Puerto Rico Loan Agreement for Investment

Description

How to fill out Loan Agreement For Investment?

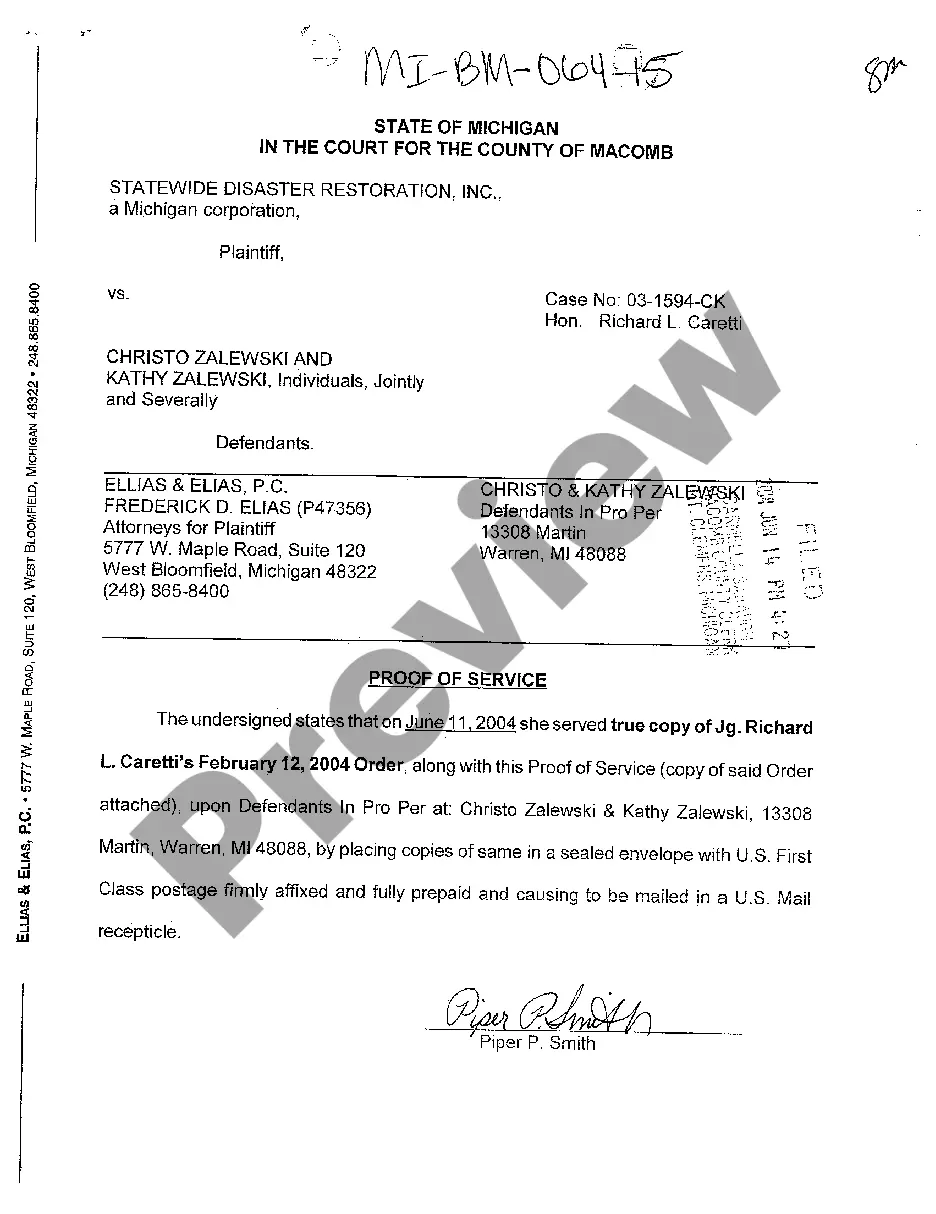

Choosing the right legal papers template can be a battle. Of course, there are a variety of templates accessible on the Internet, but how can you obtain the legal type you will need? Make use of the US Legal Forms site. The services gives 1000s of templates, like the Puerto Rico Loan Agreement for Investment, that can be used for company and personal requirements. Each of the kinds are examined by experts and satisfy state and federal demands.

Should you be previously registered, log in in your accounts and then click the Down load button to find the Puerto Rico Loan Agreement for Investment. Use your accounts to check from the legal kinds you have purchased earlier. Go to the My Forms tab of your respective accounts and have an additional copy in the papers you will need.

Should you be a fresh user of US Legal Forms, allow me to share basic directions for you to stick to:

- Initially, make sure you have chosen the proper type for your metropolis/state. It is possible to look over the shape utilizing the Review button and browse the shape outline to make sure it will be the right one for you.

- In case the type will not satisfy your requirements, take advantage of the Seach field to discover the proper type.

- Once you are certain the shape would work, click the Purchase now button to find the type.

- Pick the prices prepare you would like and enter the necessary info. Create your accounts and pay money for an order making use of your PayPal accounts or credit card.

- Pick the document file format and download the legal papers template in your system.

- Comprehensive, edit and produce and sign the attained Puerto Rico Loan Agreement for Investment.

US Legal Forms may be the most significant library of legal kinds that you can see numerous papers templates. Make use of the company to download appropriately-produced paperwork that stick to condition demands.

Form popularity

FAQ

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

While it is possible for a US-based bank or mortgage company to provide financing for the purchase of property in Puerto Rico, there are some reasons why it may be more advantageous to use a mortgage company based in Puerto Rico.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.