Puerto Rico Revocation of Will

Description

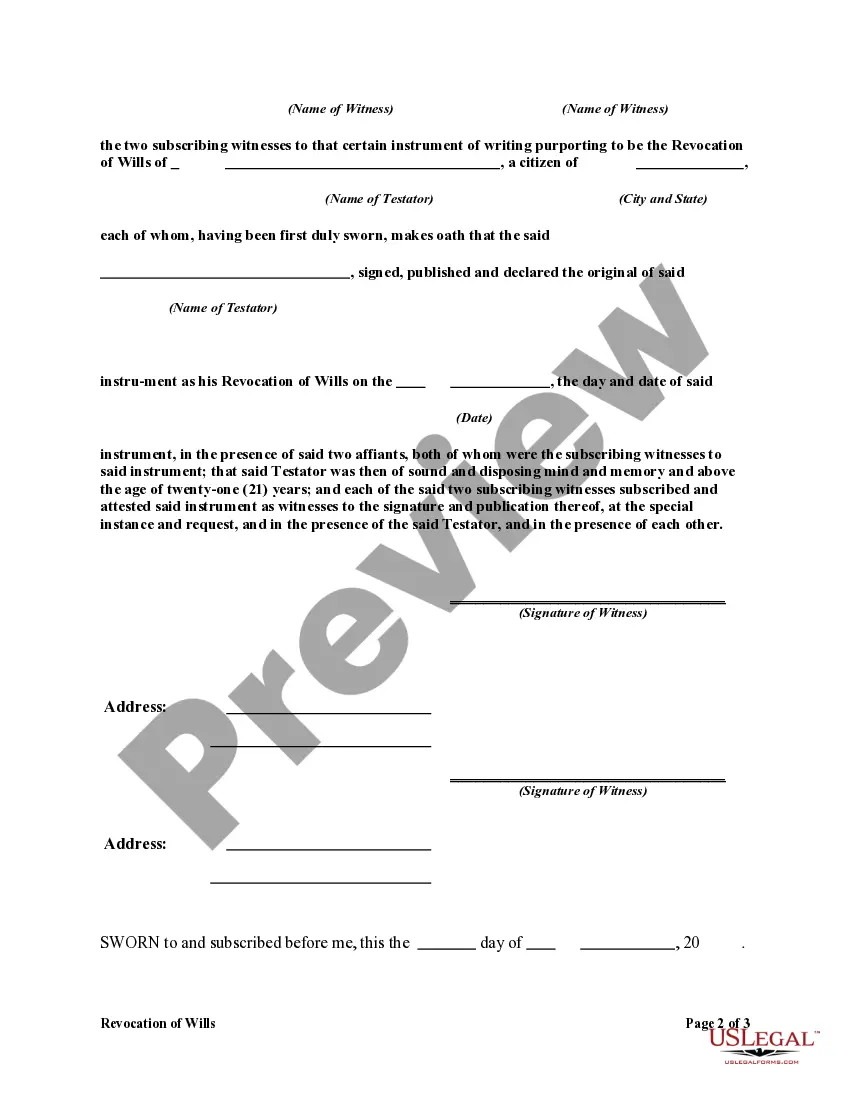

How to fill out Revocation Of Will?

Choosing the best authorized papers template could be a battle. Obviously, there are plenty of templates accessible on the Internet, but how can you discover the authorized form you need? Make use of the US Legal Forms website. The service gives 1000s of templates, for example the Puerto Rico Revocation of Will, that you can use for enterprise and personal requires. Each of the types are checked out by specialists and fulfill state and federal specifications.

If you are previously signed up, log in in your bank account and then click the Obtain option to have the Puerto Rico Revocation of Will. Make use of your bank account to appear with the authorized types you may have ordered formerly. Check out the My Forms tab of your own bank account and get an additional backup of the papers you need.

If you are a fresh user of US Legal Forms, listed here are simple recommendations that you should comply with:

- Initial, make certain you have chosen the right form to your area/region. You are able to look through the form utilizing the Preview option and look at the form information to guarantee this is basically the right one for you.

- In the event the form will not fulfill your expectations, utilize the Seach discipline to get the proper form.

- When you are sure that the form is acceptable, click the Acquire now option to have the form.

- Opt for the rates program you desire and type in the needed details. Create your bank account and purchase your order utilizing your PayPal bank account or charge card.

- Select the data file format and acquire the authorized papers template in your gadget.

- Total, edit and produce and sign the attained Puerto Rico Revocation of Will.

US Legal Forms is the biggest local library of authorized types in which you can see various papers templates. Make use of the service to acquire skillfully-created files that comply with condition specifications.

Form popularity

FAQ

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.

As a rule, there is no inheritance tax applied. Once the declaration of heirs has been issued by the Puerto Rico courts, you need to procure a certification of value and a certification of debt from CRIM.

All real estate in Puerto Rico is subject to the probate system. This system is based on a "forced heir" policy, that states that all children need to receive from the decedent (the person that died).

This is what is commonly known in the U.S. as probating an estate. A will that is drafted, either outside or in Puerto Rico, must be declared valid and must go through a court process to be validated in Puerto Rico.

As Puerto Rico is under United States sovereignty, U.S. federal law applies in the territory, and cases of a federal nature are heard in the United States District Court for the District of Puerto Rico.

Property That May Avoid Probate Property held in a trust3 Jointly held property (but not common property) Death benefits from insurance policies (unless payable to the estate)4 Property given away before you die. Assets in a pay-on-death account. Retirement accounts with a named beneficiary.

If you inherited via a will, and the will was executed outside of Puerto Rico, if the executed will is not contrary to Puerto Rico law, the Puerto Rico Real Estate Attorney will help in the process to validate the same. The Real Estate Attorney will file in court a legal action called Exequator.