Puerto Rico Subrogation Agreement between Insurer and Insured

Description

How to fill out Subrogation Agreement Between Insurer And Insured?

You may invest time on-line searching for the lawful file template that suits the federal and state requirements you want. US Legal Forms gives a large number of lawful kinds which are examined by pros. It is possible to acquire or print the Puerto Rico Subrogation Agreement between Insurer and Insured from our services.

If you have a US Legal Forms bank account, you may log in and click on the Down load option. Next, you may total, modify, print, or signal the Puerto Rico Subrogation Agreement between Insurer and Insured. Every lawful file template you buy is your own eternally. To have yet another copy for any bought type, go to the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms internet site initially, keep to the basic guidelines below:

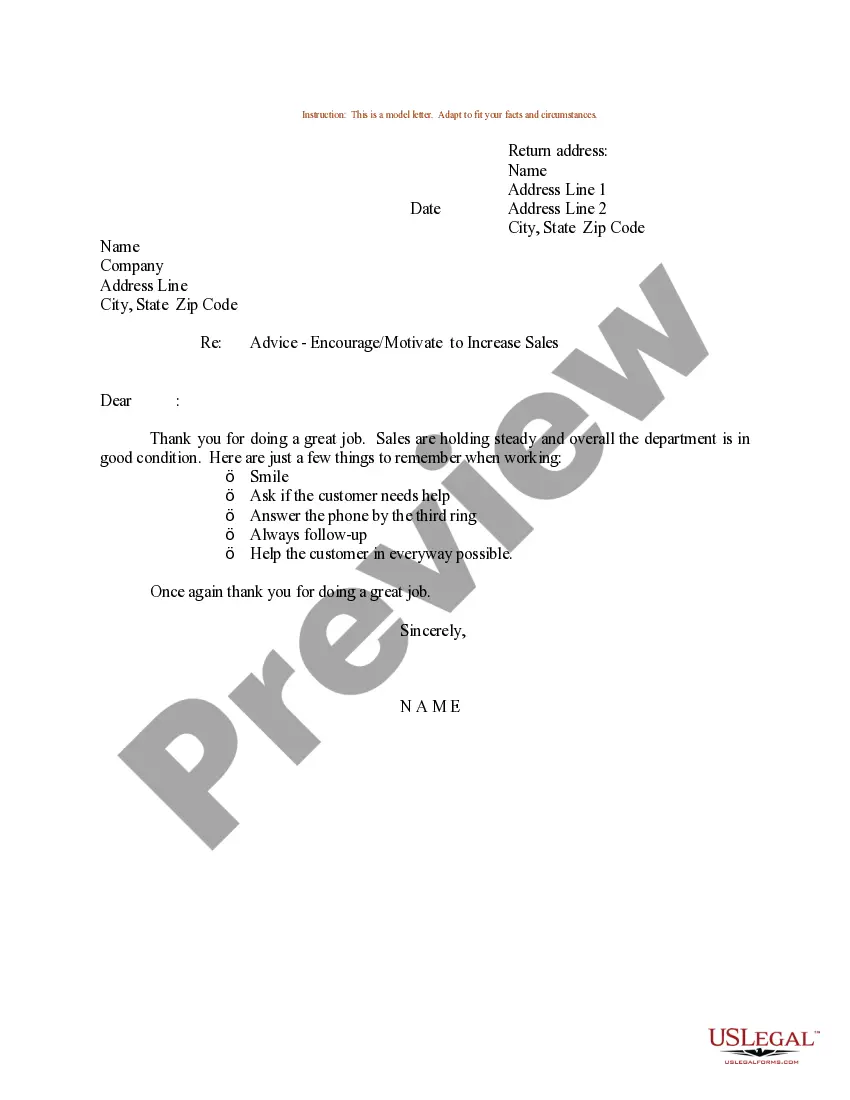

- First, be sure that you have selected the best file template for the area/city of your liking. Browse the type outline to make sure you have selected the proper type. If readily available, utilize the Review option to check with the file template at the same time.

- In order to find yet another variation of your type, utilize the Lookup industry to obtain the template that fits your needs and requirements.

- After you have located the template you would like, just click Acquire now to carry on.

- Find the rates plan you would like, type in your credentials, and register for your account on US Legal Forms.

- Full the transaction. You may use your credit card or PayPal bank account to purchase the lawful type.

- Find the file format of your file and acquire it to your system.

- Make modifications to your file if necessary. You may total, modify and signal and print Puerto Rico Subrogation Agreement between Insurer and Insured.

Down load and print a large number of file layouts using the US Legal Forms Internet site, that offers the biggest collection of lawful kinds. Use expert and condition-certain layouts to take on your small business or individual requires.

Form popularity

FAQ

Subrogation claims rely on fault, and insurance companies can only file claims against those they can prove are liable for property damage. If you can demonstrate that you are not liable for the property damage, the insurance company will have no grounds for their claim, and you will not have to pay it.

An insurer may attempt to subrogate against an additional insured for completed operations injuries caused by the insured if the additional insured endorsement provides coverage only for ongoing operations injuries.

What is Subrogation? Subrogation in insurance is a legal right of the insurance company to legally pursue a third-party responsible for the damages/insurance loss caused to the insured. Subrogation is done to recover the claim amount insurance company pays to the insured for the damages.

Subrogation refers to the right of an insurance company to recover money it paid to or on behalf of its insureds due to the actions of at-fault third parties.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

One example of subrogation is when an insured driver's car is totaled through the fault of another driver. The insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the driver at fault.

Generally, in most subrogation cases, an individual's insurance company pays its client's claim for losses directly, then seeks reimbursement from the other party's insurance company. Subrogation is most common in an auto insurance policy but also occurs in property/casualty and healthcare policy claims.

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.