Puerto Rico Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

Description

How to fill out Sample Letter For Notice Of Credit Limit - Conversion To C.O.D. Status?

US Legal Forms - one of the largest collections of legal forms in the country - provides a selection of legal document templates that you can either download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of documents such as the Puerto Rico Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status within minutes.

If the form does not fit your requirements, utilize the Search field at the top of the page to find one that does.

If you're satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the pricing plan you prefer and provide your details to register for your account. Process the payment. Use a credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make edits. Complete, modify, and print or sign the downloaded Puerto Rico Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status. Every template you add to your account has no expiration date and is yours permanently. So, if you need to download or print another copy, simply head to the My documents section and click on the form you require. Gain access to the Puerto Rico Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you already have a monthly membership, Log In and retrieve Puerto Rico Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status from the US Legal Forms library.

- The Acquire button will appear on every form you view.

- You have access to all previously obtained forms under the My documents tab of your account.

- If you are new to US Legal Forms, here are some simple steps to get started.

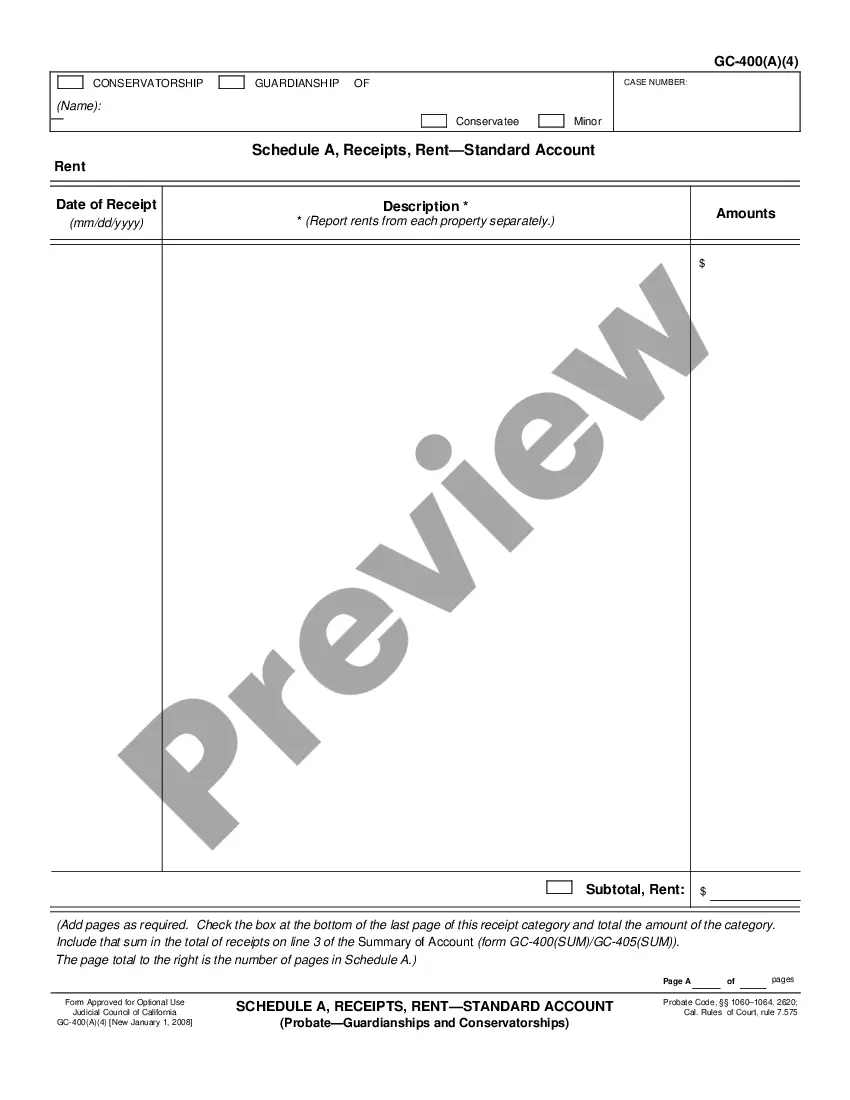

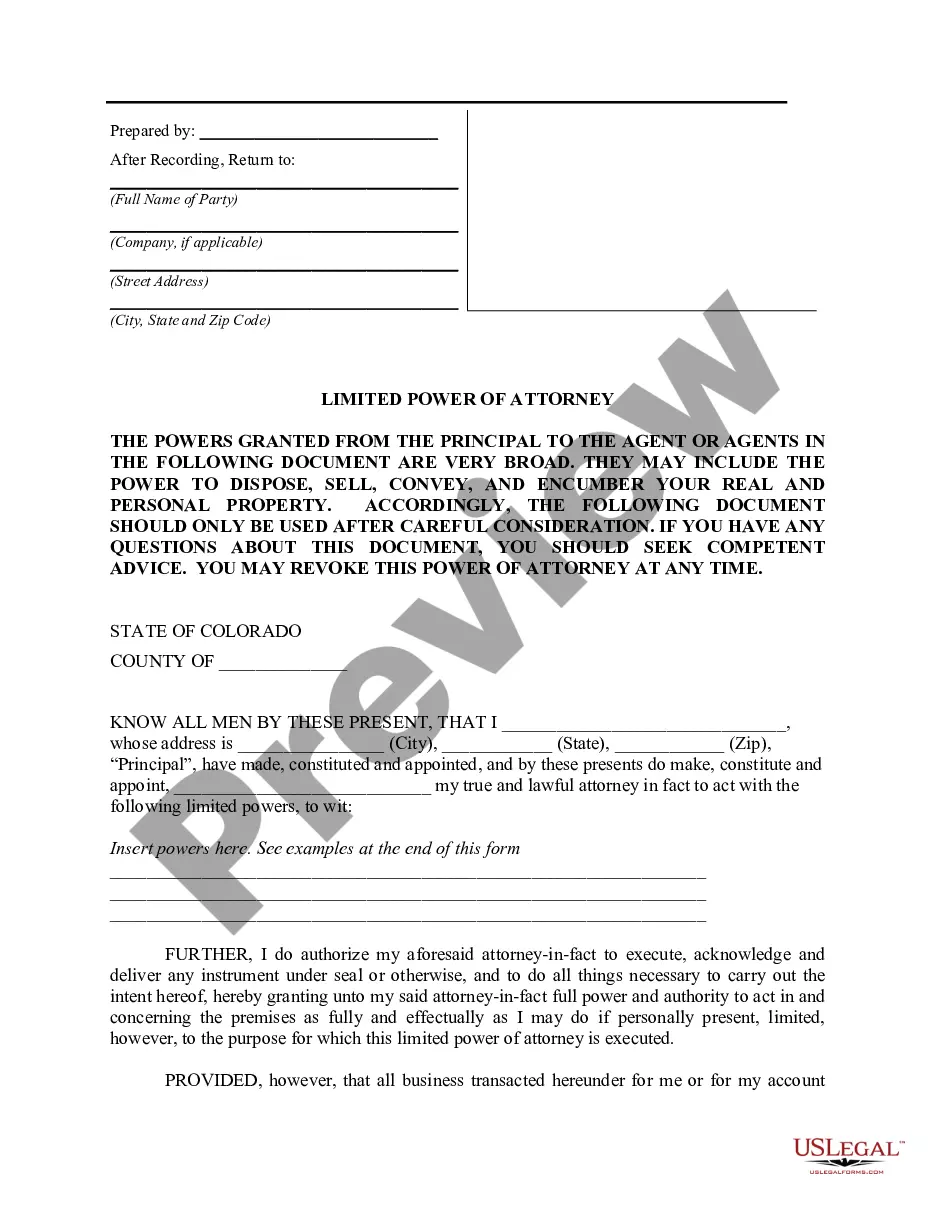

- Ensure you have chosen the correct form for your region/state. Use the Preview button to review the form’s content.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).

Options for getting a higher credit limitMake a request online. Many credit card issuers allow their cardholders to ask for a credit limit increase online. Sign in to your account and look for an option to submit a request. You may have to update your income information.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

What is a Credit Limit? A credit card credit limit is the amount of credit that a card issuer extends to its cardmembers. This credit limit, also called a credit line, is established once an application is approved based on the customer's credit quality and can increase over time with responsible card use.

To, (Name of the Vendor), (Address of the Vendor) Date: // (Date) Subject: Request for Issuance of credit note Dear Sir/Madam, With reference to the material supplied by your company against our purchase order no. , you are requested to provide us credit note for (Amount).

Borrowers who have accumulated unsecured debt exceeding 6 times their monthly income cannot obtain new credit facilities that will cause their total credit limit to exceed 12 times monthly income. They can still draw on existing credit facilities.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).