Subject: Puerto Rico Sample Letter of Credit — Comprehensive Description and Types Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. With regard to our recent discussions, I am excited to provide you with a detailed description of the Puerto Rico Sample Letter of Credit, an essential financial instrument used in international trade transactions. Additionally, I will shed light on some different types of this letter used in various circumstances. Puerto Rico, a captivating island territory of the United States located in the Caribbean Sea, boasts a vibrant economy and trade practices. To facilitate smooth trade operations and instill confidence among parties involved, letters of credit play a pivotal role. A Puerto Rico Sample Letter of Credit is a written commitment issued by a financial institution, typically a bank, on behalf of its customer (the applicant or the buyer), providing assurance of payment to a beneficiary, usually a supplier or exporter, upon the fulfillment of specified conditions. The letter of credit serves as a guarantee that the exporter will receive prompt and full payment, while enabling the purchaser to demonstrate their creditworthiness. This dynamic has made Puerto Rico Sample Letter of Credit an extremely valuable tool for businesses engaged in importing or exporting activities. Now, let's explore a few types of Puerto Rico Sample Letter of Credit: 1. Revocable Letter of Credit (RLC): As the name suggests, an RLC can be modified or revoked by the issuing bank without prior notice to the beneficiary. Although this type of letter provides flexibility to the applicant, it offers little security to the beneficiary, making it less commonly used. 2. Irrevocable Letter of Credit (ILC): The most prevalent type, an ILC provides a secure framework for both the buyer and seller. It cannot be modified or canceled without the consent of all parties involved. The beneficiary relies on the irrevocable promises of payment included in this letter, thus ensuring the exporter's peace of mind. 3. Standby Letter of Credit (SLC): This type of letter serves as a backup option if the purchaser fails to fulfill their financial obligations, such as making payment on time or providing proper performance. It acts as a form of insurance, assuring the beneficiary that their payment will be received, regardless of the buyer's circumstances or actions. 4. Confirmed Letter of Credit (CLC): A confirmed letter of credit involves an additional step to strengthen the guarantee provided by the issuing bank. A confirming bank, often a financial institution located in Puerto Rico, adds its own commitment to pay the beneficiary if the issuing bank defaults. This type of letter is particularly useful when dealing with unfamiliar or less-established banks. These four types of Puerto Rico Sample Letter of Credit are commonly used, each serving different purposes based on the specific transaction requirements and preferences of the parties involved. In conclusion, the Puerto Rico Sample Letter of Credit embodies an essential part of international trade operations, ensuring secure and efficient transactions for both buyers and sellers. By understanding the various types of letters of credit and their implications, businesses can effectively navigate the challenging landscape of global trade while fostering trust and long-term relationships. Should you require any further clarification or assistance regarding the Puerto Rico Sample Letter of Credit, please feel free to reach out. I am more than happy to provide additional information. Thank you for your time and attention. Warm regards, [Your Name] [Your Position/Title] [Your Company/Organization]

Puerto Rico Sample Letter of Credit

Description

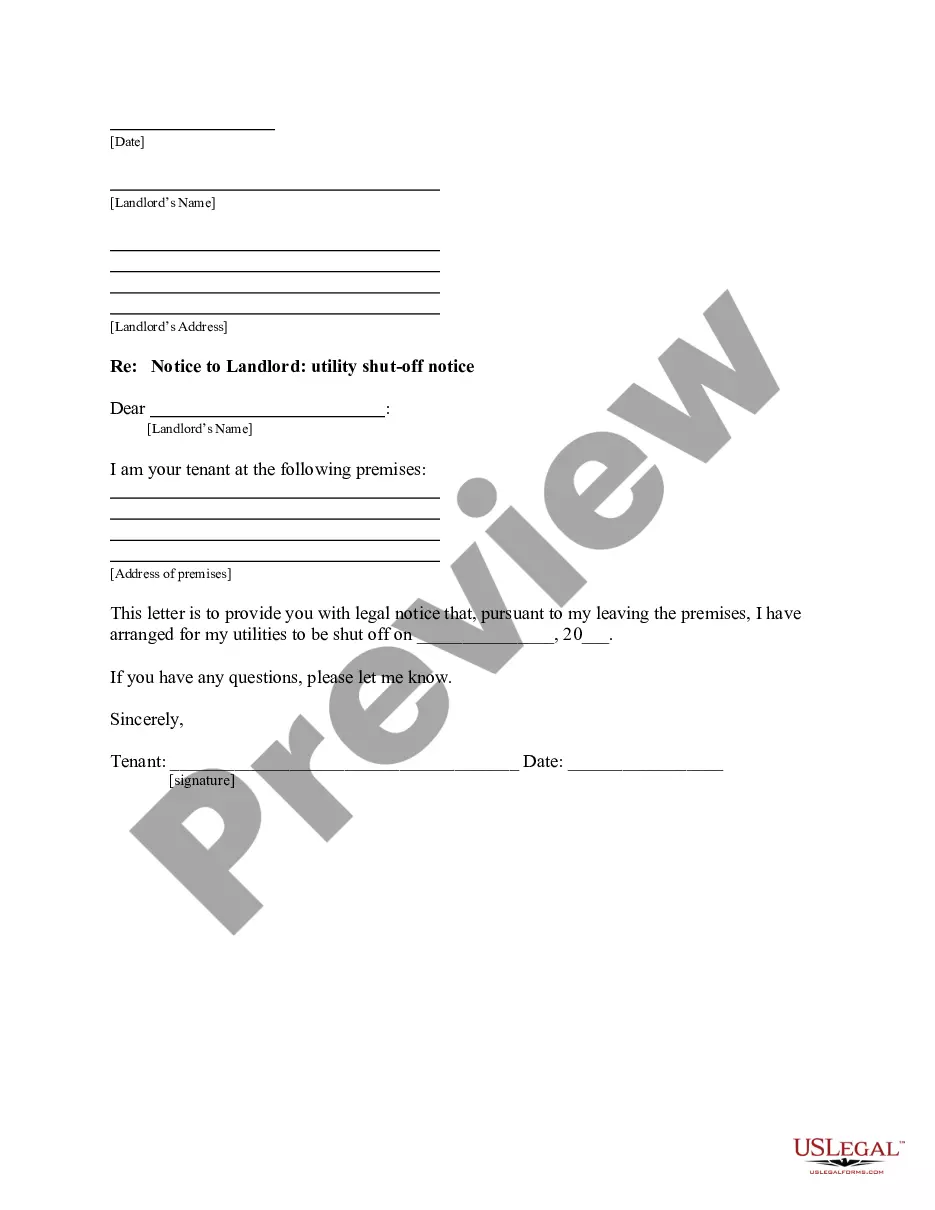

How to fill out Puerto Rico Sample Letter Of Credit?

If you have to full, acquire, or produce legal document templates, use US Legal Forms, the most important collection of legal types, which can be found on-line. Take advantage of the site`s basic and practical lookup to find the documents you will need. A variety of templates for business and person uses are categorized by categories and claims, or search phrases. Use US Legal Forms to find the Puerto Rico Sample Letter of Credit in just a couple of clicks.

Should you be presently a US Legal Forms consumer, log in to the bank account and then click the Down load option to get the Puerto Rico Sample Letter of Credit. You may also entry types you formerly delivered electronically inside the My Forms tab of your bank account.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your proper town/land.

- Step 2. Take advantage of the Preview solution to check out the form`s articles. Never neglect to see the information.

- Step 3. Should you be unhappy together with the develop, use the Research discipline on top of the display screen to get other models of the legal develop format.

- Step 4. After you have identified the form you will need, select the Buy now option. Select the pricing prepare you favor and add your credentials to sign up for an bank account.

- Step 5. Method the transaction. You can use your bank card or PayPal bank account to finish the transaction.

- Step 6. Find the format of the legal develop and acquire it on your own system.

- Step 7. Comprehensive, edit and produce or indicator the Puerto Rico Sample Letter of Credit.

Every legal document format you purchase is your own permanently. You might have acces to every develop you delivered electronically with your acccount. Click on the My Forms portion and select a develop to produce or acquire once again.

Compete and acquire, and produce the Puerto Rico Sample Letter of Credit with US Legal Forms. There are thousands of skilled and state-specific types you can utilize to your business or person demands.

Form popularity

FAQ

How to Apply for a Letter of Credit The importer's bank credit must satisfy the exporter and their bank. ... Using the sales agreement's terms and conditions, the importer's bank drafts the letter of credit; this letter is sent to the exporter's bank. ... The exporter ships the goods as the letter of credit describes. Letter of Credit: What It Is, Examples, and How One Is Used - Investopedia investopedia.com ? terms ? letterofcredit investopedia.com ? terms ? letterofcredit

The basic letter of credit procedure: Purchase and sales agreement. The buyer and the seller draw up a purchase and sales agreement. ... Buyer applies for letter of credit. ... Issue letter of credit. ... Advise letter of credit. ... Prepare shipment. ... Present documents. ... Payment. ... Document transfer. Basic letter of credit procedure - Infor Documentation Central infor.com ? lnolh ? help ? onlinemanual infor.com ? lnolh ? help ? onlinemanual

A letter of credit is a document sent from a bank or financial institute that guarantees that a seller will receive a buyer's payment on time and for the full amount. Letters of credit are often used within the international trade industry.

Pursuant to the request of our customer, ___________________________________________________________ we, (Bank) ___________________________________________________ hereby establish and give to you an irrevocable Letter of Credit in your favour in the total amount of $ _____________ which may be drawn on by you at any ... Sample Format of Letter of Credit - Peel Region Peel Region ? transportation ? _media Peel Region ? transportation ? _media PDF

To apply for a letter of credit, the buyer needs a copy of the sales agreement it made with the seller. The agreement can take the form of a contract, purchase order, or other written documentation. The agreement should include the amount and type of products involved, as well as the total cost the buyer must pay.

Commercial Invoice (Proof of Value) Bill of Lading (Proof of Shipment) Packing List (Proof of Packing) Certificate of Origin (Proof of Origin) Documents Requested in a Letter of Credit Transaction - Credit Guru creditguru.com ? credit-management ? 133-... creditguru.com ? credit-management ? 133-...

A Letter of Credit (LC) can be thought of as a guarantee that is backstopped by the Financial Institution that issues it. One party is required to guarantee something to another party; typically, it's payment, but not always ? it could also be guaranteeing that some project will be completed.

A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.