Puerto Rico Independent Contractor Agreement with Church: A Comprehensive Guide Introduction: A Puerto Rico Independent Contractor Agreement with a Church is a legally binding contract that establishes the terms and conditions between an independent contractor and a church in Puerto Rico. This agreement outlines the nature of the professional relationship, responsibilities, payment terms, and other essential clauses between the contractor and the church. The agreement is designed to protect the rights and interests of both parties involved. Types of Puerto Rico Independent Contractor Agreement with Church: 1. Music Ministry Independent Contractor Agreement: This type of agreement specifically caters to independent musicians and vocalists providing their services to the church for regular worship services, special events, concerts, or recordings. It includes provisions related to performances, rehearsals, compensation, intellectual property, and termination clauses. 2. Pastoral Services Independent Contractor Agreement: This agreement pertains to independent pastors, preachers, or ministers who offer their services to the church. It covers terms related to preaching, teaching, spiritual counseling, officiating ceremonies (e.g., weddings, funerals), and compensation for their services. 3. Building Maintenance and Repairs Independent Contractor Agreement: This agreement caters to independent contractors engaged in providing services related to maintenance, repairs, renovations, or construction of church facilities. It outlines the scope of work, payment terms, supplies, tools, insurance, and indemnification clauses. 4. Church Event Management Independent Contractor Agreement: This type of agreement is suitable for event planners, coordinators, or managers hired by the church to organize and execute various events, such as fundraisers, community outreach programs, conferences, or weddings. It includes provisions related to event planning, logistics, budgeting, compensation, and event cancellation. Key Clauses in Puerto Rico Independent Contractor Agreement with Church: 1. Parties Involved: Clearly defines the names and addresses of the church and the independent contractor. 2. Scope of Work: Describes the specific tasks, responsibilities, and deliverables expected from the contractor during the engagement period. 3. Compensation: Details the agreed-upon payment structure, whether hourly, per task, or on a project basis, including the due dates and method of payment. 4. Termination: Outlines the conditions under which the agreement can be terminated by either party, the notice period required, and any applicable penalties or consequences. 5. Intellectual Property: Addresses the ownership rights of any intellectual property created during the engagement, whether it is music compositions, sermon recordings, or event-related materials. 6. Confidentiality: Ensures that both the contractor and the church maintain confidentiality regarding sensitive information obtained during the engagement. 7. Indemnification: Specifies the responsibilities of each party regarding potential damages, liabilities, or legal claims arising from the contractor's actions or omissions during the engagement. 8. Governing Law: Identifies the jurisdiction and laws under which any disputes would be resolved. Conclusion: A Puerto Rico Independent Contractor Agreement with a Church is a crucial document that sets clear expectations, protects the rights of both parties, and establishes a professional and legal framework for the independent contractor's engagement with the church. Whether it is for musicians, pastors, maintenance personnel, or event management, having a well-drafted agreement ensures a smooth and mutually beneficial working relationship.

Puerto Rico Independent Contractor Agreement with Church

Description

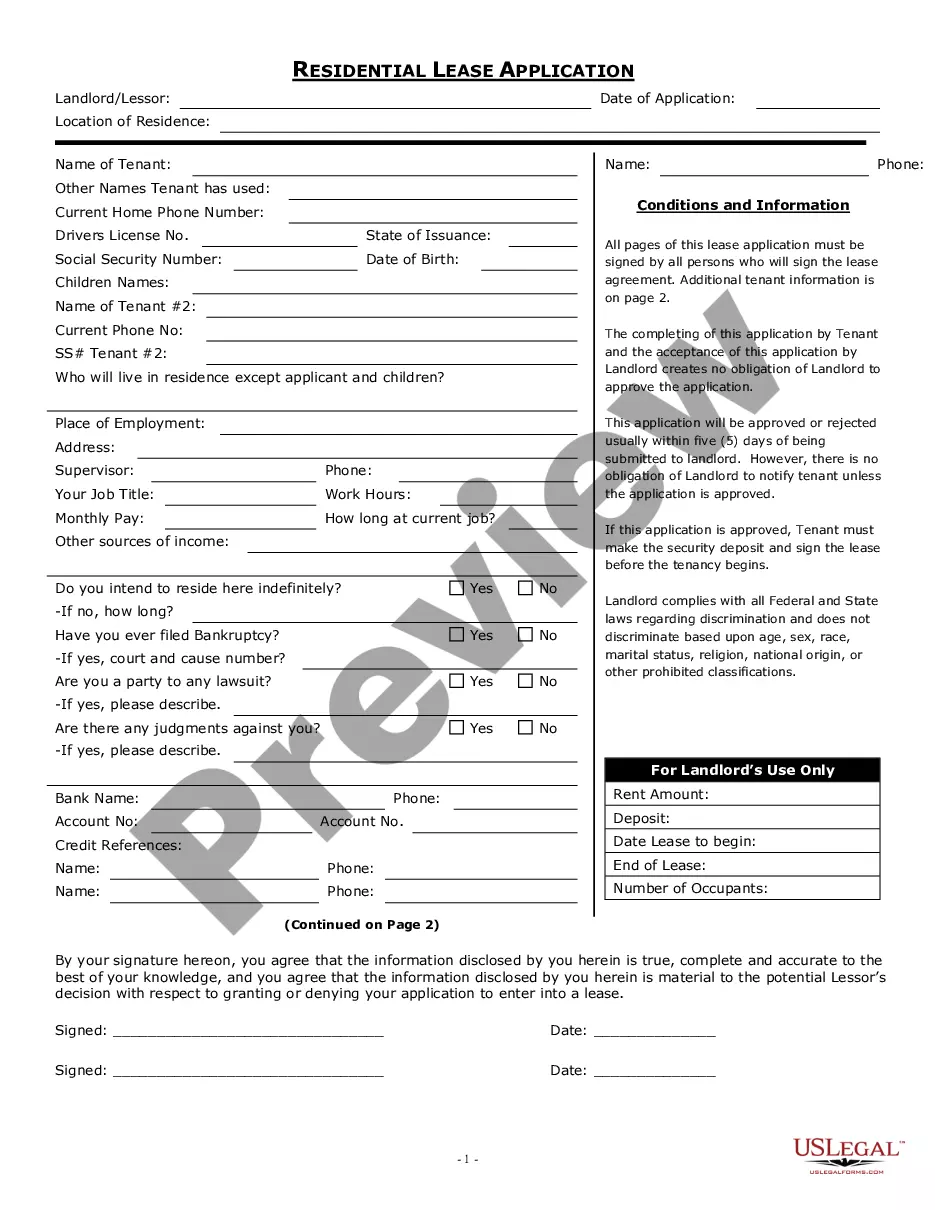

How to fill out Puerto Rico Independent Contractor Agreement With Church?

Are you currently in a situation that you need files for sometimes business or specific functions nearly every day? There are a lot of legal record web templates available online, but getting versions you can depend on isn`t effortless. US Legal Forms offers thousands of develop web templates, much like the Puerto Rico Independent Contractor Agreement with Church, which can be composed to fulfill state and federal requirements.

In case you are presently informed about US Legal Forms internet site and possess a free account, basically log in. Afterward, it is possible to download the Puerto Rico Independent Contractor Agreement with Church design.

If you do not have an account and wish to begin to use US Legal Forms, abide by these steps:

- Find the develop you need and ensure it is for your right metropolis/state.

- Take advantage of the Preview switch to review the shape.

- Look at the outline to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you are seeking, make use of the Search area to get the develop that suits you and requirements.

- If you find the right develop, just click Acquire now.

- Opt for the rates program you need, complete the required details to make your account, and buy the transaction with your PayPal or credit card.

- Pick a convenient file formatting and download your backup.

Get each of the record web templates you may have purchased in the My Forms menus. You may get a additional backup of Puerto Rico Independent Contractor Agreement with Church any time, if needed. Just select the needed develop to download or print the record design.

Use US Legal Forms, one of the most considerable selection of legal types, to conserve time and prevent faults. The support offers professionally created legal record web templates which you can use for a range of functions. Produce a free account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

The independent contractor provision states that the relationship between the parties is that of an independent contractor, that the agreement does not create an employment relationship, and that under no circumstances is the independent contractor an agent of the company for which they provide services.

Work as an Independent Contractor If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

Sole proprietors and partners pay themselves simply by withdrawing cash from the business. Those personal withdrawals are counted as profit and are taxed at the end of the year. Set aside a percentage of earnings in a separate bank account throughout the year so you have money to pay the tax bill when it's due.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.