Title: Puerto Rico Living Trust with Provisions for Disability — Comprehensive Guide Introduction: In Puerto Rico, a Living Trust with Provisions for Disability is an essential legal tool that allows individuals to manage their assets and ensure financial security, even in the event of a disability. This comprehensive guide aims to provide a detailed description of Puerto Rico Living Trusts, their importance, and various types available. 1. What is a Puerto Rico Living Trust with Provisions for Disability? A Puerto Rico Living Trust with Provisions for Disability is a legal arrangement that grants an individual (the Trustee) the authority to manage another person's assets (the Settler or Granter), should the Settler become incapacitated or disabled. It allows for the smooth management and distribution of assets without the need for probate, ensuring continued financial support during a disability. 2. Importance and Benefits of a Puerto Rico Living Trust with Provisions for Disability: — Asset Management: A Living Trust allows for uninterrupted management of assets, ensuring bills are paid, investments are managed, and finances are organized during a period of disability. — Avoidance of Probate: By transferring assets into a Living Trust, individuals can prevent the probate process, minimizing costs, delays, and maintaining privacy. — Continuity and Peace of Mind: A Trust provides a comprehensive plan, outlining how assets should be managed and distributed, offering peace of mind to both the Trustee and beneficiaries. — Tax Efficiency: Depending on the type of Trust, certain tax benefits may be available, ensuring the preservation of wealth and minimizing tax liabilities. 3. Types of Puerto Rico Living Trusts with Provisions for Disability: a. Revocable Living Trust: The most common type of Living Trust, it allows the Settler to amend, modify, or revoke the Trust during their lifetime. It provides flexibility and avoids the need for court intervention in case of disability. b. Irrevocable Living Trust: Once created, an Irrevocable Living Trust cannot be altered or revoked without the consent of all parties involved. It offers more asset protection and may have tax planning advantages. c. Supplemental Needs Trust: This trust is designed to provide for disabled or special needs individuals without affecting their eligibility for government benefits, such as Medicaid or Social Security. 4. Creating a Puerto Rico Living Trust with Provisions for Disability: To establish a Puerto Rico Living Trust, the following steps are typically involved: — Consultation with an experienced trust attorney familiar with Puerto Rico laws and regulations. — Determination of assets suitable for inclusion in the Trust. — Drafting and signing of the Trust document, clearly specifying provisions for disability. — Transferring assets to the Trust and ensuring proper record-keeping. — Appointing a successor Trustee to manage the trust in case of a disability or incapacity. Conclusion: A Puerto Rico Living Trust with Provisions for Disability serves as a crucial estate planning tool that ensures continuity of asset management and financial security during periods of disability. By choosing the appropriate type of trust and seeking legal advice, individuals can protect their interests, minimize complications, and provide for their loved ones effectively. Always consult with an experienced attorney to tailor a Living Trust to your specific needs and circumstances.

Puerto Rico Living Trust with Provisions for Disability

Description

How to fill out Puerto Rico Living Trust With Provisions For Disability?

Choosing the right legal file template can be a battle. Needless to say, there are a lot of templates available on the net, but how would you discover the legal kind you require? Make use of the US Legal Forms site. The service offers thousands of templates, for example the Puerto Rico Living Trust with Provisions for Disability, which can be used for enterprise and private demands. All of the types are examined by specialists and meet federal and state needs.

When you are already authorized, log in in your bank account and then click the Down load key to have the Puerto Rico Living Trust with Provisions for Disability. Utilize your bank account to appear with the legal types you may have ordered in the past. Check out the My Forms tab of your respective bank account and have one more duplicate in the file you require.

When you are a brand new end user of US Legal Forms, listed here are straightforward instructions so that you can comply with:

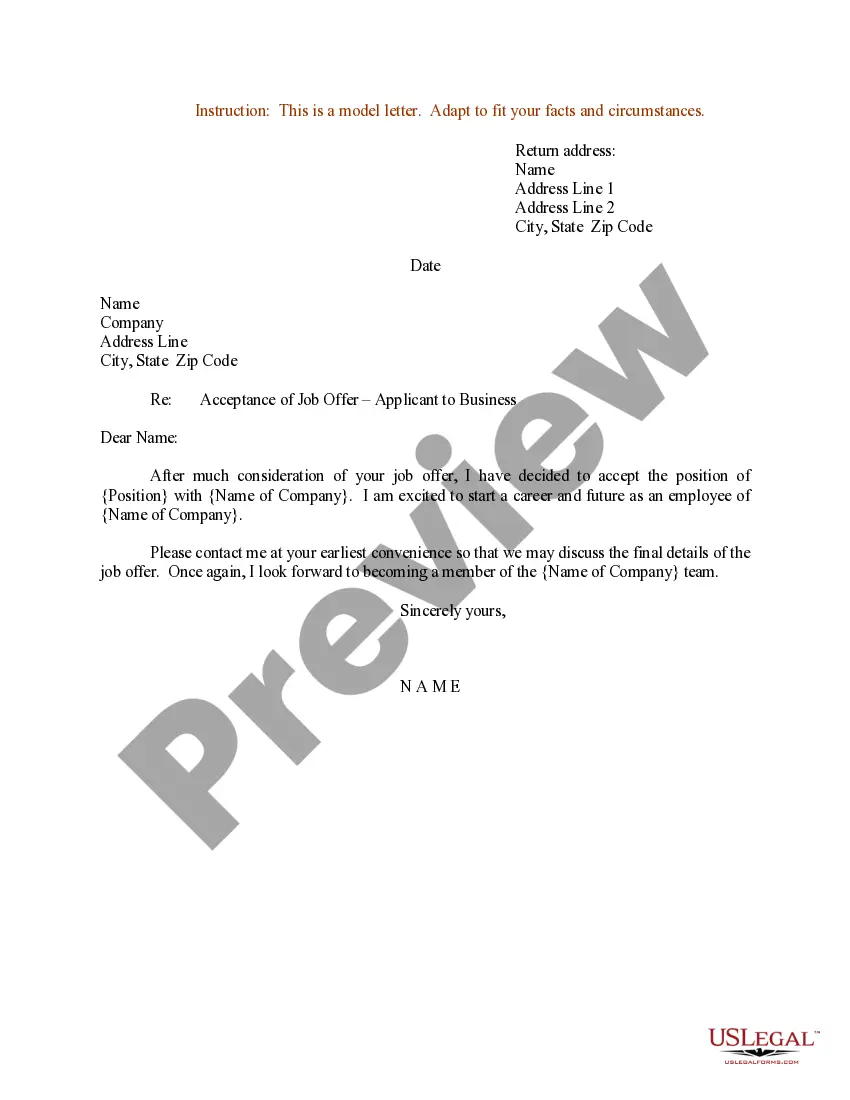

- Very first, ensure you have selected the appropriate kind to your metropolis/county. You may look over the shape utilizing the Preview key and read the shape description to ensure this is the right one for you.

- In the event the kind fails to meet your expectations, make use of the Seach discipline to get the appropriate kind.

- When you are certain the shape is acceptable, click on the Buy now key to have the kind.

- Select the pricing strategy you desire and type in the essential info. Build your bank account and buy an order with your PayPal bank account or charge card.

- Select the document format and down load the legal file template in your device.

- Comprehensive, modify and print and sign the received Puerto Rico Living Trust with Provisions for Disability.

US Legal Forms is the most significant local library of legal types that you will find a variety of file templates. Make use of the company to down load appropriately-produced files that comply with state needs.

Form popularity

FAQ

Puerto Rico enacts a new Trusts Act The Trusts Act provides new requirements for the creation or establishment of trusts and creates a Special Registry of Trusts ascribed to the Notarial Inspection Office to register trusts. Failure to timely complete such registration will render the trust null and void.

As a trust domiciled in Puerto Rico, the IRS is, without a doubt, a federal government subcontractor that is subject to this Act.

A trust can stipulate, for example, that until age 25, the trust assets are held for the benefit of the beneficiary but that he is not automatically entitled to any distributions unless the trustee believes that a distribution is advisable. At age 25, the beneficiary becomes entitled to one third of the trust assets.

There are five key elements of trust that drive our philosophy:Reliability: Being reliable creates trust.Honesty: Telling the truth creates trust.Good Will: Acting in good faith creates trust.Competency: Doing your job well creates trust.Open: Being vulnerable creates trust.

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

'Express trusts have been a part of the law of Puerto Rico since enactment of C§ 1-41 of the Act of April 23, 1928, No. 41, page 294. This Act was incorporated into the Civil Code of Puerto Rico by the final provisions of the Code, as amended April 28, 1930, No. 48, page 358, § 9.

If the trust is revocable use your Social Security number regardless of who the trustee might be. If it is irrevocable and someone else is the trustee, but you still receive benefits from the trust, use your Social Security number.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay more than $1,000, and fees will be higher for couples. You can also use online software to create trust documents at a cheaper rate.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.