A Puerto Rico Irrevocable Life Insurance Trust, also known as a PILOT, is a specialized legal tool used in estate planning to provide financial security and tax benefits for individuals residing in Puerto Rico. The PILOT is established to hold and manage life insurance policies for the benefit of designated beneficiaries, offering them certain unique rights, including the Crummy right of withdrawal. The Crummy right of withdrawal, named after the court case that established it, refers to the beneficiaries' ability to withdraw a certain portion of contributions made to the trust within a limited period, typically 30 days. This right enables the trust to take advantage of specific tax benefits by qualifying the contributions as present interest, rather than future interest gifts. The beneficiaries may choose to let the withdrawal period lapse, leaving the contributions in the trust, thus leveraging the benefits of life insurance policies without incurring immediate tax liabilities. There are various types of Puerto Rico Irrevocable Life Insurance Trusts that may incorporate the Crummy right of withdrawal, tailored to the specific needs and goals of the granter and beneficiaries: 1. Bare PILOT: In this type of trust, the beneficiaries have the Crummy right, but no additional trust provisions. The beneficiaries can withdraw contributions or let the withdrawal period lapse, and the trust functions solely for the purpose of holding and managing the life insurance policies. 2. Standard PILOT: This type of trust includes additional provisions intended to safeguard the assets and ensure their proper management. It may include restrictions on withdrawals, distribution rules, or instructions for the trustee regarding the use of policy proceeds. 3. Dynasty PILOT: A dynasty PILOT is designed to provide long-term financial security for multiple generations of beneficiaries. It typically includes perpetual terms, allowing the trust to continue for multiple decades or even centuries, ensuring the continued protection and growth of the assets. 4. Charitable PILOT: In some cases, individuals may wish to incorporate a charitable element into their estate planning. A charitable PILOT allows for the inclusion of specific charitable organizations as beneficiaries, enabling the granter to support their philanthropic causes while still providing financial security for family members. Overall, a Puerto Rico Irrevocable Life Insurance Trust with the Crummy right of withdrawal offers unique advantages for estate planning in Puerto Rico. By leveraging life insurance policies within a trust structure, individuals can maximize tax benefits, protect assets, and financially secure their loved ones, all while incorporating flexibility and control through the Crummy right of withdrawal.

Puerto Rico Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

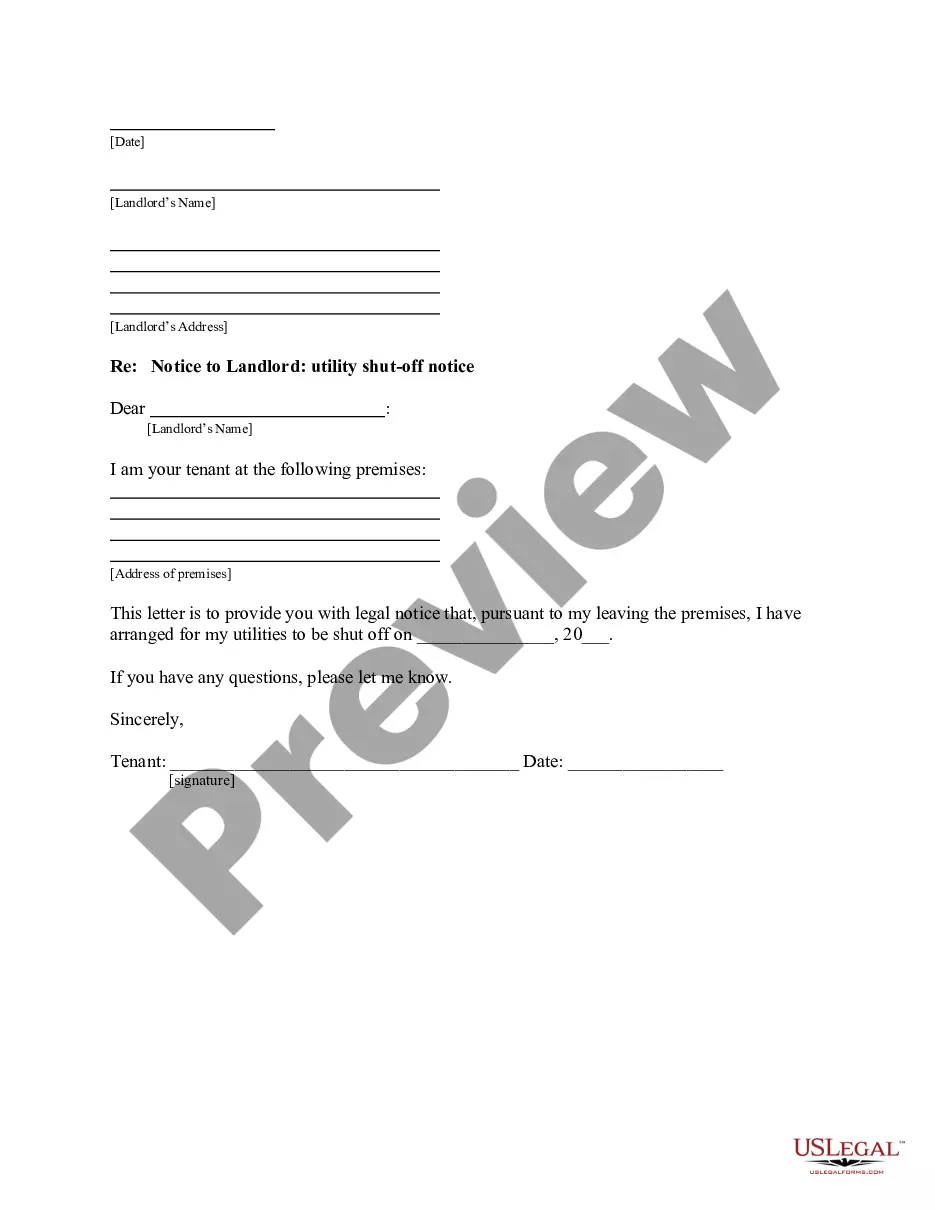

How to fill out Puerto Rico Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right Of Withdrawal?

Discovering the right legitimate papers template might be a battle. Of course, there are a lot of layouts accessible on the Internet, but how will you discover the legitimate kind you want? Utilize the US Legal Forms internet site. The support provides a large number of layouts, including the Puerto Rico Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal, that you can use for business and private demands. Each of the forms are inspected by experts and meet up with state and federal requirements.

In case you are already authorized, log in to your bank account and then click the Obtain option to have the Puerto Rico Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal. Use your bank account to search from the legitimate forms you possess purchased earlier. Proceed to the My Forms tab of the bank account and have yet another backup of your papers you want.

In case you are a brand new consumer of US Legal Forms, here are basic directions for you to adhere to:

- First, ensure you have selected the appropriate kind to your area/county. You are able to look through the form using the Preview option and read the form outline to make sure this is the right one for you.

- If the kind does not meet up with your requirements, make use of the Seach industry to obtain the proper kind.

- When you are positive that the form is proper, go through the Get now option to have the kind.

- Opt for the pricing prepare you need and enter in the required information and facts. Build your bank account and buy your order utilizing your PayPal bank account or credit card.

- Select the data file file format and acquire the legitimate papers template to your product.

- Full, edit and produce and indication the received Puerto Rico Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal.

US Legal Forms is definitely the biggest local library of legitimate forms for which you can find numerous papers layouts. Utilize the service to acquire skillfully-created documents that adhere to express requirements.

Form popularity

FAQ

Crummey powers give the beneficiary a limited time (often 30, 45 or 60 days) to withdraw contributions to a trust at will, converting the future interest gift to a present interest gift. This withdrawal right is generally limited to an amount equal to the current annual gift tax exclusion.

Crummey power allows a person to receive a gift that is not eligible for a gift-tax exclusion and then effectively transform the status of that gift into one that is eligible for a gift-tax exclusion. For Crummey power to work, individuals must stipulate that the gift is part of the trust when it is drafted.

An irrevocable trust cannot be changed or modified without the beneficiary's permission. Essentially, an irrevocable trust removes certain assets from a grantor's taxable estate, and these incidents of ownership are transferred to a trust.

Yes, you could withdraw money from your own trust if you're the trustee. Since you have an interest in the trust and its assets, you could withdraw money as you see fit or as needed. You can also move assets in or out of the trust.

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

The right of withdrawal is limited in duration and scope usually available for 30 days after you have made the annual payment to the trust. Even though this option is carefully crafted into an ILIT, the intention is that the beneficiaries of the ILIT will not actually exercise the power to make a withdrawal.

A withdrawal right is the right, given to the beneficiary of a trust, to withdraw all or a portion of each gift made to the trust. For example, if a $1,000 gift is made to a trust and a beneficiary of the trust has a withdrawal right over that gift, he or she can withdraw up to $1,000 from the trust.

When and what a trustee can withdraw from the irrevocable trust is determined by the rules of the trust that you set up your estate planning lawyer. But in general, a trustee can use the money in the trust when third-party expenses need to be covered. They cannot just decide to take out money for personal use.

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.

Distributing assets from an irrevocable trust requires that the assets first be part of the trust's corpus. Tax laws allow trusts to recover the after-tax money locked up in the corpus as tax-free return of principal. Trusts pass this benefit along to their beneficiaries in the form of tax-free distributions.