Puerto Rico Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years provide individuals with a way to support charitable organizations while receiving financial benefits during their lifetime. This legal arrangement allows individuals, known as granters, to create a trust that guarantees a fixed annual income or annuity payment for a specific term of years before the remaining trust assets are transferred to charity. In Puerto Rico, there are various types of Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, including the following: 1. Charitable Remainder Annuity Trust (CAT): This type of trust ensures a fixed annuity payment to the granter throughout the term of years specified in the trust document. The annuity payment can be set at a predetermined amount or a fixed percentage of the initial trust value. 2. Charitable Remainder Unit rust (CUT): Unlike the CAT, a CUT provides the granter with a variable annual income that is calculated as a percentage of the trust's value, which is reevaluated annually. The granter receives a predetermined percentage of the trust's fair market value each year. 3. Net Income with Makeup Charitable Remainder Unit rust (TIMEOUT): This type of unit rust offers the granter the option to distribute a fixed percentage of the trust's fair market value or the net income generated by the trust, whichever is less. If the trust income falls below the predetermined percentage, it can be made up in future years when the income exceeds the required distribution. 4. Net Income Charitable Remainder Unit rust (NICEST): The NICEST allows the granter to receive an income payment based solely on the net income generated by the trust. The predetermined percentage is applied to the trust's net income, and if the income exceeds the payment amount for a given year, the excess can be distributed to the granter in the following years. These Puerto Rico Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years allow individuals to establish a long-term charitable commitment while enjoying financial stability during their lifetime. It's important to consult with an experienced attorney or financial advisor when considering these testamentary provisions, as they involve complex legal and financial considerations.

Puerto Rico Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

How to fill out Puerto Rico Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

Choosing the best authorized document format can be a struggle. Obviously, there are plenty of templates available on the Internet, but how will you discover the authorized kind you need? Use the US Legal Forms internet site. The service offers a large number of templates, such as the Puerto Rico Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, which can be used for business and personal needs. Every one of the forms are examined by pros and meet up with state and federal needs.

When you are previously listed, log in for your accounts and click on the Down load key to get the Puerto Rico Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years. Utilize your accounts to check from the authorized forms you possess ordered previously. Visit the My Forms tab of the accounts and acquire another version from the document you need.

When you are a whole new end user of US Legal Forms, allow me to share simple instructions for you to stick to:

- Very first, ensure you have selected the proper kind for your personal town/region. You are able to check out the form utilizing the Preview key and study the form information to ensure this is the right one for you.

- In the event the kind fails to meet up with your needs, utilize the Seach field to find the proper kind.

- Once you are certain the form is suitable, select the Get now key to get the kind.

- Choose the costs strategy you would like and enter in the needed information. Build your accounts and pay for the order with your PayPal accounts or charge card.

- Pick the data file structure and download the authorized document format for your device.

- Full, modify and printing and signal the attained Puerto Rico Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years.

US Legal Forms is definitely the most significant collection of authorized forms for which you can discover different document templates. Use the company to download skillfully-manufactured files that stick to express needs.

Form popularity

FAQ

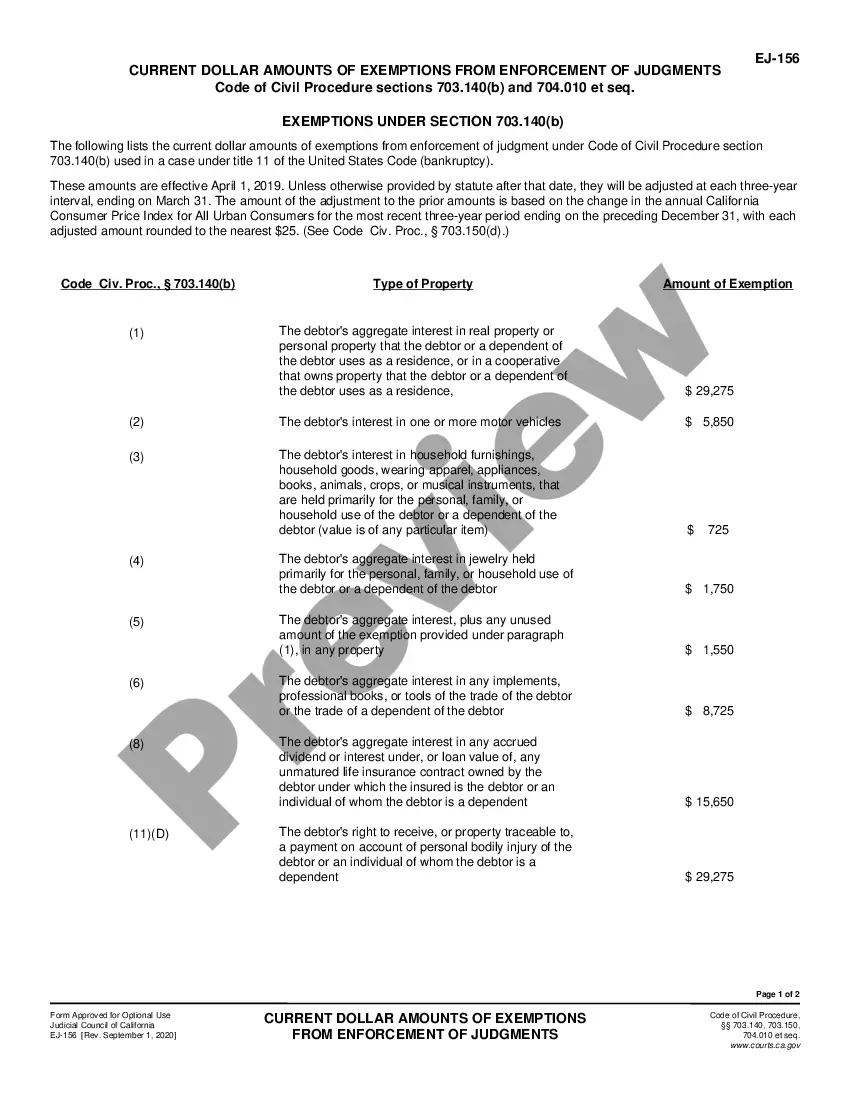

A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

Charitable trusts are created in the same manner as private express trusts, with several key exceptions: the trust must be created for a charitable purpose, the beneficiaries to the trust must be indefinite, and the trust may be perpetual.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years. These income payments are calculated annually using a set percentage rate and the value of the trust's assets.

Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years. 2. Charitable remainder annuity trust (CRAT) pays the beneficiary a fixed amount, or annuity, for the term of the trust.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

A CRT lets you convert a highly appreciated asset like stock or real estate into lifetime income. It reduces your income taxes now and estate taxes when you die. You pay no capital gains tax when the asset is sold. It also lets you help one or more charities that have special meaning to you.