Puerto Rico Sample Letter to Beneficiaries regarding Trust Money

Description

How to fill out Sample Letter To Beneficiaries Regarding Trust Money?

Are you presently in a placement that you will need paperwork for both organization or personal reasons nearly every time? There are plenty of legal record templates accessible on the Internet, but finding kinds you can depend on is not easy. US Legal Forms offers 1000s of kind templates, like the Puerto Rico Sample Letter to Beneficiaries regarding Trust Money, that happen to be published to fulfill state and federal specifications.

When you are presently informed about US Legal Forms website and get a merchant account, just log in. After that, you can download the Puerto Rico Sample Letter to Beneficiaries regarding Trust Money format.

Unless you come with an account and would like to begin using US Legal Forms, abide by these steps:

- Get the kind you want and make sure it is for the correct city/region.

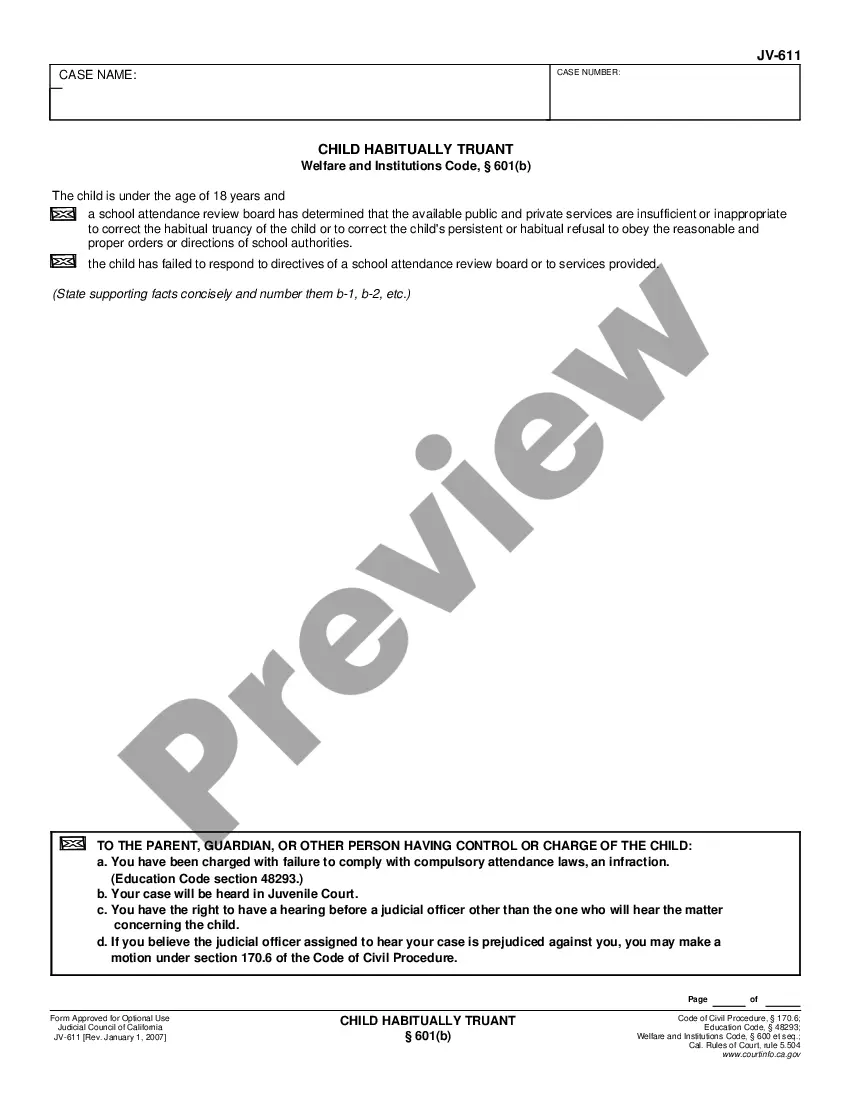

- Take advantage of the Preview switch to review the form.

- Browse the explanation to ensure that you have chosen the correct kind.

- If the kind is not what you`re trying to find, make use of the Lookup discipline to get the kind that suits you and specifications.

- When you get the correct kind, click on Buy now.

- Choose the prices program you would like, submit the necessary info to produce your money, and pay for the transaction with your PayPal or Visa or Mastercard.

- Choose a practical data file file format and download your version.

Find all of the record templates you might have purchased in the My Forms food selection. You can get a additional version of Puerto Rico Sample Letter to Beneficiaries regarding Trust Money at any time, if necessary. Just go through the needed kind to download or produce the record format.

Use US Legal Forms, by far the most considerable assortment of legal varieties, to save time as well as steer clear of blunders. The services offers appropriately produced legal record templates that you can use for an array of reasons. Produce a merchant account on US Legal Forms and start making your life easier.

Form popularity

FAQ

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

'Express trusts have been a part of the law of Puerto Rico since enactment of §§ 1-41 of the Act of April 23, 1928, No. 41, page 294.

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

Property That May Avoid Probate Property held in a trust3 Jointly held property (but not common property) Death benefits from insurance policies (unless payable to the estate)4 Property given away before you die. Assets in a pay-on-death account. Retirement accounts with a named beneficiary.

A Puerto Rico Trust must have specific assets that make up its patrimony. These assets can be any kind of present or future property, including real estate and personal property. It can be created over determined or determinable assets, or over all or part of a patrimony.

A will that is drafted, either outside or in Puerto Rico, must be declared valid and must go through a court process to be validated in Puerto Rico. If this process is not followed, the Registry of Property or the Institution that holds the funds will not respond to your requests.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.