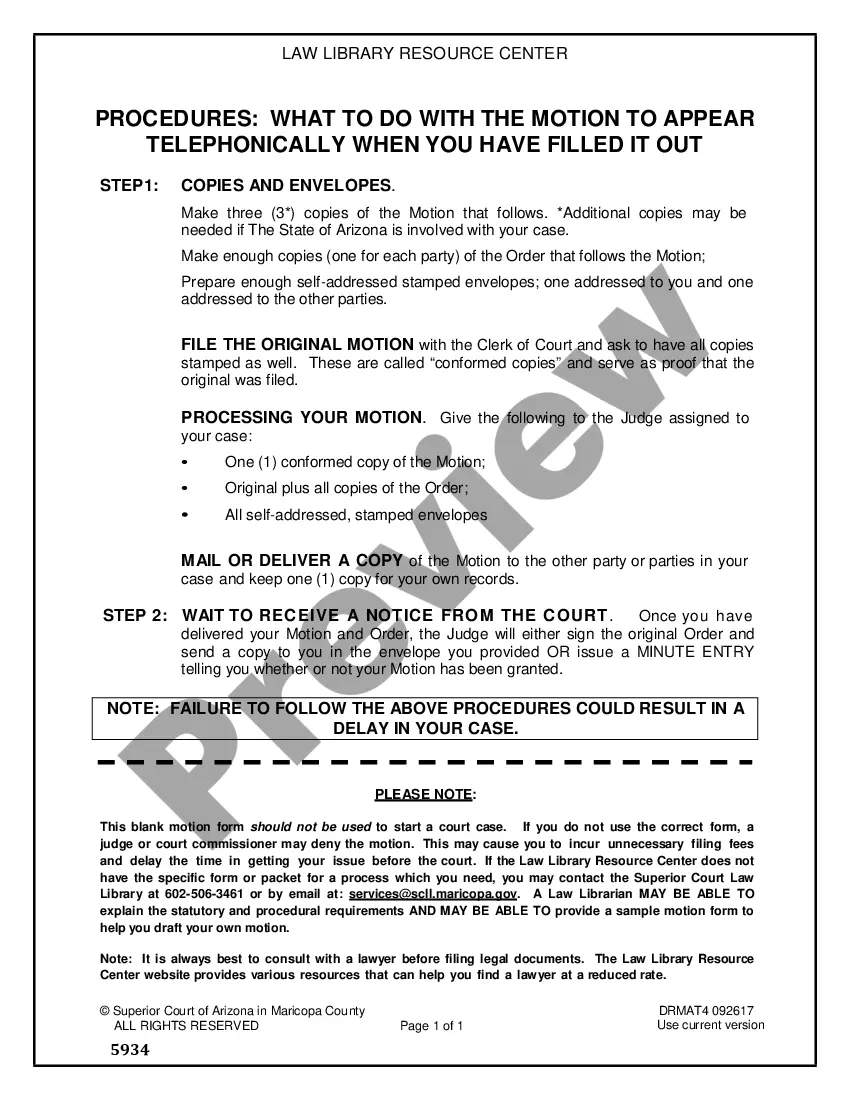

How to fill out Credit Memo?

You can invest numerous hours online attempting to discover the legal document template that fulfills your state and federal requirements.

US Legal Forms provides an extensive array of legal documents that are reviewed by experts.

It is easy to acquire or print the Puerto Rico Credit Memo from the service.

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Puerto Rico Credit Memo.

- Every legal document template you buy is yours forever.

- To obtain an additional copy of any purchased document, navigate to the My documents section and click the corresponding button.

- If you visit the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/city of your choice.

- Review the document description to confirm you have selected the appropriate template.

Form popularity

FAQ

Countries sanctioned by the U.S. government may not qualify for the foreign tax credit, as investments and revenues from these locations could face restrictions. Understanding the list of sanctioned countries is crucial for compliance with tax regulations. The Puerto Rico Credit Memo can help you navigate these complex regulations, ensuring that your cross-border tax strategies remain compliant and effective.

Claiming land in Puerto Rico typically requires you to follow the local laws regarding property acquisition. You need to satisfy various legal and administrative steps, such as registering with local authorities. The Puerto Rico Credit Memo can be an invaluable resource in navigating the process, providing essential insights and guidelines to ensure compliance and smooth transactions.

Some states, such as California and New York, offer various forms of foreign tax credits. Each state's regulations differ, so it's essential to research the specific rules applicable to you. Understanding these regulations can work in tandem with the information in the Puerto Rico Credit Memo, ensuring you maximize your tax benefits when claiming credits at both state and federal levels.

Proving residency in Puerto Rico involves demonstrating your physical presence and intent to remain. Common methods include providing utility bills, a lease agreement, or bank statements showing your local address. Additionally, the Puerto Rico Credit Memo can assist you in understanding residency requirements for tax benefits. It helps streamline your documentation, making compliance easier.

Yes, Puerto Rico does qualify for the foreign tax credit under specific conditions. U.S. citizens and residents with income sourced from outside the U.S. may claim this credit on their taxes. To effectively utilize the Puerto Rico Credit Memo, ensure you understand the eligibility criteria and documentation required for filing. This process can significantly reduce your tax liability.

Residents of Puerto Rico are generally not required to file US tax returns unless they have income from sources outside of Puerto Rico. However, specific conditions may change this requirement. To ensure compliance, the Puerto Rico Credit Memo provides crucial information to help you navigate these tax obligations.

If you are a resident of Puerto Rico, you typically do not need to file a federal tax return for income earned on the island. However, income from sources outside Puerto Rico may require federal filing. Understanding the intricacies of these requirements can be simplified with the Puerto Rico Credit Memo.

The Earned Income Tax Credit (EITC) in Puerto Rico is available for eligible residents who meet certain income criteria. This credit can significantly reduce tax liabilities, providing financial relief. To maximize benefits, consider using the Puerto Rico Credit Memo to navigate eligibility and application processes effectively.

Generally, a U.S. citizen living abroad is not required to file a state tax return if they are a resident of Puerto Rico. However, specific state laws apply, and sometimes a tax return may still be necessary. Utilizing tools like the Puerto Rico Credit Memo can streamline your understanding of state tax requirements.

Living in Puerto Rico has unique implications for US residency. If you maintain a permanent home in Puerto Rico and do not have a closer connection to another location, you can qualify as a bona fide resident. This status affects your tax obligations, and the Puerto Rico Credit Memo can clarify how it impacts your status.