Puerto Rico Sample Letter for Exemption of Ad Valorem Taxes

Description

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

Choosing the right lawful file format could be a battle. Obviously, there are a lot of layouts available on the Internet, but how would you find the lawful type you want? Utilize the US Legal Forms website. The service gives thousands of layouts, for example the Puerto Rico Sample Letter for Exemption of Ad Valorem Taxes, which can be used for organization and private needs. Each of the forms are inspected by experts and fulfill state and federal demands.

If you are currently registered, log in to your profile and then click the Acquire key to obtain the Puerto Rico Sample Letter for Exemption of Ad Valorem Taxes. Use your profile to look through the lawful forms you may have acquired previously. Check out the My Forms tab of your profile and obtain an additional duplicate of your file you want.

If you are a whole new end user of US Legal Forms, listed here are simple recommendations for you to follow:

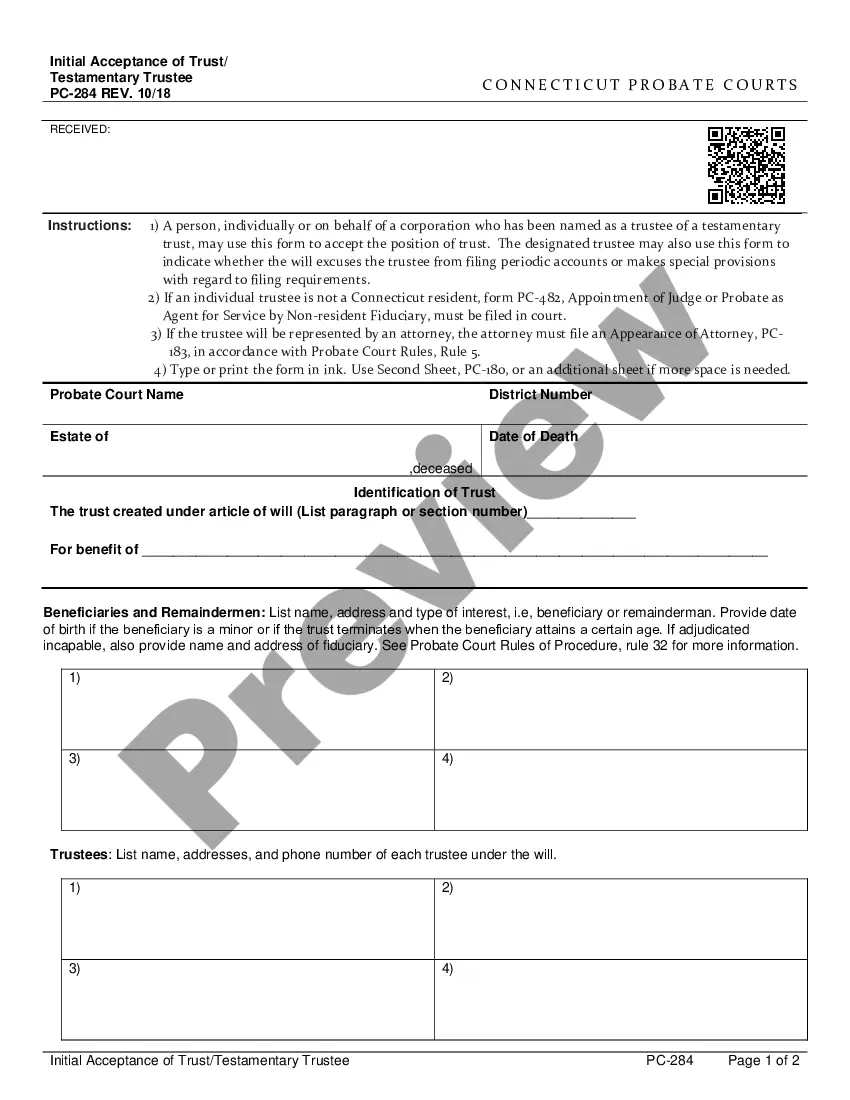

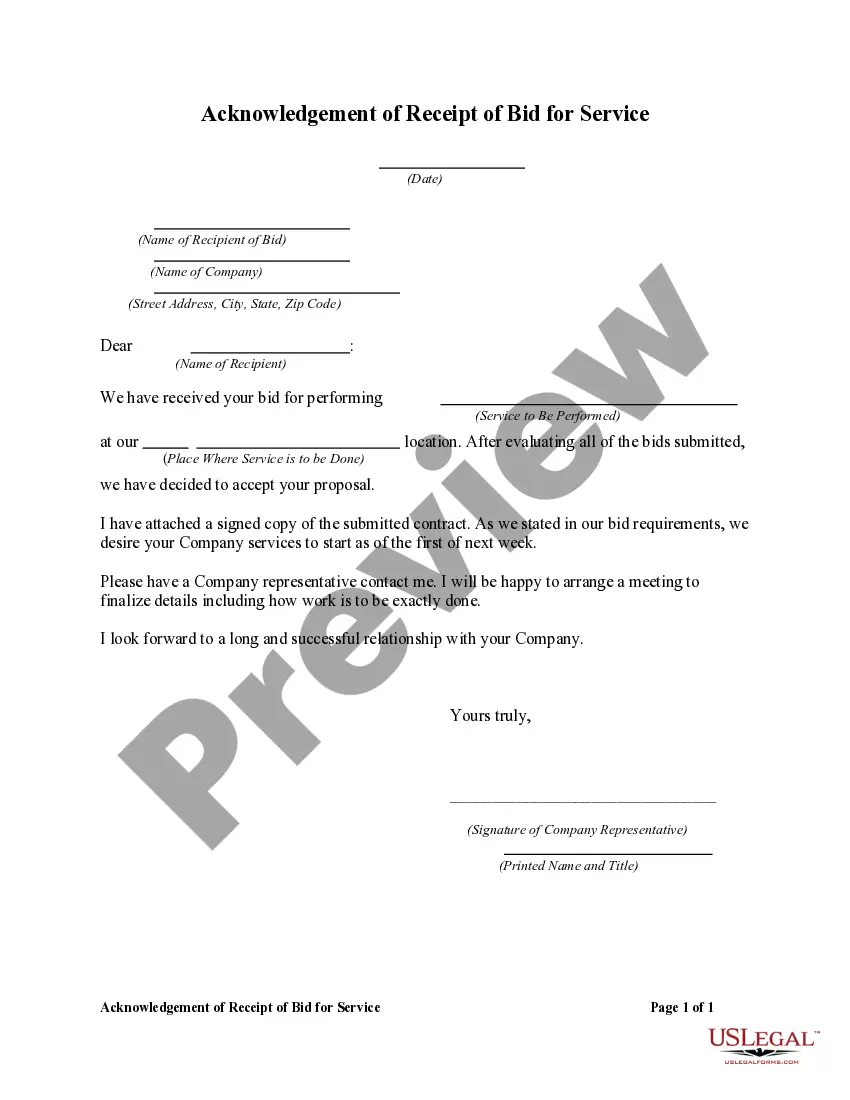

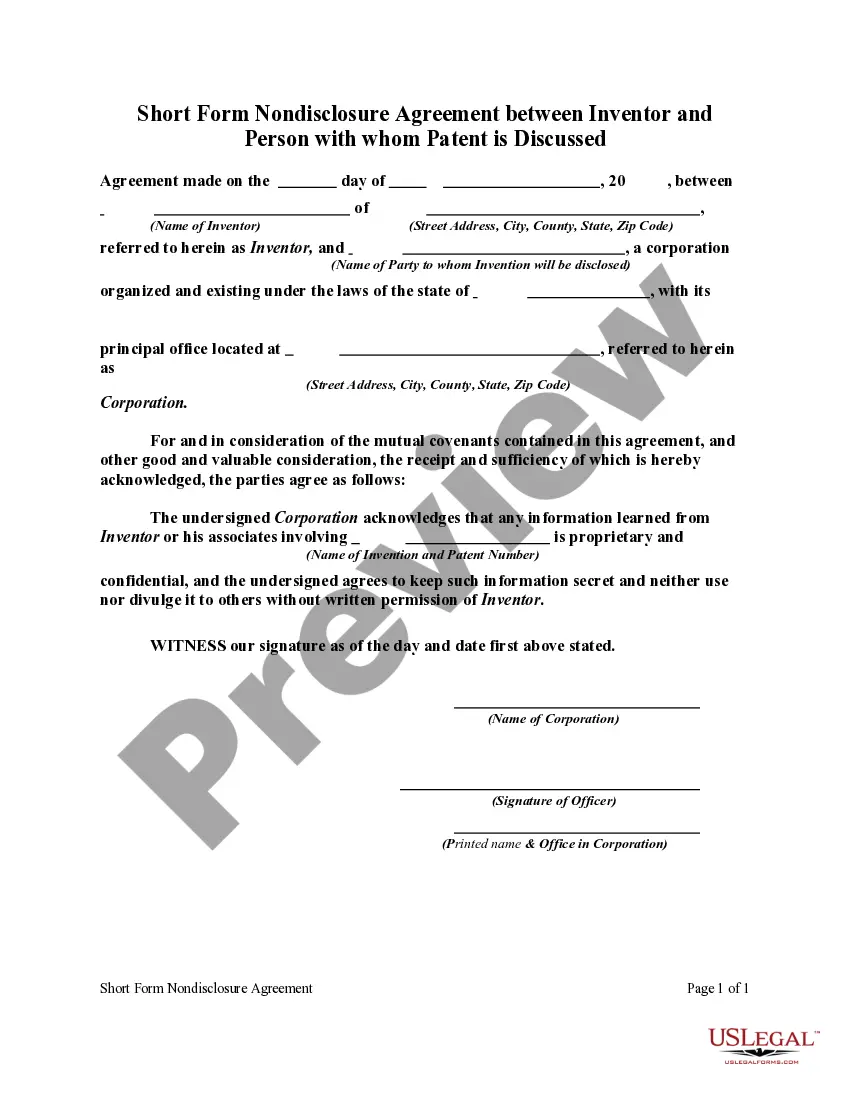

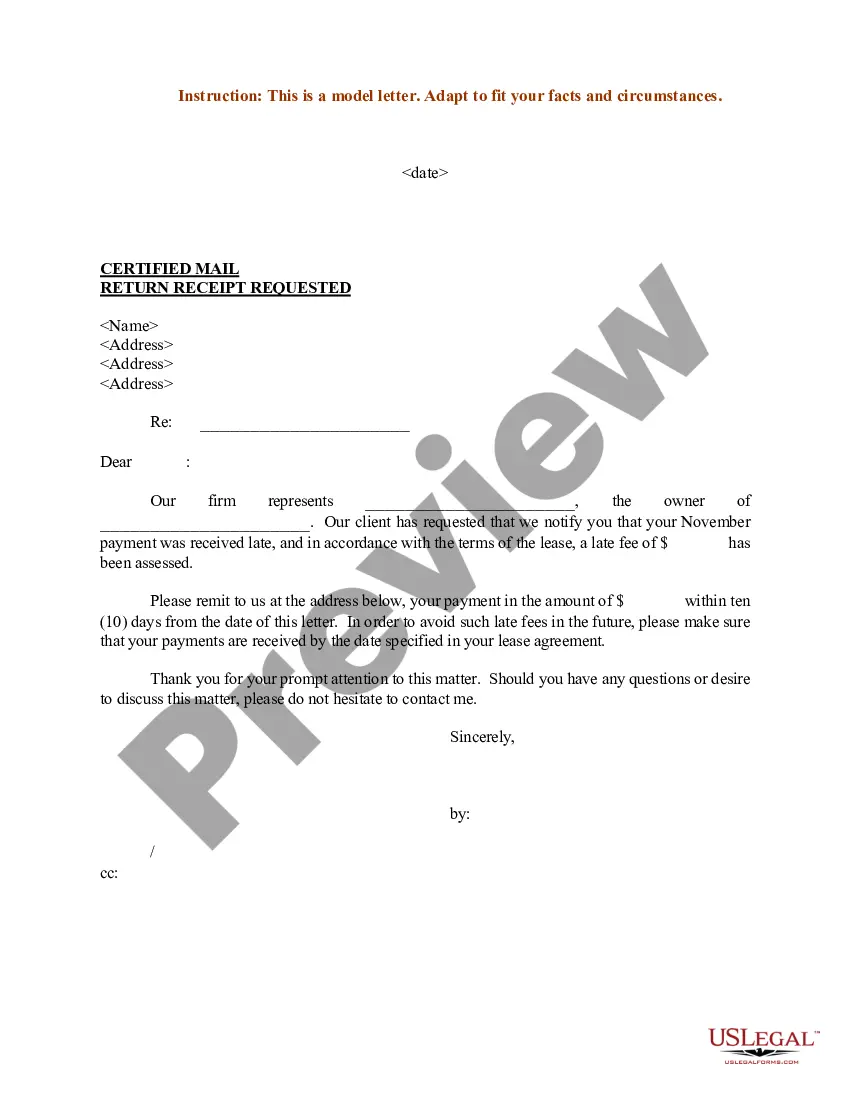

- Initially, be sure you have chosen the right type to your metropolis/state. You are able to check out the shape while using Preview key and read the shape information to guarantee it is the best for you.

- If the type is not going to fulfill your needs, use the Seach field to obtain the appropriate type.

- When you are sure that the shape is acceptable, select the Buy now key to obtain the type.

- Pick the rates strategy you want and enter the necessary details. Make your profile and pay money for the transaction making use of your PayPal profile or charge card.

- Choose the document formatting and obtain the lawful file format to your product.

- Full, modify and produce and signal the received Puerto Rico Sample Letter for Exemption of Ad Valorem Taxes.

US Legal Forms is the most significant library of lawful forms that you can see a variety of file layouts. Utilize the service to obtain expertly-manufactured paperwork that follow express demands.

Form popularity

FAQ

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

What Is Act 60? Act 60 (formerly known as Acts 20 and 22) allows certain people to avoid both federal and state income taxes on their income. With a few changes in your life, you could be one of those people.

Travelers are required to complete the online Request for Room Tax Exemption through Puerto Rico's Tourism Bureau. Once the form is approved, the traveler will be provided a tax exemption letter that must be provided to the hotel.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

Specifically, a U.S. citizen who becomes a bona fide Puerto Rico resident and moves his or her business to Puerto Rico (thus, generating Puerto Rico sourced income) may benefit from a 4% corporate tax/fixed income tax rate, a 100% exemption on property taxes, and a 100% exemption on dividends from export services.

Any U.S. source income is still subject to U.S. taxes at the regular rate, but under the tax exemption decrees, Puerto Rico source income for an individual may be taxed at 0% for Federal and Puerto Rico purposes. Puerto Rico-sourced income may include interest and dividends from sources in Puerto Rico.

A 100% exemption from state excise tax and sales and use taxes is provided for raw materials, machinery and equipment, fuel used for the generation of energy, chemicals used in the treatment of waste water, and energy-efficient equipment.

Estates of residents of Puerto Rico who are considered citizens of the United States, under Subtitle B, Chapter II of the United States Internal Revenue Code, are allowed an exemption which is the greater of (i) $30,000.00 or (ii) that proportion of $60,000 which the value of that part of the decedent's gross estate ...